NatGas Cash Inches Higher; Revised Weather Lifts Futures a Nickel

Physical gas for Thursday delivery was a mixed affair on Wednesday with stout gains in California and the Rockies offset by sluggish prices in the Southeast, Midwest and Midcontinent. The NGI National Spot Gas Average added 2 cents to $2.35, and Marcellus points continued to set one-year highs with many now above $2.00.

Futures managed to hold on to weather forecast-driven gains on the open, and at the close December was higher by 5.5 cents to $2.764, and January had advanced 3.5 cents to $2.920. December crude oil took a break from its $2.49 surge Tuesday and fell 24 cents to $45.57/bbl.

Questions about a Trump administration and its pro-coal stance impact on the natural industry continue to get the attention of industry cognoscenti.

The incoming administration is “set to be decidedly more pro-fossil fuels than either the Obama administration or a Clinton administration would have been,” said BTU Analytics’ Marissa Anderson in a note to clients. “One notable focus during the campaign was Trump’s vow to bring back the struggling coal industry, [and] while oil and gas development also arguably benefits under a Trump administration, one ramification of a supported coal industry is the potential for increased competition between natural gas and coal for power generation demand.

“Could Trump’s pro-coal support come at the cost of natural gas demand in the power market?” Power generation has been a key source of growing demand for U.S. natural gas, increasing over 30% over the past five years. Natural gas has been gradually displacing coal in the generation stack, and net generation using natural gas has even started to exceed coal beginning at the end of last year…

“Trump’s focus on the stump was in reducing regulations for the coal industry,” Anderson said. One notable regulation likely in Trump’s sights is the Environmental Protection Agency’s Clean Power Plan (CPP), designed to reduce carbon emissions to 32% below 2005 emission levels by 2030, she noted.

“This puts pressure on coal-fired power plants given they are relatively large emitters of carbon dioxide. While the plan continues to be challenged in court, and the Supreme Court placed a hold on the plan pending judicial review, Trump may advocate to kill this plan outright, lifting the regulations and stemming the decline in coal plant retirements,” said Anderson.

One industry insider does not expect much of an impact if Trump were to reinvigorate coal usage.

“It may have a little bit of an effect, temporarily, but all in all it [coal] is a needed supply source for plants that won’t switch over,” said a Houston-based industry veteran. “I think it’s going to end up not being a major difference in the natural gas side of things.”

Futures rose as traders digested expected cold in eastern markets later in the month.

Analysts see a shift to cooler temperatures, especially in the East, by the end of the month. “Over the past three to four days, we have a seen some serious shifts in the weather outlook for the balance of the month,” said EnergyGPS in a Wednesday morning report to clients. “Since walking out the door last Friday (Nov. 11) we have seen 42 heating degree days (HDD) added to the 15-day forecast” from Tuesday morning.

“The largest deltas have been in the East and Midwest regions of the United States…the driver of the increased HDDs has been the six-10 day period as a cold front moves through the Midwest and the East.”

HDDs tell the tale, according to EnergyGPS.

“We can see the cooler weather move through the Midwest driving HDDs from 4 degrees below normal to above normal” between Friday and Saturday. “The East follows suit, shifting above normal” on Sunday, bringing the entire continental U.S. HDD forecast above normal.

“After the cold spell in the six-10, the East will stay above normal for the duration of the 11-15 day periodm while the Midwest joins the rest of the country back below normal,” EnergyGPS said. “Diving into the East a little deeper, we can see that the East is forecast to rise above last year to end the month as well.

“We really can’t understate the importance of the shift up in East HDDs we have seen since the end of last week. Most of the long-term models have pointed to the expectation of December coming in just above to inline with normals for the East and well above last year. However, this is the first time that the short-term models are confirming the outlook.”

In physical market trading, West Coast locations scored some of the day’s greatest gains. Deliveries to the PG&E Citygate were flat at $2.94, but gas at the SoCal Citygate was 17 cents higher at $2.68. Deliveries priced at the SoCal Border Avg. Average also rose 18 cents to $2.47, and gas on Kern Delivery added 19 cents to $2.50.

Gas in the Marcellus continued to post one-year highs. Packages on Dominion South changed hands a nickel higher at $2.07, and deliveries on Tennessee Zn 4 Marcellus also advanced a nickel to $1.98. Gas on Transco-Leidy Line added 6 cents to $2.05.

Gas at the Chicago Citygate rose 2 cents to $2.42, and gas at the Henry Hub was quoted at $2.53, up 4 cents.

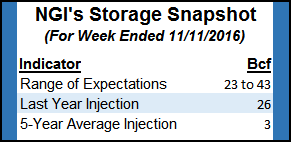

Another record is expected to be set with Thursday’s Energy Information Administration inventory report. Supplies currently stand at a record 4,017 Bcf, and estimates for the week ended Nov. 11 show supplies, and the surplus, continuing to grow.

Last year 26 Bcf was injected and the five-year pace is for a 3 Bcf increase. PIRA Energy calculated an injection of 27 Bcf and Ritterbusch and Associates is looking for a build of 35 Bcf. A Reuters survey of 19 traders and analysts revealed an average 31 Bcf with a range of 24 Bcf to 43 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |