E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Diamondback Strikes in Permian Again, Offering $2.43B For Brigham Resources

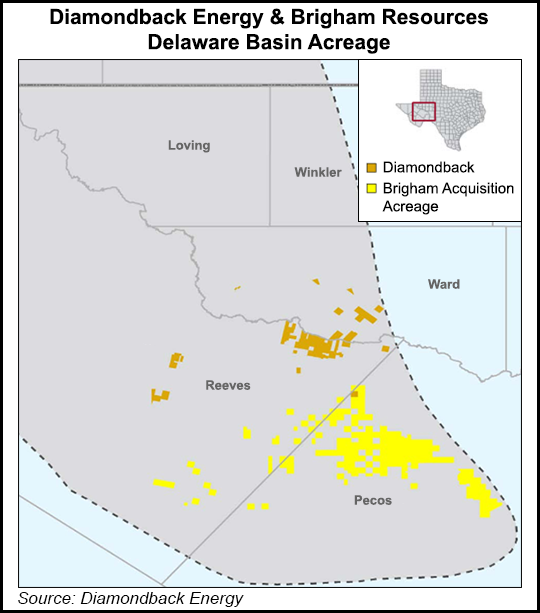

Permian Basin pure-play Diamondback Energy Inc. late Wednesday agreed to acquire Brigham Resources affiliates in a deal valued at $2.43 billion, handing the Midland, TX-based independent another 76,319 net acres in West Texas and boosting its total leasehold to 182,000 net acres.

The offer for Brigham Resources Operating LLC and Brigham Resources Midstream LLC, which work in Pecos and Reeves counties within the Delaware sub-basin, includes $1.62 billion in cash and 7.69 million shares of Diamondback common stock.

The acquisition, set to be completed by the end of February, “represents an important milestone for our company and creates a standard for growth within cash flow,” CEO Travis Stice said. The existing production allows the producer “to grow volumes on a pro forma basis without compromising balance sheet integrity.”

The “single well economics” in the play 100%-plus internal rates of return at current commodity prices “compete for capital in the top quartile of our existing inventory and are comparable to the acreage we acquired in July 2016 in the Southern Delaware Basin.”

Management is confident it has “the resource and acreage base to efficiently support 15-20 operated rigs. In addition to our soon-to-be-added sixth rig that will begin developing our previously acquired acreage in the Delaware Basin, we plan to add two additional rigs to develop this pending acquisition in 2017.”

In July, the Permian specialist paid $560 million to gain entry into the Delaware after toiling successfully in the Midland. Stice has signaled that the operator would continue to look for bolt-ons in the red-hot basin. The deal came just one day after Permian rival Callon Petroleum Co. agreed to a $615 million dealto gain entry into the Southern Delaware.

According to Diamondback, the Brigham acreage has been derisked by 48 producing horizontal wells. In November average production was 9,482 boe/d, 77% weighted to oil. Identified horizontal drilling locations are estimated at 1,213 net on four proven zones, with potential in others. The contiguous position also may support average lateral lengths of around 8,000 feet. Brigham affiliates operate 83% of the acreage and have 81%-plus working interest. Existing infrastructure is valued at about $50 million, offering more upside for development.

“We believe our near-term acceleration across our asset base, along with the production from this acquisition, will put us in a position to achieve over 60% production growth in 2017 at the midpoint of our current guidance range,” Stice said. “We also believe our balanced acreage position between the Midland and Delaware basins provides a runway for unprecedented growth for years to come, while we remain focused on shareholder returns and balance sheet integrity.”

Brigham CEO Gene Shepherd said the transaction represented a “unique opportunity to place our Southern Delaware Basin assets in the hands of one of the premier value creators and operators in the Permian Basin. I am proud of what the Brigham team accomplished over a few short years in identifying, capturing and developing a large and highly economic inventory of drilling locations across the multiple Wolfcamp and Bone Spring objectives.

“Along with our sponsors, Warburg Pincus, Yorktown and Pine Brook, we are excited to partner with Travis Stice and the Diamondback team for the asset’s next phase of accelerated development.”

Production on Brigham’s acreage today is from 48 horizontal wells and 16 vertical wells, with an estimated six drilled but uncompleted wells.

Proforma for the pending acquisition, Diamondback increased its preliminary 2017 production guidance to 64,000-73,000 boe/d, 25% higher from the midpoint of a prior forecast of 52,000-58,000 boe/d. Costs for a 7,500-foot lateral horizontal well are estimated at $5-5.5 million in the Midland and from $6-7.5 million in the Delaware.

Because of an expected increase in activity pending the purchase, Diamondback boosted its 2017 capital expenditure guidance to $700-900 million from $500-650 million. Up to $75 million is earmarked for infrastructure in the Delaware.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |