Infrastructure | Markets | NGI All News Access

East-to-West Shift Leaves Infrastructure, Marketing Developments A Mixed Bag

Natural gas infrastructure growth may be outpacing efforts to find more supply-demand balance through U.S. gas exports, according to a panel of experts at the recent LDC Gas Forum Rockies & West in Denver conference.

ICF International Vice President Kevin Petak said he remains generally bullish on natural gas prices, and east-to-west is definitely the new paradigm shift, but relatively flat demand and renewables also have to be taken seriously as infrastructure buildout continues.

The Marcellus Shale in Pennsylvania looks like it will be displacing gas supplies throughout the nation for some time, Petak said. “We’re seeing a lot of displacement in the United Sates, and gas supplies elsewhere in the West are likely to stay in their regions.”

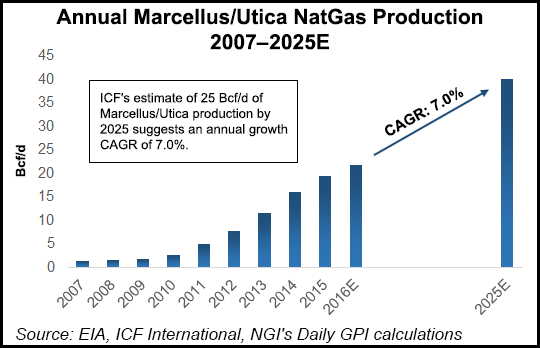

ICF projects that the Marcellus and Utica shale plays in Ohio and Pennsylvania will grow to 40 Bcf/d by 2025, nearly doubling from their present combined 21 Bcf/d. Western supplies remain relatively flat in the 13-15 Bcf/d range, Petak said.

Crystal Heter, vice president for commercial operations at the Rockies Express (REX) pipeline, which has been reversed in the east, said that REX is signing long-term contracts for up 2.6 Bcf/d of additional east-to-west capacity that is being developed on the strength of new electric generation plant loads in the Midwest and spreading westerly.

Heter said REX is developing several new power plant delivery points in Indiana and Ohio. REX’s peak loads for the year coming from the west and the east have hit 3.5 Bcf/d, she said, adding that the contracts the pipeline signs these days are typically 15-20 years.

“We are in the process of adding eight additional receipt points in the east, and the total posted capacity is just shy of 4 Bcf/d,” Heter said. “But let’s not forget that REX is based in the Rockies, and there’s still potential for west-to-east markets in the Chicago area.” Her bottom line: REX is “evolving and changing” to meet new market demands.

Drilling down into the Rockies and natural gas liquids (NGL) market, a third panelist, Kelly Van Hull, director of energy analytics for RBN Energy LLC, talked about oversupplied markets and how best to negotiate them in the NGL sector.

From 2009 through 2012 the natural gas market became extremely oversupplied, according to Van Hull. The ethane market became very oversupplied and prices eventually collapsed for NGLs, natural gas and crude oil.

“Now we are dealing with the reality of how we get over this next period of oversupply,” Van Hull said. There is currently about 1.8 million b/d of ethane being produced and up to 500,000 b/d have no market, so it is being stored, she said. At the same time, the economics have dried up for exporting ethane to foreign crackers.

After 2018, when several new crackers come online, the market for NGLs generally, and for ethane in particular, should improve, she said.

Finally, a fourth panelist, David Lavoie, vice president for business development with Vermont-based NG Advantage LLC, outlined his trucked compressed natural gas (CNG) services for businesses and institutions operating beyond the reach of existing gas pipeline systems in New England, along with a “gas island ” service allowing small local distribution utilities to extend their service territories.

For both large customers and for LDCs, service can be put in place more quickly and with less regulatory oversight with a company like NG Advantage (see Daily GPI, Oct. 15, 2015). Vermont Gas Systems has used its locally based firm to expand its utility operations to Middlebury, VT.

“Vermont Gas Systems has had plans for some time to expand its service territory, but in the state nothing is ever easy and the regulatory requirements are pretty onerous,” Lavoie said. “There was a lot of local opposition to getting a pipeline built, so they approached us to help get gas service to Middlebury.” NG Advantage ended up providing virtual pipeline service to a variety of customers, ranging from a hospital to a dairy processor.

“They wanted to start getting the benefits of burning natural gas while the utility was working to expand its pipeline system.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |