Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Canadian East Coast LNG Export Projects Need Suppliers, Higher LNG Prices

The fiscal case for exporting liquefied natural gas (LNG) from Nova Scotia to Europe continues to decline, as sponsors eye world oversupply.

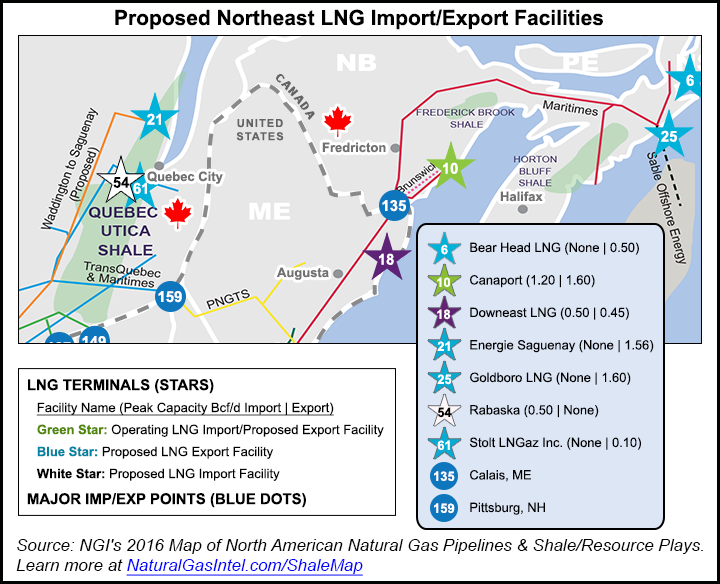

There are three proposed multibillion-dollar facilities proposed for near or on the Strait of Canso in northeastern Nova Scotia. The leading contender, Pieridae Energy’s proposed $8.3 billion export facility for Goldboro, Guysborough County, has a looming final investment decision by its proponents (see Daily GPI, March 9).

“We’re hoping to make the decision by the end of the calendar year…but these dates can move around a little bit,” said Mark Brown, director of project development for Pieridae. “There are still some milestones to finalize, mainly around supply and some of the financing arrangements.”

While Pieridae has a guaranteed buyer, Uniper of Germany, for half its projected gas production on a 20-year contract, it hasn’t signed on a supplier or finalized financing.

“I don’t know if I would put odds on it, per se,” said Brown, when asked how likely the project is to go ahead.

However analysts are more willing, and they say the odds of putting any LNG export facility on Canada’s East Coast are low.

“The world LNG market is oversupplied and prices have plummeted,” said David Hughes, president of Calgary-based consulting firm Global Sustainability and Research Inc.

The spot price per MMBtu worth of Marcellus Shale natural gas was just under $3 on Wednesday. Hughes pegged the expected cost of liquefying natural gas, shipping to Europe and re-gasifying it between $5.50 and $6 per MMBtu, so at current prices an exporter from Goldboro would be selling gas at a loss.

“There’s a whole lot of LNG capacity coming on, so the price will get worse (lower) before it gets better (higher),” said Jackie Forrest, vice-president of research at ARC Financial, before echoing many of Hughes’ comments.

When Goldboro was proposed in 2012, the European import price was over $12/MMBtu

But Hughes explained that since then, when exporting gas through a reversed Maritimes & Northeast Pipeline looked profitable, a significant amount of LNG capacity has come on stream in Australia. Though those plants export to energy hungry Asia, it means that Qatar, one of the world’s largest LNG exporters, has begun selling to the European market, which has driven the price down there.

Meanwhile, construction on Cove Point LNG in Maryland, which will convert to an export facility, is under way. Cove Point will add significant export capacity to Europe for eastern North America’s natural gas (see Daily GPI, Aug. 5).

Nova Scotia’s recent ban on hydraulic fracturing and the cuts to projected available offshore supplies from the Deep Panuke natural gas platform mean much of the gas exported from Goldboro would come from the United States.

But not all of it. Brown said that Pieridae is also in negotiations to secure supply from Ontario and Western Canada.

“We believe we can tie up some of the supply and the financing. We have a pipeline to the property. We have a binding 20-year agreement. We have all the major permits in place. Our front-end engineering and design is completed with at least a Class 3 estimate and we have proven technology,” said Brown of the factors favoring Pieridae.

As for pricing, he said that a decision on whether to go ahead with the project will based on 20- to 30-year projections of gas prices. Both Hughes and Forrest agree that world gas prices could eventually start going back up, but it may not be until the mid-2020s or later.

“But my feeling is that domestic (North American) prices are also going to go up,” Hughes said. “Right now the economics don’t make sense.”

Aaron Beswick is an NGI correspondent. This article originally appeared in the Local XPress, which covers news in and around Nova Scotia.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |