Markets | NGI All News Access | NGI Data

Bulls On Run As NatGas Storage Withdrawal Surprises Traders

Natural gas futures surged past $3 Wednesday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was not what the market was expecting.

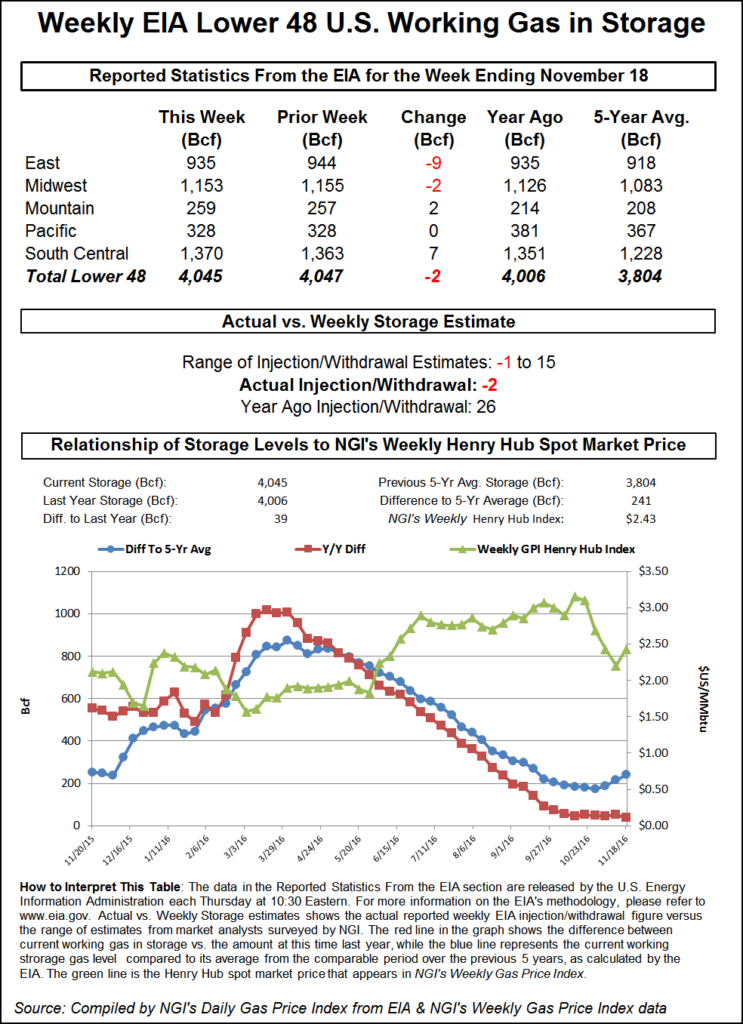

EIA reported a 2 Bcf storage withdrawal in its noon EST release, whereas traders were expecting a build of about 5 Bcf. December futures reached a high of $3.057 immediately after the figures were released and by 12:15 p.m. December was trading at $3.028, up 4.6 cents from Tuesday’s settlement.

Floor traders were fed bad information.

“We looked at the way the number popped and said that has got to be a draw, but we looked at the screen and it was showing a 2 Bcf build,” a New York floor trader told NGI. “Crazy stuff. If that had happened in the old days, it would have been chaos.

“I’m thinking $3 is light support, and below that you have $2.90. $3.10 would be resistance, and maybe $3.25 from there. The bulls will be eating the turkeys.”

Wells Fargo Securities analyst David Tameron said the 2 Bcf withdrawal “was well below consensus and 11 Bcf below last year’s mark, while the five-year average withdrawal of 45 Bcf was heavily influenced by the 162 Bcf withdrawal figure in 2014. Natural gas storage likely peaked last week and our model currently forecasts a draw of 49 Bcf next week.”

Inventories now stand at 4,045 Bcf and are 39 Bcf more than last year and 241 Bcf more than the five-year average.

In the East Region, 9 Bcf were withdrawn, and the Midwest Region saw inventories decrease by 2 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was unchanged. The South Central Region added 7 Bcf.

Salt cavern storage was up 2 Bcf at 396 Bcf, while the non-salt cavern figure was up 5 Bcf at 974 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |