NatGas Cash, Futures Pressured by Record Storage Level; December Drops 6 Cents

Next-day natural gas sported broad-based declines Thursday as traders hunkered down to get their deals done prior to the release of Energy Information Administration (EIA) inventory data.

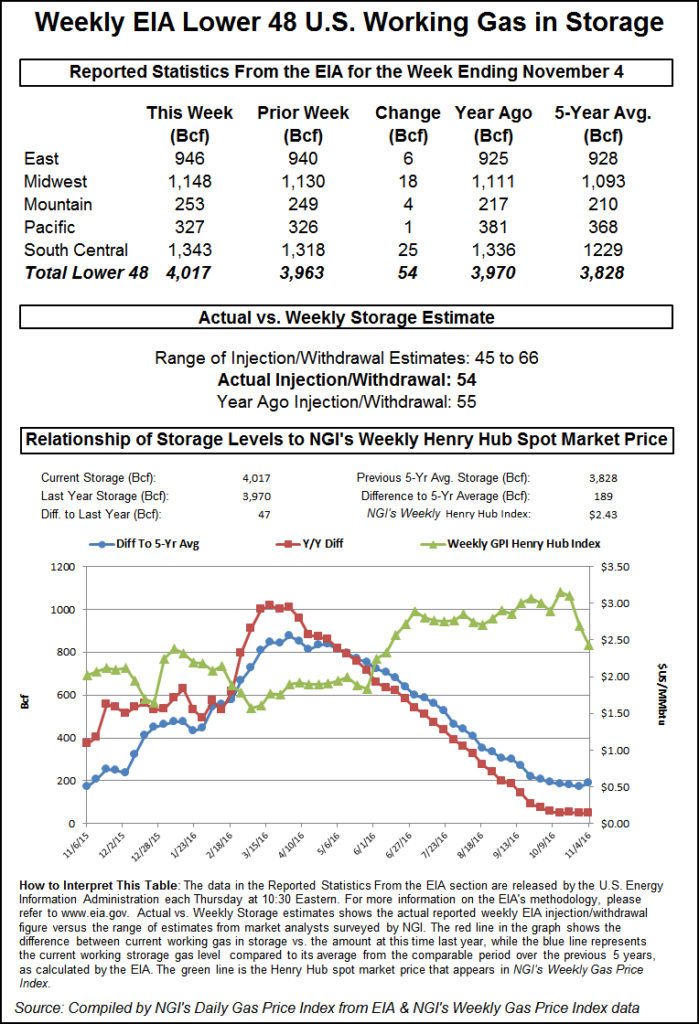

Stout double-digit losses prevailed, and only a few eastern points managed to avert the barrage of selling. The NGI National Spot Gas Average fell 14 cents to $1.95. EIA reported a storage build of 54 Bcf for the week ending Nov. 4, about what newswire surveys had projected, and prices rallied off early session lows but failed to make it to positive territory.

The build put working gas storage at a new all-time record level of 4,017 Bcf, and December futures shed 5.8 cents to $2.632 while January gave up 4.8 cents to $2.811. December crude oil fell 61 cents to $44.66/bbl.

The 54 Bcf reported by EIA was about what surveys and analyst estimates had expected but greater than pre-report electronic storage trading. December futures reached a low of $2.575 immediately after the figures were released and by 10:50 a.m., EST December was trading at $2.642, down 4.8 cents from Wednesday’s settlement but 2.2 cents higher than the session open.

“What’s interesting is that the number came in bigger than expected, and traders are rallying the market,” said Alan Harry, director of trading at McNamara Options. “It came in at 54 Bcf and was 49-50 on ICE. Most people were expecting 51, so it is more than expected.

“The reason it’s rallying is that you have speculators coming in to buy it. They think we are near a low and there are some big bullish trades coming into the market.”

Others don’t see the market rallying. “There’s a glut of natural gas. I wouldn’t advise anyone to buy natural gas,” said a New York floor trader. “Maybe at $2.48 to $2.36, but this market can’t sustain anything. It got up to $3.36 and everyone got their hopes up. That was the perfect time to sell.

“If the market bounces, it’s good for 6 or 7 cents, but there is just too much gas out there. At $2.36 it would be a buy, but not a heavy buy. I still don’t like this market. I don’t like the feel of it.”

Others are a little more positive. “We believe the storage report will be viewed as neutral,” said Randy Ollenberger of BMO Capital Markets. “Storage remains at record levels, and for the past few weeks injections have exceeded or matched the level of injections last year due to warmer-than-normal weather. We believe that U.S. working gas in storage could exit the year at five-year average levels and trend toward five-year lows by the end of the winter withdrawal season, assuming normal weather.”

Inventories now stand at 4,017 Bcf and are 47 Bcf greater than last year and 189 Bcf more than the five-year average. The new record level of gas in the ground eclipses the previous record of 4,009 Bcf that was recorded for the week ending Nov. 20, 2015. It is also important to note that the EIA’s demonstrated maximum capacity for storage is 4,343 Bcf.

In the East Region 6 Bcf was injected, and the Midwest Region saw inventories increase by 18 Bcf. Stocks in the Mountain Region rose 4 Bcf, and the Pacific Region was up by 1 Bcf. The South Central Region added 25 Bcf.

Near-term prices may be under pressure, but with the election of Donald Trump as president a tide of positive changes may be in the cards for natural gas and energy markets in general. The president-elect has championed every form of U.S. energy development, even those that compete against each other, such as coal and natural gas. He has proposed allowing states to regulate energy development over the federal agencies and opening up more federal lands to drilling.

His transition team is said to be eyeing Continental Resources Inc. CEO and founder Harold Hamm, a major GOP contributor and Trump adviser, as energy secretary.

“We are looking forward to President Trump doing what he promised, which is to undo many of the onerous regulations that have plagued our industry throughout an Obama presidency,” Hamm said. However, he demurred during an interview on CNBC Wednesday when asked about whether he had discussed the appointment, noting he had a company to run.”

In the meantime, physical markets have something of an uphill battle with burdensome supplies and a weather outlook that seems to ignore the calendar. The day’s injection marked a new high-water mark for natural gas storage at 4,017 Bcf, but observers don’t see much in the way of demand to start working that inventory down. All indications are that storage is likely to continue building. In a report Wednesday, Reuters said that the early figures for the week ending Nov. 11 ranged from injections of 30 Bcf to 45 Bcf, with an average build of 37 Bcf. That compared with a year-earlier injection of 26 Bcf for the same week and a five-year average addition of 3 Bcf.

Recent strength at Northeast physical delivery points isn’t expected to continue. “A handful of Northeast basis points picked up a few more cents in [Wednesday’s] trading, but we don’t see the momentum of the past few days sustaining itself,” said industry consultant Genscape in a Thursday report to clients. “Weather forecasts for the entire nation are reverting to significantly bearish for next week; western gas markets face increased competition from restoration of nuke capacity and strong renewables output; storage facilities are running out of space; and price-driven gains in power burns are kept in check by modest power loads.

“Weather forecasts are still showing a moderate cooling trend today through Saturday. However, things quickly revert starting Sunday. Genscape mets noted that the failure for ridging to develop over the Gulf of Alaska means the warm-weather trend that has dominated so far this month will persist well into Thanksgiving. And an averaging of the last 40 CFS weather model runs projects warmth pushing into December.”

Gas at Eastern points was mixed. Deliveries to the Algonquin Citygate plunged 57 cents to $2.23, but gas on Texas Eastern M-3, Delivery up a penny at $1.90. Gas bound for New York City on Transco Zone 6 rose 9 cents to $2.00.

Elsewhere, deliveries to the Chicago Citygate shed 15 cents to $2.00, and packages at the Henry Hub came in 14 cents lower at $2.08. Gas on Panhandle Eastern skidded 16 cents to $1.90, and gas at the PG&E Citygate was quoted 12 cents lower at $2.42.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |