NatGas Forwards, November Expiration More Trick Than Treat For Price Bulls

Just days before Halloween, November natural gas forwards prices in playing the part of Ichabod Crane fell off their high horse — tumbling an average of 18.5 cents between Oct. 21 and 27 — as the humdrum of shoulder season gripped the market and gas storage inventories closed in on last year’s record-breaking levels, according to NGI’s Forward Look.

“There was some wild price action this week as market sentiment experienced its typical shoulder-season ”October Gloom’ (no weather),” analysts with investment bank Jefferies said.

Indeed, warmer-than-normal weather continues to linger across the western, central and southern U.S., limiting both heating and cooling gas demand. The exceptions to this unseasonably warm pattern are in the slightly cool Upper Midwest and Northeast, and also over the West Coast as mild Pacific storms bring heavy showers, forecasters with NatGasWeather said.

“Until the large dome of high pressure that has been dominating the central and southern U.S. shifts or weakens, temperatures across much of the U.S. will be much warmer than normal and won’t impress,” the forecaster said.

Aside from the dismal demand picture, Jefferies analysts said this week’s rapid sell-off could have been some sizable speculative length focused on the ”fronts’ that needed to be reversed before expiry. “Mechanically, that means a need to short the equivalent number of contracts as the existing long position. Why? The Nymex is a ”physical’ clearinghouse/exchange, and the wild downward volatility likely led to a reversal of positions (a New York trader would have trouble receiving gas in Louisiana). Dealers struggle to play the physical markets, too (”Volcker rule’),” Jefferies said.

And analysts at Houston-based Mobius Risk Group said they expect the wild swings to continue as the week’s price action was short on fundamental drivers. “We continue to expect volatility at the front of the curve. Uncertainty remains high on what will be required in near-term pricing to manage still-elevated inventory levels,” Mobius said.

Indeed, the Nymex November contract shed 22.9 cents from Oct. 21 to 27 to expire at $2.764 , while the December contract was down 29.3 cents during that period to $3.068. Friday’s trading session saw continued volatility as December futures had swung in a more than 10-cent range by midday but had essentially flattened.

While past market behavior has shown such that a sudden drop in futures prices is typical for this time of year, especially in the absence of weather, some in the market suspect other factors are at play.

“A collapse of this nature has only been seen three to four times in the last 15 years,” a trader said. “A bank fund or something obliterated the whole complex. Sure, weather is a part of it, but not a 19% pullback in less than two weeks. There was a bigger event going on.”

Nevertheless, the expiring front month was thrown a bone Thursday as the contract rose a few cents the day the latest storage data was released. The U.S. Energy Information Administration reported a 73 Bcf injection into storage inventories for the week ending Oct. 21, which was in line with market estimates. Inventories are now at 3,909 Bcf and are 52 Bcf greater than last year and 182 Bcf more than the five-year average.

“The refill season itself was obviously bullish, with total injections down 40% (about 4.6 Bcf/d) YoY, but we’ve basically ”run out’ of space (particularly in the Northeast) as is the norm this time of year. Cash prices will struggle to rally before colder weather surfaces (not so far away),” Jefferies said.

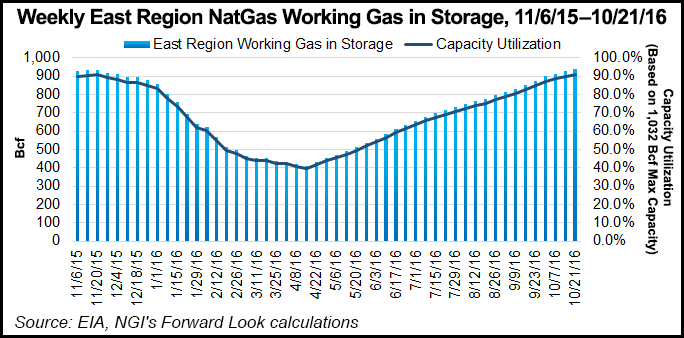

Indeed, Northeast cash and forwards markets remain depressed as regional gas stocks continue to swell with little in the way of sustained weather-driven demand to take on the bloated inventories. In the East, gas storage is now at 939 Bcf, while total capacity in the region was reported to be 1,032 Bcf in November 2015, according to the EIA. Some 14 Bcf was injected in the region last week.

Meanwhile, forecasters continue to show only brief periods of cold in the East over the next couple of weeks, and even long-term outlooks don’t show much promise. “We continue to see signs of more seasonal cool blasts arriving around or just after Nov. 5-7, but they would need to be followed by a steady barrage of additional weather systems for weather sentiment to completely flip from the current bearish stance to bullish,” NatGasWeather said.

While the forecaster believes it is critical for more intimidating cold shots to show promise for mid-November, even with much warmer-than-normal weather, EIA’s 73 Bcf build was once again under the five-year average, highlighting a very tight supply-demand environment.

“Next week’s report will also be factoring in bearish temperatures, but once again likely coming under the five-year average, the 26th week in a row. Although, the build two weeks out could finally end this streak,” NatGasWeather said.

The focus going forward will be squarely on whether cold patterns can begin setting up sometime between Nov. 5 and 7. The failure to do so could bring considerable disappointment, it said. “To our view, as long as more impressive cold outbreaks were to arrive for the second half of November, any damage done due to the recent mild spell could be quickly reversed,” NatGasWeather said.

But forecasters with Bespoke Weather Services said even long-range weather models are showing a continued bearish sentiment through at least the next couple of weeks. The latest GFS models show significant Great Plains ridging that will keep almost the entire country warmer than normal. “Come day 14, some weak trough action returned to the East, but it was not as pronounced as it was overnight. CPC forecasts showed slightly less warmth, but the analog still favors warmth over colder weather as well,” Bespoke said.

The bearish sentiment has kept cash prices in much of the Northeast below $2, while forward curves in the region put up much larger declines than the rest of the country for the second week in a row. For example, at the Algonquin Gas Transmission citygates in New England, November forward prices dropped about 27 cents between Oct. 21 and 27 to reach $2.505, Forward Look data shows.

The AGT December forward price plunged 48 cents during that time to $4.69, and the balance of winter (December to March) tumbled 36 cents to $6.21. Even packages further out the curve posted hefty losses as the summer 2017 strip lost 11 cents to hit $2.34, and the winter 2017-2018 shed 23 cents to hit $5.71.

By comparison, the Nymex November futures contract dropped 23 cents between Oct. 21 and 26 to $2.76, December futures fell 29 cents to $3.07 and the balance of winter (December-March) slid 27 cents to $3.20. Beyond that, the Nymex summer 2017 futures strip was down 18 cents to $3.09 and the winter 2017-2018 was down 16 cents to $3.30.

“There also have been some huge spec positions taken going into this winter in the Northeast. Look at the size of trading in last month or two,” the trader said. “Winter is not over. There is now a good consensus for December-February weather, so if we get a cold forecast, we will rally hard.” Such wild swings are rather commonplace in the Northeast forwards market during the winter, the trader said. “That’s why Gas Vegas fits so well. It’s the easiest commodity to move. And Dodd-Frank was worthless to curb algo’s influence.”

Indeed, the Northeast’s other often-volatile market hub also fell hard this week. Transco zone 6-New York November forward prices fell 17.5 cents from Oct. 21 to 27 to reach $1.90, December forward prices dropped 33 cents to $3.74 and the balance of winter forward price slid 30 cents to $5.95, according to Forward Look. Nationally, November forward prices were down an average of 18.5 cents during that time, December forward prices were down an average of 27 cents and the balance of winter was down an average of 26 cents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |