Markets | NGI All News Access | NGI Data

Futures Inch Higher Following On-Target NatGas Storage Data

Natural gas futures traded higher Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was about in line with what traders were expecting.

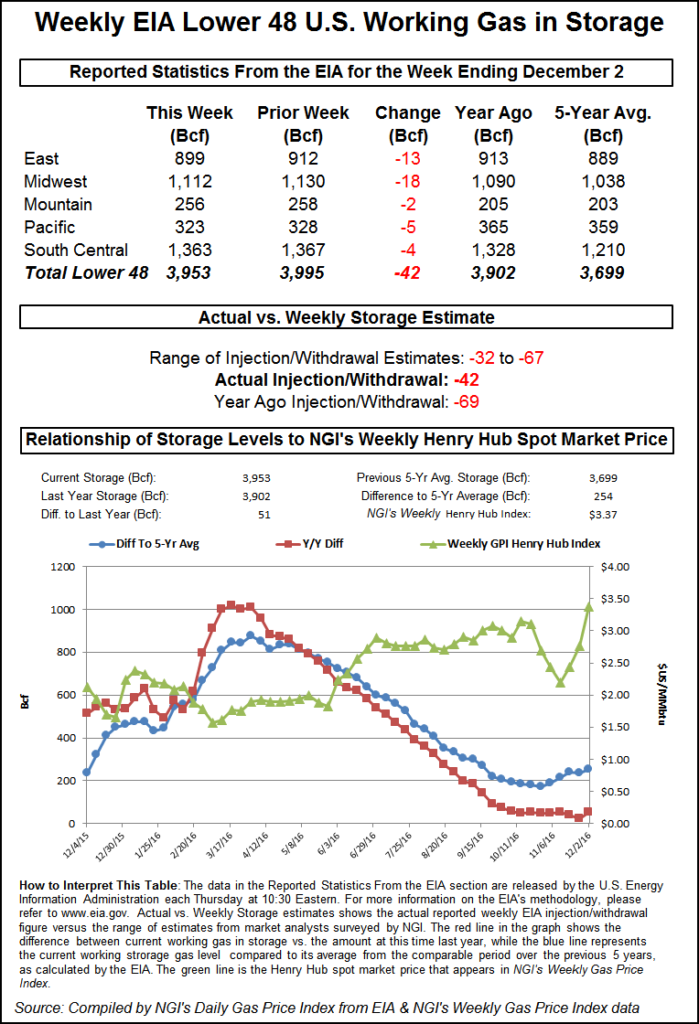

EIA reported a 42 Bcf storage withdrawal in its 10:30 a.m. EST release, whereas traders were expecting a pull about 1 Bcf greater. January futures reached a high of $3.680 immediately after the figures were released, and by 10:45 a.m. January was trading at $3.628, up 2.5 cents from Wednesday’s settlement.

“You see the way this market goes regardless of the number,” a New York floor trader told NGI. “If it goes down 7 cents, it comes back basically to where we were before, and if it goes up 7 cents we go back down to where it was 15 minutes before. You’ve got to pick your point right at the onset and then get out. Then you are in good shape. It’s a little scary to have your position on before the number comes out.

“I think we have to look at $3.75 as resistance and $3.50 as support,” he said.

“The 42 Bcf net withdrawal for last week was in line with revised consensus expectations for 42-43 Bcf but moderately bearish relative to the 61 Bcf five-year average for the date,” said Tim Evans of Citi Futures Perspective. “However, we fully expect the market to focus more on the upcoming cold than only last week’s details.”

Inventories now stand at 3,953 Bcf and are 51 Bcf greater than last year and 254 Bcf more than the five-year average. In the East Region 13 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 18 Bcf. Stocks in the Mountain Region fell 2 Bcf, and the Pacific Region was down by 5 Bcf. The South Central Region shed 4 Bcf.

Salt cavern storage was up 3 Bcf at 403 Bcf, while the non-salt cavern figure was down 7 Bcf at 960 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |