Spec Buying In Play Following On-Target Storage Report

Natural gas futures rallied off session lows Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was curiously higher than what traders were anticipating.

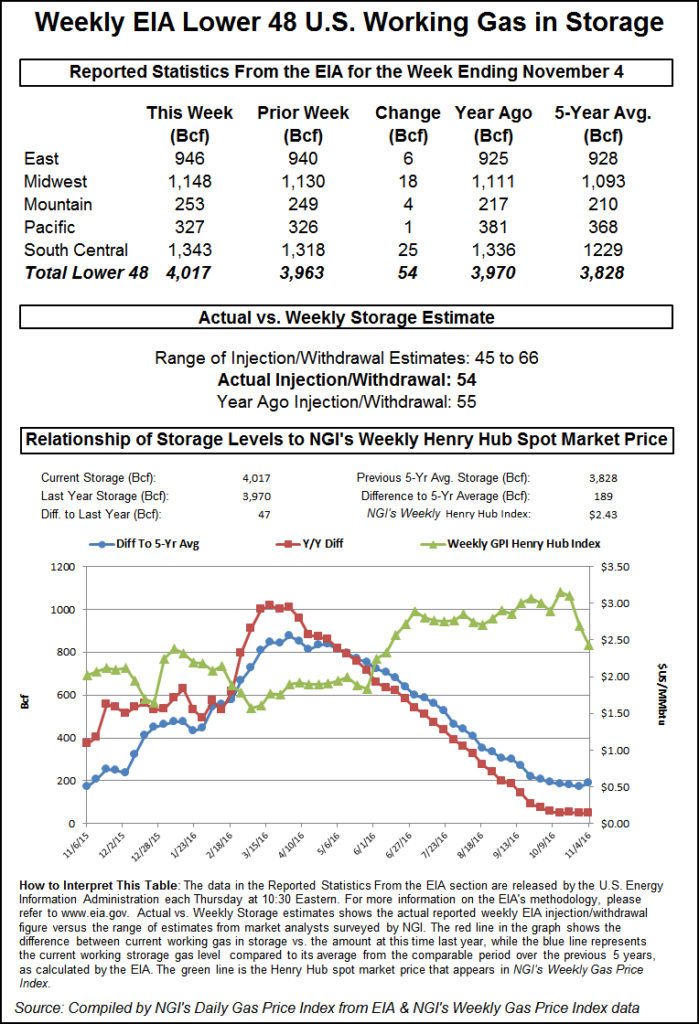

EIA reported a 54 Bcf storage injection in its 10:30 a.m. EST release, about what surveys and estimates by analysts were expecting, but greater than pre-report electronic trading. December futures reached a low of $2.575 immediately after the figures were released and by 10:50 a.m. December was trading at $2.642, down 4.8 cents from Wednesday’s settlement but 2.2 cents higher than the session open.

“What’s interesting is that the number came in bigger than expected, and traders are rallying the market,” said Alan Harry, director of trading at McNamara Options. “It came in at 54 Bcf and was 49-50 on ICE. Most people were expecting 51, so it is more than expected.

“The reason its rallying is that you have speculators coming in to buy it. They think we are near a low and there are some big bullish trades coming into the market.”

Others don’t quite see it that way. “We believe the storage report will be viewed as neutral,” said Randy Ollenberger of BMO Capital Markets. “Storage remains at record levels, and for the past few weeks injections have exceeded or matched the level of injections last year due to warmer-than-normal weather. We believe that U.S. working gas in storage could exit the year at five-year average levels and trend toward five-year lows by the end of the winter withdrawal season, assuming normal weather.”

Inventories now stand at 4,017 Bcf and are 47 Bcf greater than last year and 189 Bcf more than the five-year average. In the East Region 6 Bcf was injected, and the Midwest Region saw inventories increase by 18 Bcf. Stocks in the Mountain Region rose 4 Bcf, and the Pacific Region was up by 1 Bcf. The South Central Region added 25 Bcf.

Salt cavern storage was up 11 Bcf at 385 Bcf, while the non-salt cavern figure was up 14 Bcf at 958 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |