Weekly NatGas Cash Groans Under Weight Of Record Storage Inventory

The weekly natural gas cash average failed to break under $2 for the week ended Nov. 11, but the stress of moderate weather and record storage inventories prompted double-digit losses throughout the country with the notable exception of Appalachia and the Northeast, which were propped up by a potential bout of cold.

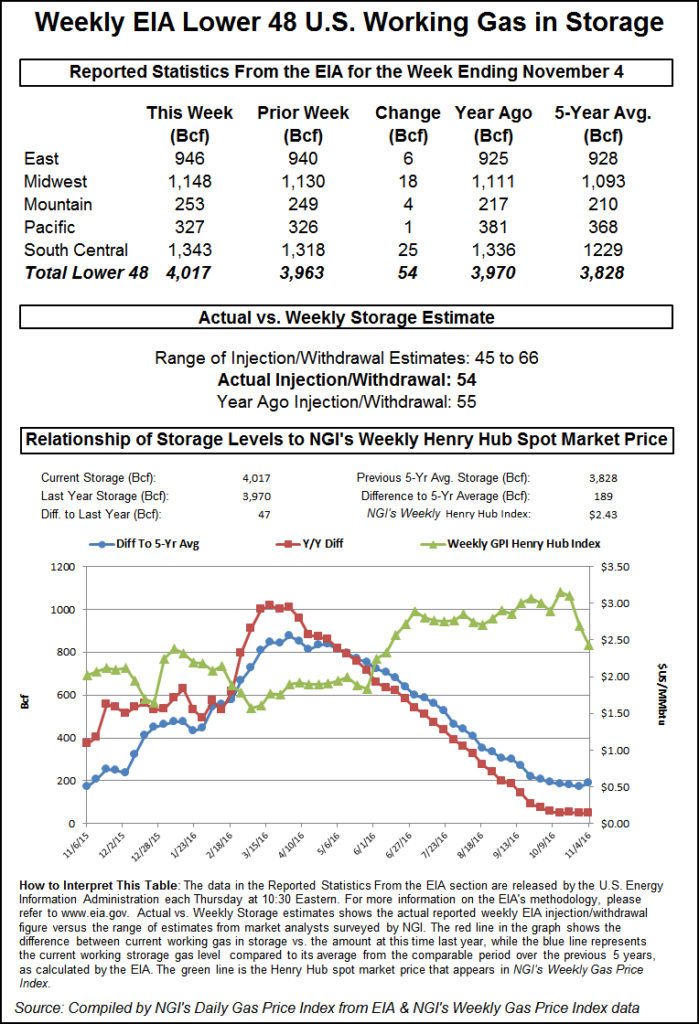

On Thursday the Energy Information Administration (EIA) reported a natural gas storage increase for the week ending Nov. 11 of 54 Bcf to 4,017 Bcf, a new all-time record. NGI‘s National Weekly Spot Gas Average fell a dime to $2.05, but eastern points proved resilient. Of the actively traded points Tetco M-3 Delivery and Transco Zone 6 non New York North tied for the week’s greatest gainer with 25-cent advances to $1.89 and $1.98, respectively. The Houston Ship Channel took the cellar position with a loss of 27 cents to average $2.20.

Regionally the Northeast rose 10 cents to average $2.06 and Appalachia added 17 cents to $1.79 as the region slowly breaks free of the yoke of infrastructure shortcomings and strives for price parity with points west and south.

All other regions fell into the loss column. South Lousiana and South Texas both dropped 21 cents to $2.11 and $2.09, respectively, and East Texas came in 20 cents lower at $2.13.

The Midwest shed 15 cents to $2.12 and the Midcontinent fell 14 cents to $2.04.

The Southeast dropped 13 cents to average $2.14, California was down 12 cents to $2.18, and the Rocky Mountains fell by 11 cents to $1.93.

December futures joined the party with a 14.8-cent decline on the week to $2.619, aided by a storage milestone reached on Thursday. The EIA reported a storage build of 54 Bcf for the week ending Nov. 4, about what newswire surveys had projected, and prices rallied off early session lows but failed to make it to positive territory.

The build put working gas storage at a new all-time record level of 4,017 Bcf, and December futures on Thursday shed 5.8 cents to $2.632 while January gave up 4.8 cents to $2.811.

The 54 Bcf reported by EIA was about what surveys and analyst estimates had expected but greater than pre-report electronic storage trading. December futures reached a low of $2.575 immediately after the figures were released and by 10:50 a.m., EST December was trading at $2.642, down 4.8 cents from Wednesday’s settlement but 2.2 cents higher than the session open.

“What’s interesting is that the number came in bigger than expected, and traders are rallying the market,” said Alan Harry, director of trading at McNamara Options. “It came in at 54 Bcf and was 49-50 on ICE. Most people were expecting 51, so it is more than expected.

“The reason it’s rallying is that you have speculators coming in to buy it. They think we are near a low and there are some big bullish trades coming into the market.”

Others don’t see the market rallying. “There’s a glut of natural gas. I wouldn’t advise anyone to buy natural gas,” said a New York floor trader. “Maybe at $2.48 to $2.36, but this market can’t sustain anything. It got up to $3.36 and everyone got their hopes up. That was the perfect time to sell.

“If the market bounces, it’s good for 6 or 7 cents, but there is just too much gas out there. At $2.36 it would be a buy, but not a heavy buy. I still don’t like this market. I don’t like the feel of it.”

Others are a little more positive. “We believe the storage report will be viewed as neutral,” said Randy Ollenberger of BMO Capital Markets. “Storage remains at record levels, and for the past few weeks injections have exceeded or matched the level of injections last year due to warmer-than-normal weather. We believe that U.S. working gas in storage could exit the year at five-year average levels and trend toward five-year lows by the end of the winter withdrawal season, assuming normal weather.”

Inventories now stand at 4,017 Bcf and are 47 Bcf greater than last year and 189 Bcf more than the five-year average. The new record level of gas in the ground eclipses the previous record of 4,009 Bcf that was recorded for the week ending Nov. 20, 2015. It is also important to note that the EIA’s demonstrated maximum capacity for storage is 4,343 Bcf.

In Friday’s trading weekend and Monday natural gas went begging as price gains in Appalachia and the Northeast prompted by a brief weekend tease of cold air couldn’t counter weakness in the Midcontinent, Rockies and California.

The NGI National Spot Gas Average shed 4 cents to $1.91. Supportive Monday power also helped the cause of eastern gas, but futures continued to flounder. At the close, December had fallen 1.3 cents to $2.619, yet January added 3.9 cents to $2.850. December crude oil imploded $1.25 to $43.41/bbl.

Strength in Monday on-peak power along with forecast cooler temperatures in the Northeast lifted prices by as much as a dime. Intercontinental Exchange reported on-peak Monday power at the ISO New England’s Massachusetts Hub gained $2.20 to $26.00/MWh and power at the PJM West terminal added $3.93 to $31.26/MWh.

Gas on Texas Eastern M-3, Delivery rose 7 cents to $1.97, and gas headed for New York City on Transco Zone 6 rose 6 cents to $2.06.

Marcellus points also firmed. Gas on Dominion South gained 10 cents to $1.83, and packages on Tennessee Zn 4 Marcellus tacked on 2 cents to $1.70. Gas on Transco-Leidy Line changed hands at $1.76, up 4 cents.

According to AccuWeather.com meteorologists. “December-like air will push across the northeastern United States during the first part of this weekend. There will be a brief taste of winter in the days to come as we move closer to the winter months in the Northeast,” said meteorologist Matt Rinde.

“A cold front will deliver a shot of frosty air from northern Canada, dropping temperatures closer to those typical of early December, [and] the core of the cold will cycle through into Saturday morning along with gusty winds.

“The long stretch of abnormal warmth this fall, combined with a gusty wind, will make it feel particularly cold Friday night into Saturday,” said meteorologist Ryan Adamson.

“Accompanying this turn to colder weather will be a few rain showers, mixed with, or possibly turning to all snow in the higher elevations of New York state and northern New England,” Rinde said. Any accumulations will be minor and mainly limited to northern New York and New England, [and] The colder weather on Saturday will run about 5 to 10 degrees Fahrenheit below average,” Rinde said.

In spite of recent price weakness analysts say it’s too early to give up on 2017. “We do not see the warm start to Q4 as a significant enough concern to abandon our constructive outlook for natural gas in 2017,” said Nicholas Potter of Barclays Commodities. “A warm October and November means March 2017 storage will end at 1.8 Tcf, a 150 Bcf increase from our previous outlook and in line with the five-year average.

“However, if a warm November extends into a warm December, this would be a larger concern for the bullish 2017 thesis. A repeat of heating degree days from last year’s warm December would result in end-March storage levels closer to 2 Tcf and keep Q4 cash prices below $3.00/MMBtu for the quarter.

A warm November was on the minds of other traders as well. “[T]here is still no evidence of even broad-based normal trends, especially within the upper Midcontinent where mild views are now extending beyond Thanksgiving,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning report. “[Thursday’s] larger than normal storage injection of 54 Bcf stretched the surplus against five-year averages by around 16 Bcf. But we see the market currently looking ahead to next week’s report that could easily post double yesterday’s expansion in the surplus with storage lifting to above 4.05 Tcf.

“Should mild trends stretch into month’s end, a record 4.1 Tcf supply would remain on the table, in our opinion, providing a major supply cushion against even the coldest of winter requirements. And with storage currently some 1.2% above a year ago, another mild winter similar to last year would imply a burdensome supply situation that will require a major shift in coal to gas displacement, increased exports, downsized production, etc., if additional price weakness toward the $2 area is to be precluded.”

Drillers are biding their time as U.S. drilling rigs mostly stayed put during the week ending Friday, according to Baker Hughes Inc. The land-based count was even with the previous week; one rig left the inland waters. And that was it.

Gas buyers focused on weekend power generation across the MISO footprint were likely to see widely varying amounts of wind generation. “The tail end of a polar cold front will continue to push southward across the Midwest [Friday],” said WSI Corp. in its Friday morning report. “A northerly breeze behind the front will briefly knock temperatures down into the 40s, 50s to low 60s across the aforementioned regions, which are still above average in most cases. This cool-down will be short lived as fair weather and a blustery southwest wind will lead to a surge of warm weather during the weekend into early next week. Once again, max temps will range in the 50s, 60s to mid 70s.

“High pressure will cause wind generation to subside and become light today. Another surge of strong wind gen is likely during tonight into the weekend. Output is forecast to peak 8-11+ GW.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |