Markets | NGI All News Access | NGI The Weekly Gas Market Report

NatGas Traders Mulling Long, Short-Term Price Trends While Futures Probe Sub-$2.80

Both physical natural gas and futures continued their trek lower in Wednesday trading as the specter of mild weather prompting storage builds at record levels well into November had traders embracing the bearish argument for the near term.

The NGI National Spot Gas Average fell 6 cents to $2.06, and although major market points were down sharply, the Marcellus and points in the Mid-Atlantic made gains. Futures continued lower with double-digit declines of their own.

At the close, December had fallen 11 cents to $2.792 and and January was off 10 cents to $2.978.

Current market sentiment is fairly bearish. In the nearterm, weather developments and abundant if not burdensome storage have traders focusing on lower prices, and longer term, futures and forwards data suggests $3.00 natural gas may not be seen for awhile.

Tim Evans of Citi Futures Perspective is forecasting ongoing storage builds into the middle of November and an implication of downward price pressure. Evans is looking for a build of 56 Bcf in this week’s storage report and said it is in line with industry estimates. “The market’s greatest worry is the forecast for warmer than normal temperatures into the middle of November,” Evans said. The “year-on-five-year average storage surplus that was 182 Bcf on Oct. 21 would decline to 175 Bcf in Thursday’s report, but then trend higher to 260 Bcf as of Nov. 18.

“The rising surplus confirms the market is becoming better supplied on a seasonally adjusted basis, putting downward fundamental pressure on prices,” he said. “This forecast would also result in a new record high storage of 4,070 Bcf on Nov. 11. Overall, we think December futures could fall into the $2.50 to $2.75 range given this outlook.”

Evans recommended holding on to an earlier short position established in the December contract at $3.34 with a protective stop at $3.22 to ensure some additional profit on the trade.

Looking out longer term, NGI data shows trader expectations in the form of forwards and futures pricing not only indicating sub-$3.00 pricing, but also a trend lower that goes out to 2019. NGI‘s National Avg. Forward price for 2017 is sitting at only $2.942 as of Wednesday (Nov. 2), and in the futures market the 2017 Henry Hub strip sits barely above $3.00 at $3.074.

Contrary to expectations of rising prices, forwards and futures are currently anticipating price declines on an annual basis for the next three years. In the forward market, the annualized National Avg. price is expected to fall from the $2.942 in 2017 to $2.897 in 2018 and further to $2.878 in 2019 before recovering slightly in 2020 with a price of $2.908, according to NGI‘s Forward Look data.

Likewise, the futures market shows the Henry Hub contract losing its three-handle as the 2018 strip falls to $2.987 in 2018 and to $2.94 in 2019. It appears that, on an annual basis, $3.00 natural gas just isn’t on the table at this point.

Market technicians see an ongoing downtrend with the bullish case requiring some heavy lifting to get reinstated. United ICAP market technician Brian LaRose said Tuesday he was “a little concerned with some of the divergences we are seeing as a result of Tuesday’s fresh lows in the December contract.

“That said, bulls would need to lift natgas back above $3.100-3.130 to make a case for some sort of bottom being forming. As long as the bears can prevent that from happening, the trend will point down. [We] see $2.832-2.823 as the next challenge for the bears in this situation.”

Traders watching the slip-sliding futures think that the December contract at $2.80 is about as low as the market could go before a rally.

“I’m trying to figure out what the bullish news is going to be,” said Alan Harry, director of trading at McNamara Options in New York. “It always seems as though when we are at a market low, there is all this bearish news that is coming out, and whenever we get to a high, there is all this bullish news. If we are at a low then by default we are headed back up, so I am trying to predict what the bullish news is going to be.

“What I see is natural gas is really tight in the UK. They have a problem with a storage facility; it’s not because of production, and they can’t store like they usually do. They will have to float through the winter, and if they get cold weather it will shoot prices up dramatically. That will make traders here think there is some upside in our natural gas. I don’t think it will go up a lot, but I think December will hit $3.30 before this is over.”

Harry said the market “is technically oversold, and we should see a rebound coming in.”

Other traders eyeing the bullish side of the market look to do so “only after some shift in the weather forecasts toward cold trends,” said Jim Ritterbusch of Ritterbusch and Associates. “On an outright basis, next support develops at the $2.75 area, a violation of which could trigger additional selling to about 2.62 where a long-term, seven-month uptrend line should prove capable of halting this dramatic price decline that has now entered its third week.”

Forecasts just keep getting warmer.

Wednesday’s 11-15 day forecast was warmer than Tuesday’s “over the eastern two-thirds of the nation,” said WSI Corp. Wednesday morning. As a result, continental U.S. gas-weighted heating degree days “plunged by 7.2 for days 11-14 and [are] forecast to be 64.4 for the whole period. This is 27.5 below average.

“The forecast confidence is only near average as models continue to highlight a warm cyclical, positive PNA [Pacific North American] driven pattern. There are typical technical differences throughout the period and signs of retrogression late.”

It “seems hard for there to be warmer risks given the changes,” but European guidance “is even warmer than the forecast. A typical positive PNA offers a colder risk across the southern and eastern U.S., but there is not much cold air over Canada to tap into,” WSI said.

In physical market activity, warming temperatures at major market points kept buyers on the sidelines. Wunderground.com reported that New York City’s Wednesday high of 69 would reach 70 Thursday before falling to 55 Friday, 3 degrees below normal. Chicago’s high on Wednesday of 66 was seen easing to 65 Thursday and 60 Friday, 4 degrees above normal.

Gas at the Chicago Citygate shed 7 cents to $2.17, and gas at the Henry Hub fell 26 cents to $2.27. Deliveries on El Paso Permian skidded 12 cents to $1.88, and gas at the PG&E Citygate changed hands 3 cents lower at $2.58.

Deliveries on Dominion South, however, added 13 cents to $1.61, and gas on Tennessee Zn 4 Marcellus rose a dime to $1.55. Deliveries on Transco-Leidy Line rose 8 cents to $1.51.

In the Mid-Atlantic, gas on Texas Eastern M-3, Delivery was quoted 8 cents higher at $1.69, and gas bound for New York City on Transco Zone 6 added 9 cents to $1.69 as well.

Thursday’s storage report should give traders an idea of storage supplies as the industry heads into the heating season.

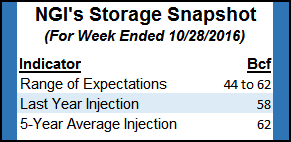

Tom Saal of FCStone Latin America estimated a 55 Bcf increase. A Bloomberg survey showed a range of 50 Bcf to 62 Bcf, with an average of 56 Bcf. Last year 58 Bcf was injected and the five-year pace stands at 62 Bcf. A reuters survey of 18 market-watchers produced a range of 44 Bcf to 60 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |