E&P | NGI All News Access | NGI The Weekly Gas Market Report

Continental Touts Record Meramec Test Well in STACK

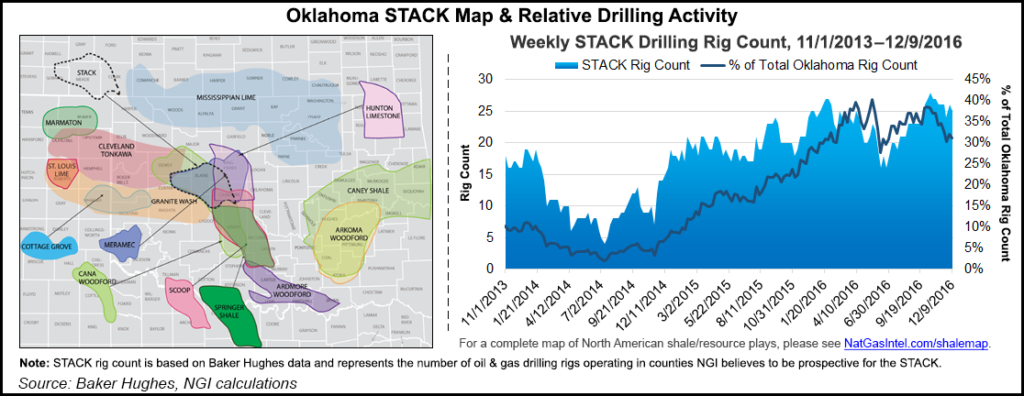

Continental Resources Inc. released results of a record well Wednesday drilled in the overpressured window of its acreage in the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties, OK (aka, the STACK).

The Oklahoma City-based exploration and production (E&P) company said its Angus Trust 1-4-33XH well, targeting the Meramec formation, produced at a 24-hour test rate of 4,642 boe/d, including 2,088 bbl of oil and 15.3 MMcf of natural gas. Continental, which has a 78% working interest in the well, said it flowed at 5,200 psi during the test.

“The Angus Trust is another tremendous STACK Meramec well,” CEO Harold Hamm said. “Aside from being a company record well, it further validates our perspective of the extent of the overpressured oil window.”

The Angus well is just north of Continental’s Boden 1-15-10XH in south-central Blaine County. At 5,000 psi, the Boden well produced 3,508 boe/d in a 24-hour test, 28% weighted to oil. Boden, the company’s first completed well in the condensate window of the STACK, has produced 591,000 boe (26% oil) in a little over a year and is producing at a current rate of 1,815 boe/d (22% oil), Continental said.

Continental’s Angus well was completed for an estimated $8.9 million, a 30% decrease compared to the Boden well. Continental said both wells used similar 36-stage completions with 20 million pounds of sand and were each drilled with 9,500-foot laterals.

Based on its production from both Oklahoma and North Dakota, Continental has raised its exit rate for 2016 to 213,000-218,000 boe/d from previous guidance of 205,000-210,000 boe/d. The E&P expects to maintain this production rate through the first quarter.

Midcontinent operators have been preparing to ramp up activity in Oklahoma’s stacked plays in 2017. Newfield Exploration Co. said during a third quarter conference call that it’s preparing to transition from delineation to full-field development in 2017. CEO Lee Boothby said the Anadarko Basin’s mix of both oily and gassy windows offered optionality for producers.

“We have exposure to all hydrocarbon phases across our acreage,” Boothby said. “As you transition from dry gas in the Cana Field and move north and east, you enter the oil window, which is what we originally targeted when our leasing began here five years ago. Today, we have solid representation to the west where we are confident that EURs [estimated ultimate recovery] and gas content both move significantly higher.” He added that Newfield’s assets will give it “the flexibility to target the right commodity at the right time.”

Meanwhile, Devon Energy Corp.’s output in the STACK jumped 38% during the third quarter following strong results from its tests in the Meramec earlier in the year.

In a 3Q2016 conference call with analysts last month, Continental released results from its Ludwig eight-well Meramec spacing test. Management said at the time that the Ludwig unit wells would generate a rate of return over 100% at $50/bbl West Texas Intermediate and $3/Mcf.

Meanwhile, a late-November agreement by the Organization of the Petroleum Exporting Countries (OPEC) to curtail output has the oil bulls — and U.S. shale producers — stirring heading into 2017.

Hamm, an adviser to President-elect Trump during his campaign, said during the third quarter call that “for the first time since OPEC was founded 56 years ago, markets are increasingly driven by free market forces. Foreign producers will have less power to manipulate the crude oil market because there are multiple sources for supplied capacity growth, most notably the leading U.S. shale plays.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |