Weekly NatGas Cash Holds On To Slim Gains, Yet Futures Tumble

Weekly natural gas trading for the week ending Oct. 21 was highly variable, and in a broad sense the weekly advance in the November contract for the week ended Oct. 14 of 9.2 cents did carryover into cash trading as the NGI National Spot Gas Average did rise 4 cents to $2.71. Traders in Texas, South Louisiana, and the Southeast might be inclined to disagree over the predictive power of the futures market as their regions lost ground.

The individual market point showing the week’s greatest gain was Tennessee Zone 5 200 L with an advance of 58 cents to average $2.15 and the week’s laggard was Transco non New York South covering deals in Virginia and Maryland with a drop of 69 cents to average $1.96.

Regionally the Southeast and South Louisiana showed the weakest regional performances with losses of 11 cents and 7 cents to $2.95 and $3.01, respectively. South and East Texas didn’t do much better with declines of 3 cents and 6 cents to $3.02 and $3.06, respectively.

The Midwest and Appalachia just eked into positive territory with rises of 1 cent and 3 cents to $3.01 and $1.16, respectively.

California added a nickel to average $3.02, while the Midcontinent rose 7 cents to $2.93, the Rocky Mountains added 9 cents to $2.80. The Northeast landed atop the leader board with a jump of 23 cents to average $1.99.

While the cash market was a bit topsy-turvy, there was no such uncertainty for the screen during the week. November futures dropped 29.2 cents to $2.993.

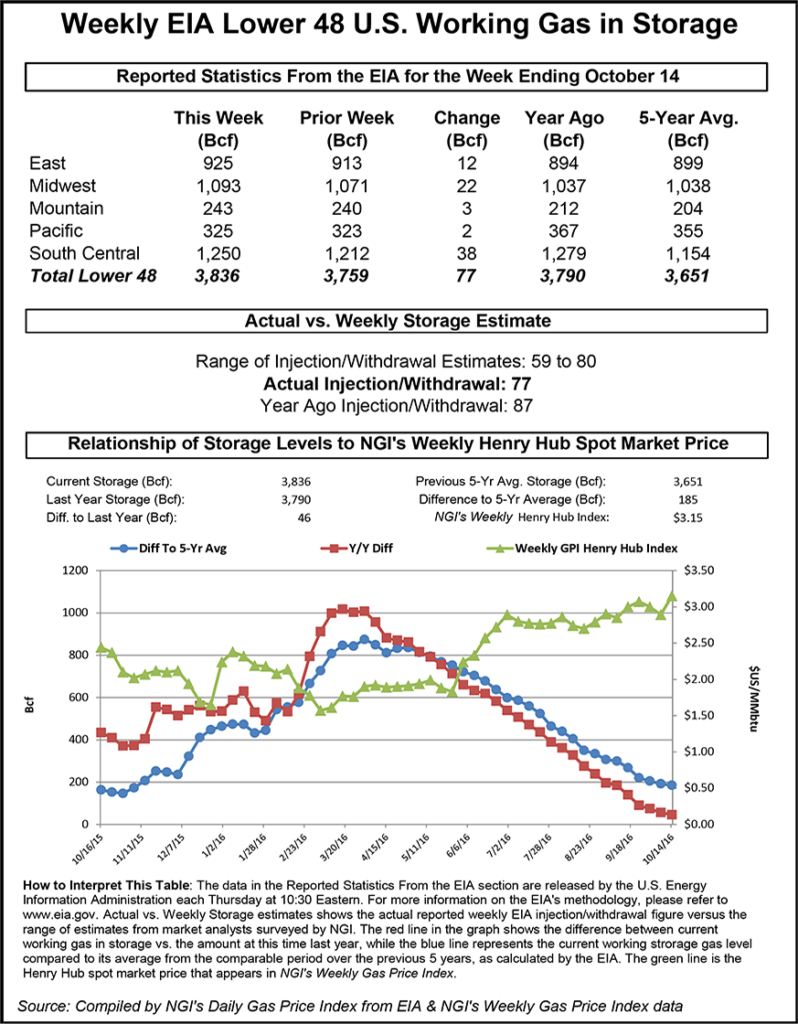

In Thursday’s action, cash traders who typically get their deals done ahead of the weekly Energy Information Administration (EIA) storage report appeared almost clairvoyant before the 77 Bcf was reported for the week ending Oct. 14. The number was about 3 Bcf greater than market expectations. At the close Thursday, November futures had given up 2.9 cents to $3.141 and December held was unchanged at $3.434.

Fundamentals traders noting the bin-busting levels of gas storage have been suspicious that the recent futures strength might have been a little too much, too soon, especially with cold winter weather existing only on paper. That suspicion may have played out just ahead of Thursday’s release of inventory data, when it appeared that traders were expecting the upside miss as the November natural gas futures contract began the day trading below Wednesday’s regular session settle. After trading as low as $3.127 prior to the report, November futures notched a $3.112 as the 77 Bcf number ripped across trading screens. A few minutes later, the front-month contract carved out a $3.101 low.

However, after a bit of back-and-forth, November inched higher into the afternoon and was trading at $3.154 at 1 p.m., down only 1.6 cents from Wednesday’s $3.170 regular session close.

Futures traders remained optimistic after Thursday’s action. “We traded down to $3.10 but ultimately settled up at $3.14. I think today was just traders taking some money off the table,” a New York floor trader told NGI.

Citi Futures Perspective’s Tim Evans called the 77 Bcf build “modestly bearish,” adding that it might be just large enough to dislodge the recent bullish natural gas price momentum.

“The 77 Bcf refill for last week was somewhat more than the 73-74 Bcf consensus expectation and so a minor bearish surprise,” Evans said. “The build was still slightly below the 84 Bcf five-year average and so marginally supportive on a seasonally adjusted basis. Overall, we see the injection as failing to fully support the bullish market narrative, adding to the case for a downward correction.”

Randy Ollenberger, an analyst at BMO Capital Markets, was mostly unimpressed by the report. “We believe the storage report will be viewed as neutral. Storage remains at record levels, but the level of injections is lower than last year and points to a rebalancing over the course of the fall. We believe that U.S. working gas in storage could exit the fall season at five-year average levels, assuming normal weather,” Ollenberger said.

Analysts with Wells Fargo Securities said that while the injection was “slightly above consensus,” they too saw it as “neutral” for the market. “Though not far below last year’s change, this marks the 30th week in a row the storage change has come in below 2015 levels, continuing the relatively slow inventory build throughout the summer and fall,” the analysts wrote in a research note.

With smaller injections during this year’s storage refill season, analysts with Jefferies LLC said natural gas price spikes this winter are certainly in play. “With only two weeks remaining in the refill season, the storage glut has largely been abated,” they said. “While storage is in-line with prior year levels, we enter the withdrawal season this year under very different circumstances. Exports (LNG, Mexico) are likely to be about 1.5-2 Bcf/d higher this winter and supply is down about 2 Bcf/d. We continue to see an imbalanced risk of gas price spikes this winter on even brief cold weather periods.”

Heading into the report, Evans had been expecting a 72 Bcf build, while PIRA Energy estimated a 71 Bcf increase and Ritterbusch and Associates was looking for a 76 Bcf build. A Reuters survey of 21 traders and analysts revealed an average 73 Bcf injection with a range from 70 to 77 Bcf. The 77 Bcf build fell short of last year’s 87 Bcf injection and the 84 Bcf five-year average build.

Inventories now stand at 3,836 Bcf and are 46 Bcf greater than last year at this time and 185 Bcf more than the five-year average. In the East Region, 12 Bcf was injected, and the Midwest Region saw inventories increase by 22 Bcf. Stocks in the Mountain Region rose 3 Bcf, and the Pacific Region was higher by 2 Bcf. The South Central Region topped the rest with a 38 Bcf build.

The addition of 77 Bcf is all well and good and gives the industry a well-supplied cupboard going into the heating season, but the 800-pound questions in the room are what will winter 2016-2017 be like, what is the likely impact on supplies, and most importantly what kind of pricing environment will result?

To answer those questions, analysts Kevin Adler and Robert Applegate of PointLogic Energy constructed three scenarios on varying levels of residential/commercial demand to see what ending inventories might be in spring 2017, and if that would indicate a rebalanced market.

Commodity Weather Group also offered its recent and somewhat more aggressive winter outlook in its recent Energy Seasonal Outlook.

“To accurately project gas demand in the winter, getting the residential/commercial number right is crucial,” Adler and Applegate said. “That’s why PointLogic uses a 330-city temperature model to get accurate, granular information that we feed into our model for how gas demand in different parts of the country reacts to temperature variations.”

Their worst case scenario is for a repeat of winter 2015-2016. “From Oct. 1, 2015, through March 31, 2016, residential/commercial demand averaged 32.6 Bcf, or a total of 4,917 Bcf for the five-month (151 days) period. The average over the last eight years, including last winter, was 36.6 Bcf/d. To put it another way, over the typical 151-day winter season (or 152 days during a leap year), residential/commercial demand on average for the last eight years was about 604 Bcf higher than it was last winter. That figure represents drawdown of inventories that would happen in a typical year but did not occur last winter.” That case, 32.6 Bcf/d, results in ending inventories at 2,372 Bcf, not far off March 2016 at 2,467 Bcf.

From another angle, the 32.6 Bcf/d translates to 3,210 GWHDD (last season’s heating load), according to figures from Commodity Weather Group in its recent Energy Seasonal Outlook.

Using its model and incorporating normal weather and temperature assumptions of the eight-year average PointLogic found this would result in residential/commercial demand of 36.8 Bcf/d, almost 13% greater than the worst case. This calculates to an end-of-March inventory level of 1,698 Bcf.

Commodity Weather Group is forecasting winter GWHDD of 4,031 or 26% higher than last year. Commodity Weather Group did not forecast residential/commercial demand.

A third case, mid-point between the two, showed 34.7 Bcf/d residential/commercial demand and came to an ending inventory of 2,054 Bcf.

Residential/commercial predictions are useful, but PointLogic admits that it cannot predict the weather, and “recent history suggests that temperatures are on the rise — and this is a risk factor that should be taken into account. According to NASA’s Goddard Institute for Space Studies, August 2016 marked the 11th month in a row when worldwide temperatures set a record. These are record temperatures each month, not merely temperatures above average. September looks like it will continue the trend, at least in the U.S.”

However, if either the PointLogic assumptions of an eight-year average winter or the more aggressive Commodity Weather Group forecast are realized, the market should have little trouble avoiding the price collapse that sent spot futures as low as $1.61 in March 2016.

In Friday’s trading the physical natural gas market almost turned schizophrenic, with large gains and losses the rule.

When the dust settled the NGI National Spot Gas average for weekend and Monday delivery had fallen 12 cents to $2.53. Near-term weather forecasts called for an early taste of winter, but longer-term outlooks called for fewer degree days.

Futures took it on the chin as well, with November dropping 14.8 cents to $2.993 and December giving up 7.5 cents to $3.361.

New England points scored $1-plus gains as near-term weather changed. “A dramatic change to colder weather, and in some cases a taste of winter with snow, will take place into this weekend following summerlike conditions in the northeastern United States,” said AccuWeather.com meteorologist Alex Sosnowski. “The colder air was making slow progress across the Midwest prior to the end of the week. However, the cold push will accelerate and reach the Appalachians during Friday night and then the Atlantic Seaboard on Saturday.”

Weekend and Monday gas at the Algonquin Citygate jumped 94 cents to $2.52, and gas on Iroquois, Waddington added 77 cents to $2.62. Packages on Tenn Zone 6 200L zoomed $1.11 to $2.55.

“Shorts and short-sleeve weather will be replaced by conditions requiring long-sleeves and layered clothing, including coats, hats and even gloves, for those spending time outdoors at area football games. Some people may have to put their heat on for the first time this season. For those heating with firewood, be sure to bring wood in ahead of the rain to keep it dry. Record-challenging high temperatures in the 70s and 80s F will be replaced by highs in the 40s and 50s,” Sosnowski said.

Major market centers did not fare nearly as well. Gas at the Chicago Citygate tumbled 24 cents to $2.83, and gas at the Henry Hub shed 22 cents to $2.87. Gas on El Paso Permian fell 29 cents to $2.62, and weekend and Monday gas at the SoCal Citygate gave up 30 cents to $2.88.

Futures traders joined in the selling as well. November futures opened floor trading a stout 7 cents lower and continued lower from there as weather models once again turned milder. “[Friday’s] 11-15 day forecast is warmer than the previous forecast over the southern and eastern U.S. The West is a bit cooler,” said WSI Corp. in a Friday morning report to clients. “PWCDDs are up one for Days 11-14 but are only forecast to be 7.3 for the period. GWHDDs are down 2.9 and are now forecast to be 47.9, which are 23.5 below average. Forecast confidence is only average due to model spread during the end of the six-10 day period and some uncertainty with the evolution/persistence of the Pacific flow.”

“This market is seeing a surprisingly strong bout of selling this week as mild temperature forecasts are now being stretched well into the first week of November in suggesting some normal storage injections for a couple of weeks until peak supply is established,” said Jim Ritterbusch in a Friday note to clients. “Although the narrowing in the supply surplus against averages was sustained per yesterday’s EIA, the contraction was comparatively modest at only 7 Bcf. Given forecasts looking out over the next two weeks, we would expect a couple of injections proximate to five-year averages within the next two to three EIA releases. However, a supply excess of only around 5% could easily be erased by year’s end should the month of December prove to be unusually cold amidst a significant downsized pace of production.

“While a record supply could keep the money managers rotating back into the short side of this market well into next week’s trade, we are having difficulty constructing a scenario that would carry values much below today’s price bottom at our expected support at 3.07. But at the same time, we will avoid the ‘falling knife’ syndrome as we caution against attempts to pick a bottom to this week’s hard price selloff. We will instead await weekend updates to the six-14 day temperature outlooks before probing the long side of the December futures in next week’s trade. As nearby carrying charges expand, the December futures will require more time to test our expected support that we have defined as existing at the $3.35 level.”

Gas buyers with the responsibility of making incremental purchases for power generation across PJM over the weekend should have their hands full. According to WSI, “A storm system will continue to traverse the power pool during the next one to two days, with rounds of rain and showers. This will lead to highly variable and changeable conditions [Friday], but the Mid-Atlantic will remain mild and humid with max temps in the 60s and 70s. Eventually a brisk northwest wind with gusts in excess of 40 mph behind the departing system will usher a much cooler, Canadian air mass into the power pool by Saturday.

“A north-northwest wind behind the aforementioned storm system and trailing cold front will lead to prolonged period of elevated wind generation through Monday. Output is forecast to range near 2-4 GW,” WSI said in a Friday morning report.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |