Natural Gas Bulls Inch Higher Following Much Larger Than Expected Withdrawal

Natural gas futures traded higher Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was greater than what the market was expecting.

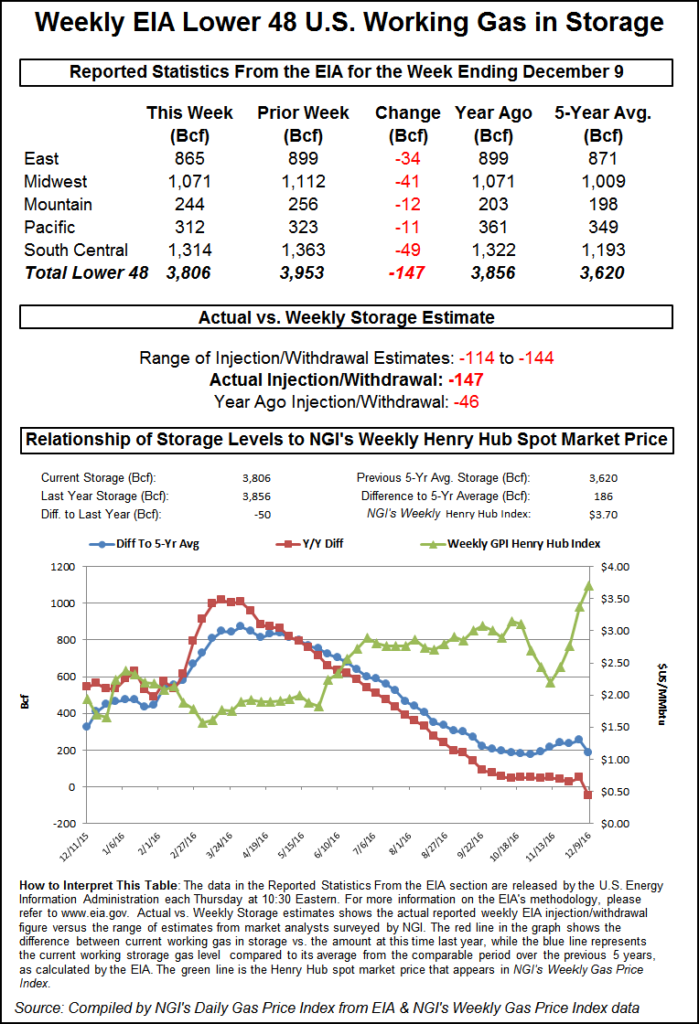

EIA reported a 147 Bcf storage withdrawal in its 10:30 a..m. EST release, whereas traders were expecting a pull of about 19 Bcf less. January futures reached a high of $3.589 immediately after the figures were released and by 10:45 a.m. January was trading at $3.552, up 1.2 cents from Wednesday’s settlement.

The figure was well beyond expectations. A Reuters survey showed an average 128 Bcf withdrawal with a range of 114 Bcf to 144 Bcf.

“We were hearing a number of 123 to a 124 draw, so this is something of a surprise,” said a New York floor trader. “I’m putting support at $3.50 and resistance at $3.75. It looks like people are looking at the weather reports and not the storage.”

“The 147 Bcf draw for last week was above the range of expectations and also above the 79 Bcf five-year average for the date, a clearly bullish report that implies greater sensitivity to cold temperatures than anticipated, a possibly ongoing factor,” said Tim Evans of Citi Futures Perspective.

“This drawdown was 17 Bcf below our estimate of -130 Bcf and outside the range of most other analyst estimates as well,” said Harrison NY-based Bespoke Weather Services. “Bearish weather trends should temper any rally today, though.”

Inventories now stand at 3,806 Bcf and are 50 Bcf less than last year and 186 Bcf more than the five-year average. In the East Region 34 Bcf was withdrawn and the Midwest Region saw inventories decrease by 41 Bcf. Stocks in the Mountain Region fell 12 Bcf, and the Pacific Region was down 11 Bcf. The South Central Region shed 49 Bcf.

Salt cavern storage was down 15 Bcf at 388 Bcf, while the non-salt cavern figure was down 33 Bcf at 927 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |