Bakken Shale | E&P | NGI All News Access

North Dakota Producers Keep Eye on Dakota Access, OPEC Developments

As production continues to fall further below the 1 million b/d level, North Dakota producers and state officials are casting an anxious eye on the political fight surrounding the completion of the Dakota Access oil pipeline and developments thousands of miles away in the Middle East, where OPEC ministers are considering a production cutback.

Both developments could influence what approach the Bakken Shale producers ultimately take regarding production increases next year, the state’s chief oil/natural gas regulator, Lynn Helms, said Wednesday during a webinar reporting the latest monthly production statistics. Oil production was down about 1% in September, the latest month for complete statistics, but natural gas production dropped even more, 2.3%, Helms said.

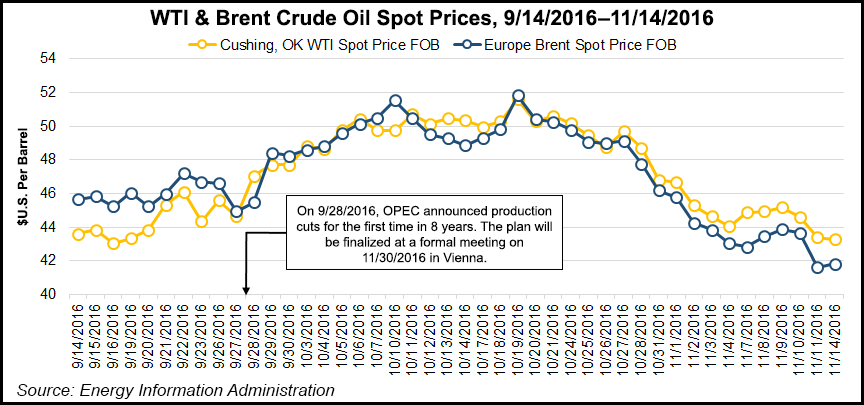

While it is now “more probable” there will be a drop in production at OPEC, Helms said in anticipation of the cutbacks, in recent weeks production was ramped up to what he called “record levels (33.7 million b/d).” This means even with the cuts the global production will still be at the levels of August or September, he said.

“This slows all the expectations about increased [Bakken] activity,” Helms said, adding that Bakken operators have indicated that they plan to add about a dozen rigs next year collectively. With the current rig total at 38, that means the overall rig count a year from now will be about 50, he said.

Helms said state and industry officials will be watching the Dakota Access and Keystone XL oil pipelines with the new Trump administration set to take over in January. Dakota Access, in particular, has a large potentially favorable economic impact on North Dakota producers if it can be completed early next as planned, he said.

In response to a question on the webinar, Helms said he thinks the delay and uncertainty now surrounding the $3.8 billion Dakota Access project is affecting production in the state.

“The uncertainty is having an impact,” he said. “When producers look at their economics, they look at well cost, well productivity and taxes, and then they have to look at transportation costs, and that is a big factor. If they can lock in a known transportation cost, that really helps them in terms of raising venture capital, so if they ramp up production and all of it has to be shipped on rail cars that adds $15-25/bbl for transportation.”

Helms estimates that transportation costs generally with the new oil pipeline would be $6-10/bbl for shipping, without Dakota Access those costs are $12-25/bbl. The key is to lock in transportation costs long term and have a widely known value for it, he said.

A combination of the completion of the new four-state oil pipeline and a substantial cut in OPEC production would remove a lot of the current uncertainty that is keep production down in the state, Helms said in response to another question.

“Instead of cutting the 700,000 b/d that they have talked about, cutting 1 million b/d would put us solidly above the $50/bbl WTI price, which is a key number in terms of mobilizing frack crews and really stabilizing production in North Dakota,” he said. “So I think the state and our energy industry would like to see a million barrels [daily] taken off the [global] market.”

Producers are looking for $50-55/bbl oil to allow them the “running room” to frack wells and stabilize production above 900,000 b/d, Helms noted.

For September, the state’s oil production was 29.1 million bbl (971,658 b/d), compared to August totals of 30.4 million bbl (982,011 b/d). Natural gas production in September was 48.3 Bcf (1.61 Bcf/d), compared to 50.8 Bcf (1.63 Bcf/d).

Prices on Wednesday for Bakken sweet crude were $34.75/bbl, down from October prices of $39.31/bbl.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |