E&P | Eagle Ford Shale | NGI All News Access

Carrizo Buying Sanchez Acreage in Eagle Ford, Grows Position 15%

Carrizo Oil & Gas Inc. (CRZO) is buying 15,000 net acres in the Eagle Ford Shale from an affiliate of Sanchez Energy Corp. for $181 million in cash.

The acreage being acquired is mostly in the volatile oil window of the play. After closing, Carrizo will hold more than 100,000 net acres in the Eagle Ford, concentrated in LaSalle, McMullen, and Atascosa counties. Based on Houston-based Carrizo’s current development spacing assumptions, which include only a single layer within the Lower Eagle Ford, the acquisition increases the company’s drilling inventory in the play to about 1,100 net locations.

Closing is expected by mid-December, with the price subject to adjustments; the deal’s effective date is June 1. Equity financing will support the deal. The company is offering 6 million shares of common stock in an upsized offering. Gross proceeds are expected to be $225 million.

The acquisition “…increases our acreage position in the play by more than 15% and expands our core inventory in it by approximately 10%, with additional upside possible from a combination of infill drilling and multi-zone development,” said Carrizo CEO Chip Johnson. “A number of the acquired properties are also contiguous with our core acreage position, which should allow us to capitalize on efficiencies, such as the ability to drill longer lateral wells from our existing leasehold. In addition to the increased inventory and potential operational efficiencies, we also believe the transaction is accretive on a variety of financial metrics, including cash flow and earnings per share.”

Jefferies has a “buy” rating on Carrizo and said in a note Tuesday that the base case for drilling allows for 10-11 years of inventory at a four-rig pace. “Assuming $30,000 per flowing, CRZO paid $5,900 per acre or $1.1 million per location,” Jefferies analysts said.

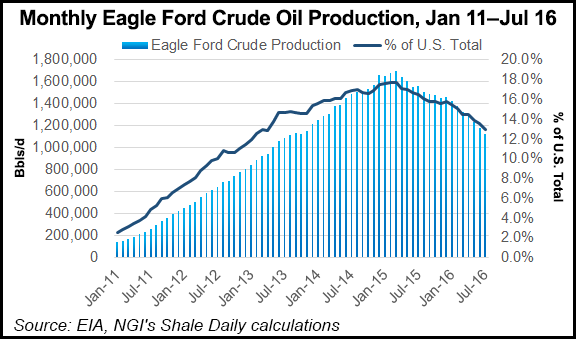

“In our view, the market is struggling to value Eagle Ford properties as many are in decline. However, CRZO has an opportunity as being one of the few companies willing to consolidate. We believe CRZO is open to acquiring more acreage in the Eagle Ford.”

Last February Johnson said the company would dial back spending this year to preserve its balance sheet while it focused on the Eagle Ford (see Shale Daily, Feb. 23). Last August Sanchez said it beat production guidance during the second quarter and would raise spending to grow production further (see Shale Daily, Aug. 8).

According to Sanchez, the Eagle Ford assets being acquired by Carrizo hold about 6.9 million boe, about 90% of which is developed. Net production has been about 3,000 boe/d (61% oil) from 112 gross (93 net) wells. Sale proceeds will boost company liquidity, Sanchez said. “The transaction announced today is further evidence of our dedication to improving our balance sheet while maintaining our focus on core areas of operations,” said CEO Tony Sanchez.

While announcing the deal, Carrizo also provided a third quarter update. The company’s estimated production volumes during the third quarter were 3.75 million or, or 40,762 boe/d, an increase of 13% versus the third quarter of 2015. The year-over-year production growth was driven by the Eagle Ford Shale and Delaware Basin assets, as well as a lower level of voluntary curtailments in its Marcellus Shale assets.

Oil production during the third quarter averaged 24,488 b/d, while natural gas and natural gas liquids production averaged 69.26 Bcf/d and 4,730 b/d, respectively. Estimated third quarter production exceeded the high end of guidance mainly because of stronger-than-expected performance from the Eagle Ford Shale and Delaware Basin as well as lower-than-planned levels of voluntary curtailments in its Marcellus Shale.

Since June 30 Carrizo has added crude oil hedges for the second half of 2017. For the third and fourth quarters of 2017, the Company added swaps covering 6,000 b/d and 3,000 b/d of crude oil at average fixed prices of $54.15/bbl and $55.01/bbl, respectively. For 2017, Carrizo now has swaps covering an average of about 8,200 b/d of crude oil at an average fixed price of $51.30/Bbl. The company recently added natural gas hedges for 2017. For the full year of 2017, Carrizo added swaps covering 20,000 MMBtu/d of natural gas at an average fixed price of $3.30/MMBtu.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |