Markets | NGI All News Access | NGI Data

NatGas Cash Unchanged, But Futures Continue Grinding Lower

Next-day natural gas on average was unchanged in Wednesday’s trading, with many locations in the Midwest, Midcontinent and Gulf gaining modest amounts. Hefty setbacks, however, in the Northeast and Appalachia negated those advances, and the NGI National Spot Gas Average was flat at $2.51.

November and December futures quotes continued to unravel, and at the close November had fallen 4.3 cents to $2.731 after trading as low as $2.627. December shed 11.3 cents to $3.036, and December crude oil dropped 78 cents to $49.18/bbl.

The sudden drop in futures prices caught the attention of some market participants, but an examination of past market behavior showed it is well traveled territory and nothing new in the realm of natural gas pricing. Followers of market sentiment pointed out the price drop was predictable.

Figures from market vane Walter Zimmermann of United ICAP found that on Friday, bullish sentiment reached 49%. Although this may not seem like a particularly high figure, for natural gas a 49% bullish sentiment is akin to 90% bullish readings found in other commodities.

The last time natural gas sentiment was as high as 49% was the November 2014 peak, Zimmermann said. “In sentiment terms, the bulls had their run.”

From the November 2014 peak of $4.529, spot futures began a retreat to $2.443 by May 2015.

Commitments of traders figures were also telling. The Commodity Futures Trading Commission in its weekly report showed that on Oct. 18 swap dealers, those involved in transacting hedge trades for clients, were 135,845 net futures contracts short. Meanwhile, speculative and directional traders, managed accounts, were net long by 167,015 contracts.

Perhaps the directional traders could have gained insight on where market risk was headed from their swap dealer brethren.

The recent weakness in spot futures notwithstanding, confidence is returning to the oil and natural gas sector, led by an improving outlook among local distribution companies and pipeline operators, industry consultant Black & Veatch found in a recent survey (see Daily GPI, Oct. 24). Nearly 70% of all respondents indicated they were either “optimistic” or “very optimistic” for future growth between now and 2020, the firm said in its report.

Other traders are keeping a watchful eye for opportunities to buy into a reconfigured market. “When we were up at $3.36 on Oct. 14, the daily RSI [Relative Strength Indicator] was at 80 and it was a question of too much, too soon,” said a California broker. “Now the RSI is at 24 and you start looking for your buy zone going into winter as November comes off the board.

“The market anticipated some effect off the big hurricane [Matthew] and it didn’t go left at all. When you saw $3.36, I wish I had the fortitude to sell it, but my clients don’t sell, they just buy,” the broker said.

“I know the utilities did not buy into this run so they are probably saying ‘Let’s start looking for some value here on the curve.’ That’s probably what will happen now. When it got up to $3.36, I started moving my numbers around and at that point $2.76 was my support.

“With expiration coming up on Thursday, you probably wait a little bit [to buy] into that window and wait to see if any of that cold weather in the Northeast drifts down. Here’s the first line of support at 24.83 RSI at $2.76 even.

“Each time the RSIs get to the lower 20s you get your bounces.”

Analysts see something of a delayed market reaction by the December contract.

“The natural gas market remained under selling pressure on Tuesday, with the nearby November futures stabilizing to some degree on book squaring ahead of tomorrow’s contract expiration, but forward values tending to fall more dramatically in something of a delayed reaction to the weakness at the front of the curve,” said Tim Evans of Citi Futures Perspective in closing comments Tuesday.

“Beyond Thursday’s November contract expiration and the need for traders to reassess the prospects for future delivery months in light of the nearby market’s sharp drop over the past week, traders will also be interested in the weekly storage data.”

Evans calculated a gas storage build of 77 Bcf, in line with historical averages and generally in line with industry estimates. He expects injections to continue into November. By Nov. 11 the year-on-five-year surplus is expected to have grown again and be up to 230 Bcf. Evans expects a new storage peak of 4,062 Bcf.

The “downside price correction could have further to run, with nearby futures possibly testing the $2.50 level in the weeks ahead,” Evans said. “At some point, this more conservative valuation may represent a buying opportunity as there is still plenty of time for the winter to still prove colder than a year ago, even if the cold arrives later than the natural gas bulls had hoped.”

Evans is currently short the December futures contract from $3.34 with a protective stop at $3.44.

For the week ending Friday (Oct. 29), the National Weather Service is forecasting balanced heating requirements. New England is expected to see 139 heating degree days (HDD), or 11 more than normal, and the Mid-Atlantic is forecast to have 124 HDD, also 11 more than its normal seasonal tally. The greater Midwest from Ohio to Wisconsin is seen with 100 HDD, or 22 fewer than normal.

In physical activity, Mid-Atlantic sellers got little help from next-day power prices, and prices slipped. Intercontinental Exchange reported that on-peak Thursday power at the New York ISO Zone G (eastern New York) delivery point fell $1.83 to $27.30/MWh, and power at the PJM West terminal fell 59 cents to $33.93/MWh.

Gas on Texas Eastern M-3, Delivery skidded 17 cents to $1.31, and gas bound for New York City shed 28 cents to $1.57.

Gas at major market hubs rose modestly. Deliveries to Chicago Citygate rose 4 cents to $2.82, and gas at the Henry Hub added a penny to $2.68. Packages at the Cheyenne Hub gained a nickel to $2.60 and gas at the PG&E Citygate shed a penny to $3.07.

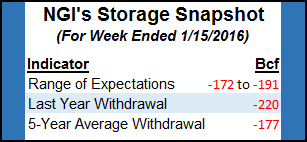

Thursday’s storage report should give traders an idea if injections are likely headed on a course to surpass last year’s 3,954 Bcf record storage. Estimates are in line with historical averages, and last year 67 Bcf were injected and the five-year rate is 76 Bcf.

First Enercast is looking for a 70 Bcf build, and IAF Advisors calculates an increase of 75 Bcf. A Reuters survey of 20 traders and analysts showed an average 73 Bcf with a range of 55 Bcf to 77 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |