CA NatGas Gains Stand Out in Otherwise Messy Market; Futures Sheds 9 Cents on Revised Weather

Physical natural gas prices for Thursday delivery couldn’t quite make it three in a row and gave ground on Wednesday in large part because of weather-driven screen losses.

For the most part, market points were peppered with gains and losses of about a nickel, but the Northeast and Southeast declines of about 30 cents pulled the average well into the red. The NGI National Spot Gas Average dropped 3 cents to $2.82, but California and the Rockies managed gains of about a nickel.

Overnight weather models changed, and that was enough to bring out the futures bears. November fell 9.3 cents to $3.170, and December was off 7.1 cents to $3.434. November crude oil rose $1.31 to $51.60/bbl.

Overnight weather models changed abruptly, and futures opened floor trading about 9 cents lower.

“Two model cycles in a row shed demand from the national picture, leading to bigger early season heating demand losses and now, at this point, only marginal last-minute southern cooling demand gains,” said Commodity Weather Group President Matt Rogers in a Wednesday morning report to clients. “The models are in fairly good agreement…on a stronger warm area in the six-10 day from Texas to the Midwest, with just some lingering cooling on the Eastern Seaboard (some cool air wedging risks) as another stormy situation affects the West Coast.

“The story continues for the 11-15 day, with mostly a Midcontinent warm pattern, but the European makes stronger progress shifting the warmth toward the Eastern Seaboard as well.” In spite of broadly lower prices at many market points, California posted healthy gains for the most part, led by increasing power demand and firm prices. Intercontinental Exchange reported that on-peak power at NP-15 rose $4.78 to $42.53/MWh and on-peak Thursday power at SP-15 added $5.35 to $43.49/MWh.

Next-day gas at Malin added 6 cents to $3.03, although packages at the PG&E Citygate fell 12 cents to $3.25. Gas at the SoCal Citygate rose 13 cents to $3.27, and gas priced at the SoCal Border Average gained 9 cents to $3.04. Gas on Kern Delivery rose 8 cents to $3.07.

CAISO forecast peak load Thursday of 33,750 MW, up from Wednesday’s estimated peak of 31,580 MW.

Eastern points were lower as next-day power prices offered little incentive for incremental purchases for power generation. Intercontinental Exchange reported Thursday on-peak power at ISO New England’s Massachusetts Hub fell a stout $10.25 to $29.32/MWh, and power to the PJM West terminal skidded $5.78 to $35.15/MWh.

Gas at the Algonquin Citygate retreated 21 cents to $2.84, and deliveries to Iroquois Waddington shed 26 cents to $2.94. Gas on Tennessee Zone 6 200 L dropped 15 cents to $2.79.

Other market centers were mostly lower as well. Gas at the Chicago Citygate fell 3 cents to $3.18, and deliveries to the Henry Hub dropped 8 cents to $3.14. Gas on Panhandle Eastern rose 3 cents to $2.98.

Prior to the Tuesday night plunge, Citi Futures Perspective’s Tim Evans saw the market as settling into “a high-level consolidation phase, with some additional light volume book,” squaring ahead of Thursday’s gas storage report for the week ended Oct. 14.

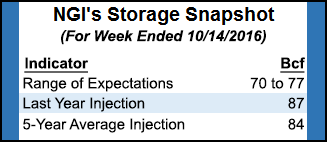

Evans calculated a 72 Bcf build and said “a refill on that order of magnitude would represent a seasonal step down from the 79 Bcf gain in the prior week and less than the 84 Bcf five-year average.” Evans showed the year-on-five-year surplus dwindling from its current 192 Bcf to 155 Bcf by Nov. 4.

Overall estimates for Thursday’s storage report are tightly bunched. PIRA Energy estimated a 71 Bcf increase, and Ritterbusch and Associates is looking for a 76 Bcf build. A Reuters survey of 21 traders and analysts revealed an average 73 Bcf injection with a range from 70 Bcf to 77 Bcf. The Desk’ Early View storage survey issued last Friday of 12 analysts showed an average 74 Bcf but with a range from 59 Bcf to 82 Bcf.

Last year 87 Bcf were injected and the five-year average is a 84 Bcf build.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |