ICE to Provide NatGas Price Data to Platts

Intercontinental Exchange (ICE), which since 2008 has provided its daily and monthly physical natural gas prices for Natural Gas Intelligence (NGI) to incorporate into its published spot market price surveys, agreed Monday to provide similar data for S&P Global Platts. Under the agreement, ICE data would be anonymized and included as inputs into the Platts physical market price assessments in early 2017.

In addition, Platts expects to grant exclusive rights to ICE of its North American physical gas benchmarks in settling and clearing gas derivatives contracts after a transitional period. Currently CME’s NYMEX lists a number of indexes based on Platts data.

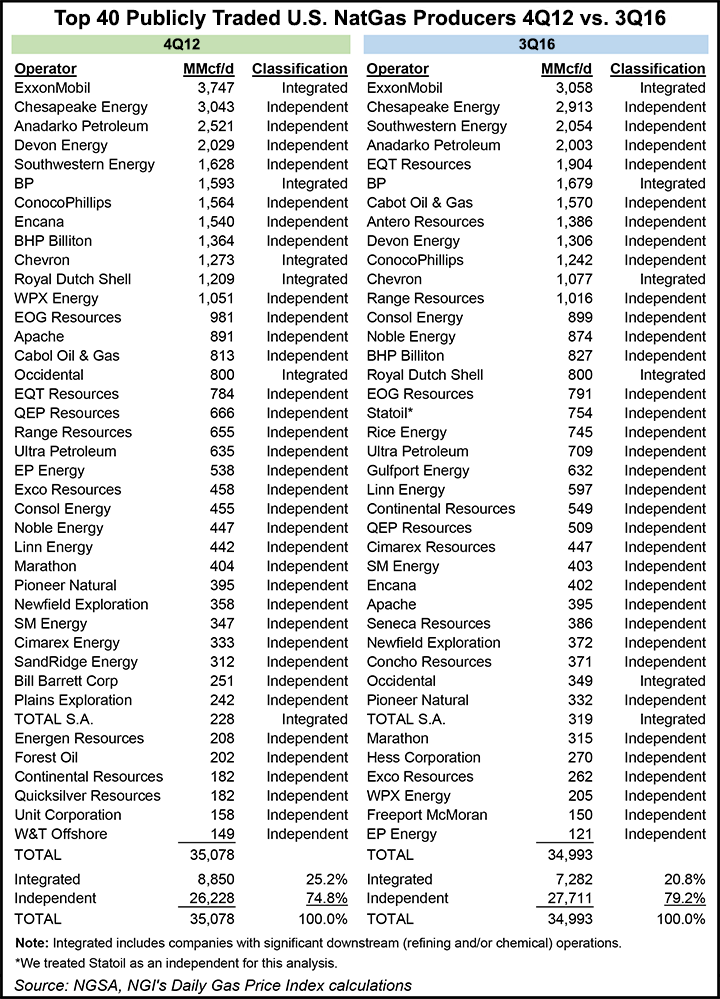

NGI and Platts, the two most cited price reporting agencies (PRA) aggregating natural gas prices under a voluntary format set out by the Federal Energy Regulatory Commission in 2003, have both experienced a decline in reported transactions from market participants in recent years. As the price of natural gas has declined, shrinking margins have made it less attractive to speculative traders. Also, much of the booming shale gas production comes from independents, who do not tend to report, and regulatory reforms following the banking crisis of 2008 have likely curbed physical market activity from financial institutions.

The price indexes also have suffered from their own success, with more of the market simply using the indexes in their contracts instead of doing fixed price trading. This is despite the fact that the PRAs, adhering to FERC guidelines, publish the shrinking number of transactions and volumes of gas that underlie each of the price index locations.

By way of a 2007 deal with ICE, NGI has been able to include ICE next day and next month transactions in its indexes since January of 2008, boosting the data NGI receives by more than 40% at many of its 143 price index locations. For more on how NGI utilizes ICE and market data in the construction of its Natural Gas Price Indexes, see NGI‘s Price Methodology.

ICE has become a powerhouse among market exchanges. In late 2012, after making several strategic exchange deals, ICE acquired the New York Stock Exchange for $8.2 billion. The transaction followed two key agreements in 2007, including an alliance with Canada’s Natural Gas Exchange Inc. (NGX), which produces the AECO/NGX — Intra Alberta natural gas index, referenced in many swaps transactions in Western Canada. Also in 2007, ICE merged with the New York Board of Trade, and at midyear acquired the Winnipeg Commodity Exchange.

NGI, headquartered in Dulles, VA, has been collecting, aggregating and publishing spot natural gas price indexes since 1983 in NGI’s Daily Gas Price Index, adding in shale basin prices in its Shale Daily for the last six years.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |