Infrastructure | M&A | NGI All News Access

Dril-Quip Ties Up with TIW; Oceaneering Nabs Blue Ocean

Two Houston-based offshore specialists are making deals as the oil and gas industry contracts, with Dril-Quip Inc., in its first acquisition ever, agreeing to buy crosstown operator TIW Corp., a century-old downhole oil and gas consumables manufacturer, while Oceaneering International Inc. is buying riserless well intervention specialist Blue Ocean Technologies LLC.

The $143 million Dril-Quip deal would hand the offshore specialist a company that provides liner hanger systems and related equipment and services worldwide for onshore and offshore applications.

“TIW has a long history of success as a family-owned company and we intend to preserve that legacy by continuing to reliably serve our customers with our combined teams around the world,” said Dril-Quip CEO Blake DeBerry. “TIW is a market leader in the liner hanger business and we are particularly excited about its expandable liner hanger technology that is frequently utilized in deepwater or high pressure/high temperature environments.

“This acquisition will be the first in Dril-Quip’s history and allows us to use our strong balance sheet to increase shareholder value in the long-term. TIW’s products and services fit squarely with and complement our current product offerings. In addition to its offshore market, TIW’s onshore presence, particularly in the Middle East and South America, will provide Dril-Quip with more market opportunities.”

Dril-Quip manufactures offshore drilling and production equipment used in deepwater, harsh environments and severe service applications. It also provides technical advisory services, reconditioning services and running tools for use in connection with installing and retrieving its products. Dril-Quip has manufacturing facilities in the United States, Brazil, Scotland and Singapore.

TIW was founded in 1917 as the newly developed rotary oil drilling technique led to an oil boom in East Texas. Originally, Texas Iron Works (TIW) was formed as an oilfield services repair facility by the Pearce family, some of whom were blacksmiths and machinists. They pooled their cash, machinery and knowledge — and the Pearce family remains in charge today.

The global operator manufactures liner hanger systems, including expandable liner hangers, for onshore and offshore applications. Products also include kelly valves, safety valves and a line of packers. In addition, TIW provides rental tools and services to install its products and other wellbore construction activities.

“I believe this transaction will positively position our business for further expansion,” TIW President Steve Pearce said. “Both TIW and Dril-Quip have a long and proud tradition of innovation and commitment to the oil and gas industry, along with a shared culture of customer service, quality products and continual product development. Dril-Quip’s wider product offering and broader international footprint should allow for long-term growth of our liner hanger business.”

TIW reached peak revenues of about $140 million in 2014. Revenue is expected to trough at $60-70 million in 2016 and increase to between $80 million and $100 million by 2018. The company is being acquired on a debt-free, cash-free basis, and Dril-Quip intends to fund the transaction with cash on hand. The transaction is expected to be completed by the end of the year.

In related news, Houston’s Oceaneering agreed to pay $30 million for the assets of privately held Blue Ocean, which provides riserless light well intervention services. Blue Ocean, headquartered north of Houston in Conroe, has three systems underway, with two under construction and expected to be fully functional by mid-2017. Oceaneering plans to invest $10 million to complete construction of the two systems.

Global operator Oceaneering provides engineered services and products, primarily to the offshore oil and gas industry, with a focus on deepwater applications. Through the use of its applied technology expertise, it also serves the defense, entertainment, and aerospace industries.

Subsea well intervention services are intended to maximize production and increase the recovery rate from offshore oil and gas reservoirs or, alternatively, prepare wells to be plugged and abandoned. Blue Ocean’s technology holds the current depth record for deepwater riserless intervention at 8,200 feet (2,500 meters).

The acquisition enables Oceaneering “to further penetrate the subsea well intervention market and support existing and new customers with additional safe, cost effective subsea solutions,” CEO Kevin McEvoy said. “The services offered by Blue Ocean are complementary to our subsea products operations,” and the acquisition “fits our strategy on increasing our services and products offerings focus related to the production phase of the offshore field lifecycle.”

More OFS operators are tying up, with Houston-based Frank’s International NV agreeing earlier this month to buy well construction specialist Blackhawk Group Holdings Inc. in a transaction worth $321 million (see Shale Daily, Oct. 7).

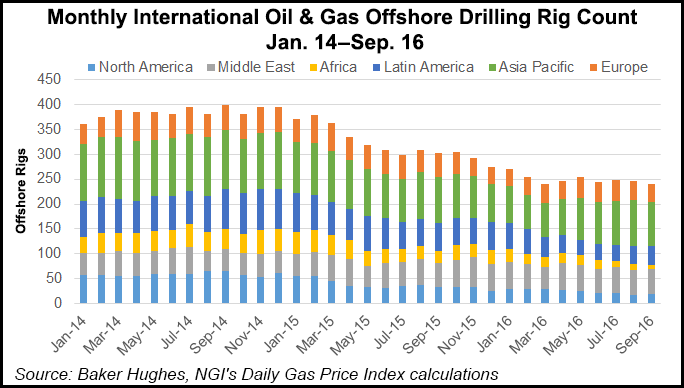

The downturn in the OFS sector may bottom this year, researchers with Douglas-Westwood said (see Shale Daily, Oct. 3). According to their calculations, OFS capital expenditures should increase 10% year/year between 2016 and 2020, reading $186 billion in 2020. The strongest growth is expected in North America, seen increasing on average by 19% every year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |