It Ain’t Over Till It’s Over; Weekly NatGas Soars

Just when the natural gas cash gains for the short week ended Nov. 23 looked like they were going to be hard to beat, the market moves for the week ended Dec. 2 proved even greater.

NGI‘s Weekly Spot Gas Average advanced a stout 41 cents as of Nov. 23, but for the week ended Dec. 2, only two points followed by NGI fell into the loss column and theaverage vaulted 53 cents to $3.23.

Algonquin Citygate, with a loss of 3 cents to $3.63, and Tennessee Zone 6 200 L, with a 6-cent decline to $3.78, were the only locations not deeply into double-digit gains for the week. Of all the remaining actively traded points the week’s greatest gainer was Transwestern with an advance of 65 cents to average $3.22.

Regionally only Appalachia with a rise to 30 cents to $2.66 and the Northeast with a gain of 36 cents to $3.34 did not see the 50- to 60-cent moves of other sections of the country.

California and East Texas both advanced 56 cents to $3.41 and $3.25, respectively, and the Southeast rose 57 cents to average $3.33.

The Midwest and South Texas added 58 cents to $3.37 and $3.26, respectively, and South Louisiana and the Midcontinent both posted 59 cent gains to $3.29 and $3.23, respectively.

The Rocky Mountains stood atop the leader board with a 60 cent rise to $3.17.

December natural gas futures expired Monday at $3.232, 46.8 cents higher than the November contract.

Should futures retain their function as a leading indicator, next week’s cash gains are likely to be stellar as well. The January contract added 40 cents to settle at $3.436 after trading Friday at a two-year spot high of $3.568.

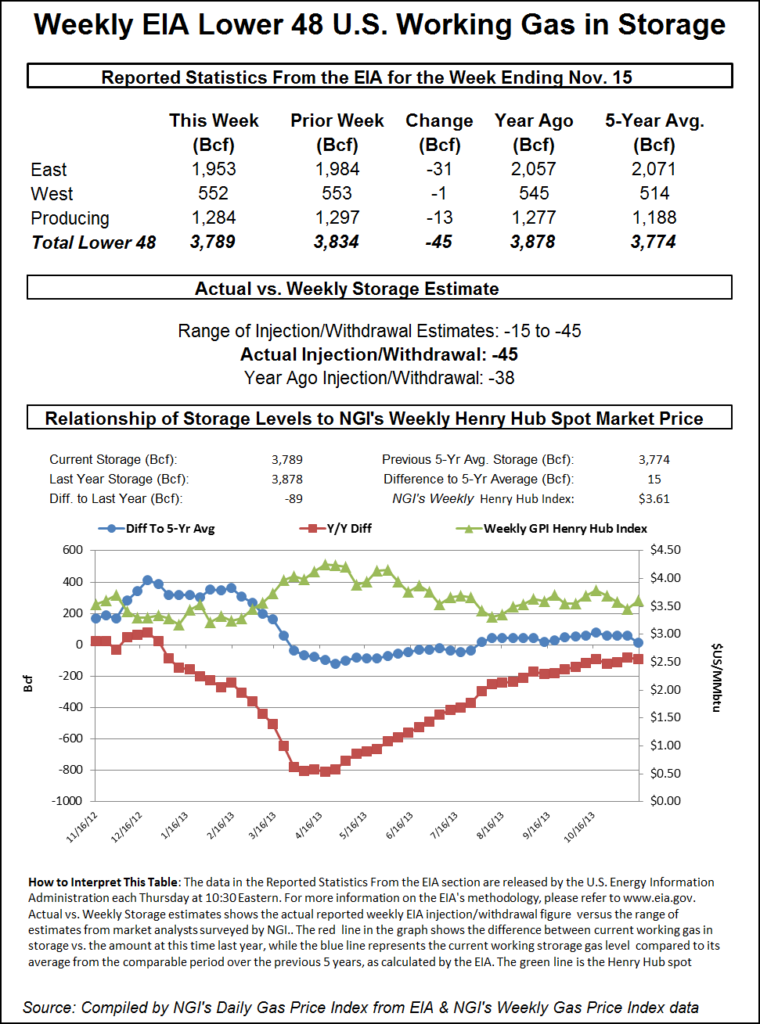

Thursday the Energy Information Administration (EIA) reported the second storage withdrawal of the young heating season, and futures bulls welcomed it with open arms. The withdrawal of 50 Bcf for the week ending Nov.25 fell only about 3 Bcf shy of expectations.

January finished Thursday’s session with a 15.3-cent advance to $3.505, the highest spot close since December 2014, and February added 15.0 cents to $3.509. January crude oil was able to build on its $4-plus gain of Wednesday and added $1.62 more Thursday to end at $51.06/bbl.

Even though the EIA-reported withdrawal was slightly less than what traders were expecting, it was above seasonal averages — all the bulls needed to carry the market higher.

January futures reached a high of $3.479 on Thursday immediately after the figures were released, and by 10:45 a.m., January was trading at $3.470, up 11.8 cents from Wednesday’s settlement.

Traders saw the market move off the number as somewhat ephemeral, but proved clairvoyant by the end of the week.

“I think it’s going to do a little pull back from this number,” said a New York floor trader. “It didn’t really tap the $3.48 area, so I think it’s going to pull back to the $3.41 to $3.43 area, and there is the possibility to slip back to the upper $3.30s.

“Traders are trying to hold the market up, but at this time it doesn’t look like a strong hold,” he said.

“The net implied flow this week was -50 Bcf, still slightly [more] than the five-year average of -44 Bcf as stockpiles began to rapidly fall back towards the five-year historical range,” said Harrison, NY-based Bespoke Weather Services. “Next week’s number will likely be a bit more loose, though even this week saw a small amount of loosening as an additional 54 temperature degree days (TDD) only drew 48 Bcf more out of storage. We may struggle to break above $3.50 resistance.”

Understatement, anyone?

“The 50 Bcf net withdrawal from U.S. storage for last week was a bit less than some expected, given the 49-53 Bcf range among the newswire survey estimates,” said Tim Evans of Citi Futures Perspective. “This is not a major miss, however, and was still more than the 43-Bcf five-year average, so we wouldn’t anticipate much of a bearish price reaction.”

Others see a market ripe for a correction. “I think it is very overbought here,” said McNamara Options Director of Trading Alan Harry. “We may have a high of $3.70, but I think it’s going to wedge [congest] in here, and I think we are going to come off. I would look for the market to trade below $3.38, and that would be my signal to go short.

“There are so many longs in the market that it would have to entice some large players to take a short position. It’s probably going to take a fund on the opposite side to be the short. If I were a producer I would be hedging all I could.”

Inventories now stand at 3,995 Bcf and are 24 Bcf above last year and 235 Bcf more than the five-year average. In the East Region, 23 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 23 Bcf as well. Stocks in the Mountain Region fell 1 Bcf, and the Pacific Region was unchanged. The South Central Region shed 3 Bcf.

In Friday’s trading buyers and sellers for weekend and Monday deliveries were mostly balanced, as a strong Northeast and Appalachia were able to offset weakness in Texas, Louisiana, the Rockies and California.

The NGI National Spot Gas Average added 2 cents to $3.29, but eastern points got a boost from strong power demand expected next week. Futures took a breather following the 19-cent rise from the previous two sessions as January lost 6.9 cents to $3.436, and February also slipped 6.9 cents to $3.440. January crude oil continued its romp higher and gained 62 cents to $51.68/bbl.

Analysts see firm physical pricing next week as cold weather treks eastward from the Rockies to the East.

“Demand and prices are poised to rise…through early next week as the coldest temps so far this season are making their way into U.S. markets coast-to-coast,” said industry consultant Genscape Inc. in a report. “Several Northeast markets are already experiencing the cold,” as prices firmed in weekend trade at the Algonquin Citygate, Tenn Zone 6 200L and Transco Zone 6.

Friday’s demand in New England was up to 2.97 Bcf/d, Genscape noted. The “weekend effect may sap some of the momentum, but with the cold forecast to be present well into next week, we have demand rising to a peak of 3.1 Bcf/d on Tuesday.”

Appalachia demand, Genscape said, rose above 12 Bcf/d on Thursday and remained there on Friday.

“We show it picking up about 0.4 Bcf/d through the weekend and headed toward a peak of 14.2 Bcf/d by Monday. Southeast/Mid-Atlantic demand is also expected to remain elevated,” after cresting at the 15 Bcf/d-mark Thursday and climbing to 16.2 Bcf/d by Monday.

Gas for weekend and Monday delivery at the Algonquin Citygate jumped 68 cents to $4.32, and deliveries to Iroquois, Waddington added 22 cents to $3.91. Gas on Tenn Zone 6 200L jumped 32 cents to $4.21.

Packages on Texas Eastern M-3, Delivery rose 6 cents to $2.88, and gas bound for New York City on Transco Zone 6 rose 23 cents to $3.29.

Firming power prices and strong Monday loads also made purchases for incremental gas-fired generation more feasible. Intercontinental Exchange reported on-peak Monday power at the ISO New England’s Massachusetts Hub jumped $9.98 to $43.91/MWh, and Monday power at the PJM West terminal rose $2.80 to $35.82/MWh.

Monday power loads were forecast to be higher than Friday’s. The PJM Interconnection forecast peak power Friday of 34,451 MW would reach 35,115 MW by Monday. The New York ISO predicted Monday peak power load of 20,483 MW, well above Friday’s 19,826 MW peak.

Major market centers were widely mixed. Gas at the Chicago Citygate rose 2 cents to $3.41, and gas at the Henry Hub shed a penny to $3.41. Deliveries to El Paso Permian slipped a dime to $3.16, and gas at the SoCal Citygate plunged 19 cents to $3.41.

Traders see the market embracing the trend to colder temperatures at the expense of record storage.

Gas supply “remains at a record level per date,” but “this static factor continues to take a backseat to the bullish dynamic of upcoming cold weather trends,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients. “Technical indicators also appear bullish amidst fresh multi-week highs that have been developing on almost a daily basis.

“While our indicators are beginning to signal an overbought condition, the market also appears to see little chart resistance until the mid-October highs of about $3.67.

“In sum,” he said, “we will continue to caution against attempts to pick a top to this strong three-week price advance as we continue to emphasize holding bull spreads that appear capable of capturing the influence of additional expected strengthening in the cash basis.

Allowing for “a consolidation phase for a few sessions as the market digests the huge 80-cent price-up move of the past three weeks, we feel that a further extension of cold temperature forecasts toward the Christmas holiday break could further advance January futures toward the October highs of about $3.67,” Ritterbusch said.

The nearest price support “develops at about the $3.37 level,” which “could easily be tested on even a minor bearish shift in the weather views,” he added. “But for now, we are steering away from any strong buy or sell recommendations at this early stage of the heavy usage cycle when even minor shifts in the forecasts tend to prompt an outsized price response.”

Gas buyers across PJM for Friday and weekend power generation will have only a nominal amount of wind power to offset gas purchases.

A “complex, split storm system will introduce an increasing chance for one round light rain/snow showers during late Sunday into early Monday,” said WSI Corp. in its Friday morning report to clients. “A second round of rain, perhaps even some wintry weather, is possible during Tuesday. Temperatures will generally fluctuate in the upper 30s, 40s to mid 50s.

“A brisk west-northwest wind behind the cold front” was expected to continue to support elevated wind generation on Friday, with output forecast to be 2-3 GW. “Eventually, wind gen will drop off and become light during the majority of the weekend, with only modest improvement during early next week.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |