E&P | NGI All News Access | NGI The Weekly Gas Market Report

Basic Energy to Restructure as ‘Poor Operating Conditions’ Persist in Onshore

Basic Energy Services Inc., whose U.S. onshore fortunes have mirrored those of the producers it serves, entered into a restructuring support agreement (RSA) on Sunday with its lenders that will lead to a voluntary Chapter 11 bankruptcy filing. Key Energy Services Inc. also has secured creditor support to file for voluntary protection.

The Fort Worth, TX-based operator, whose RSA has the support of all of its secured term lenders and senior note holders, said the plan would delever the balance sheet and provide it with $125 million of additional liquidity. Lenders and some noteholders also committed up to $90 million in debtor-in-possession financing to help maintain uninterrupted operations.

“After careful consideration, we have taken this difficult but necessary step to secure a bright future for Basic Energy Services,” CEO Roe Patterson said. “This process is about fixing our capital structure for the long-term to benefit all of our stakeholders.”

Basic provides well site services in more than 100 service points throughout the major onshore oil and gas producing regions, and it employs more than 3,500 people. Expectations that maintenance projects deferred in the onshore last year would resume this year have not panned out as expected (see Shale Daily, April 21).

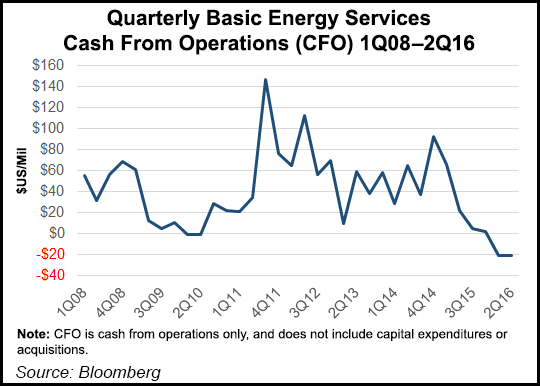

“The sharp and prolonged period of depressed commodity prices have created poor operating conditions in the field and significantly reduced our operating cash flow,” Patterson said. “The actions we have taken, combined with the support of our existing lenders, will help us strengthen our balance sheet and position Basic for a sustainable future to benefit from what we anticipate will be an eventual recovery in oil and natural gas prices.”

During the restructuring, “we anticipate meeting all of our ongoing obligations to suppliers, customers, employees, and others, as usual, and we will continue to provide our customers with dependable, high-quality services, which is the hallmark of our company. The fundamentals of the business are strong and having access to new capital will enable us to strengthen our current business lines, grow organically as opportunities develop and participate in potential merger and acquisition activities in the future.”

The restructuring would, among other things, cancel more than $800 million of principal and accrued interest in outstanding unsecured notes. It also would amend and restate the pre-petition loan outstanding in the principal amount of $165 million to provide for more flexible terms. All “undisputed” customer, employee, vendor and trade obligations would be paid in full. And Basic is working with potential lenders to replace its pre-petition $100 million asset-based revolving credit facility.

Subject to approval by the board, Basic expected to file for Chapter 11 by Tuesday in U.S. Bankruptcy Court for the District of Delaware. It expects to exit should exit bankruptcy before the end of the year.

Also on Monday, Houston’s Key, which provides well services worldwide, filed for Chapter 11 protection after securing creditor support for its debt restructuring.

Key, with 2,900 employees who mostly are Houston-based, is the largest onshore, rig-based well servicing contractor based on the number of rigs owned. It provides a range of well intervention services, with operations in all major onshore oil and gas producing regions of the continental United States and internationally in Mexico and Russia.

Under the plan support agreement (PSA), Los Angeles-based investment firm Platinum Energy would become Key’s largest shareholder.

“The PSA contemplates a comprehensive recapitalization of the company,” which would be implemented under a prepackaged Chapter 11 reorganization that would be underway by Nov. 8. Once completed, Key would remain a publicly traded company.

“By significantly reducing Key’s debt from almost $1 billion to $250 million, we believe that Key will be well positioned to take advantage of opportunities that emerge as the market recovers,” said CEO Robert Drummond.

Platinum Equity partner Jacob Kotzubei said the company will benefit from his firm’s financial, operational and merger/acquisition resources.

“Key Energy is a market leader in North American production services and will emerge from this process as a stable, well-capitalized business with all the tools needed to thrive long term,” said Kotzubei. “The company is an ideal platform for growth and consolidation as the oilfield services industry works through today’s challenging market conditions.”

Many oilfield services companies have struggled to maintain operations since the downturn, as their exploration and production (E&P) customers have contracted their operations. However, there are signs that the onshore is slowly returning as more rigs are raised and E&Ps re-emerging from bankruptcy (see Shale Daily, Oct. 13; Oct. 6; Sept. 12). Midstates Petroleum Co. Inc. emerged from bankruptcy last Friday (see related story).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |