Markets | NGI All News Access | NGI The Weekly Gas Market Report

Henry Hub Spot Prices to Average More Than $3/MMBtu Through 2017, EIA Says

The Energy Information Administration (EIA) said Thursday that it expects Henry Hub natural gas spot prices to average $3.04/MMBtu in 4Q2016 and $3.07/MMBtu next year, substantially higher than the agency’s previous 2017 price forecast.

In September, EIA said it expected 2017 Henry Hub natural gas spot prices to average $2.87/MMBtu (see Daily GPI, Sept. 7). After back to back months of increases, EIA’s natural gas price forecast in August stood at $2.41/MMBtu for 2016, and the 2017 price forecast was $2.95/MMBtu (see Daily GPI, Aug. 9).

Natural gas futures contracts for January 2017 delivery (for the five-day period ending Oct. 6) averaged $3.34/MMBtu. “NYMEX contract values for January 2017 delivery traded during the five-day period ending Oct. 6 suggest a price range from $2.28/MMBtu to $4.88/MMBtu encompasses the market expectation of Henry Hub natural gas prices in January 2017,” EIA said.

Temperatures this winter are expected to average 3% warmer than the 10-year average, but 15% colder than last winter, which was exceptionally warm, EIA Administrator Adam Sieminski said during a conference call Thursday. Those colder temperatures will lead to higher demand for space-heating fuels, compared to winter 2015-2016, but fuel demand will still be 2-3% lower than average, and while prices for all fuels are forecast to be higher than last winter, heating oil and propane prices are forecast to be “significantly below the average of the previous five winters,” he said.

A winter expected to be 12% colder than last year’s and increased industrial demand have brightened the prospects for natural gas producers heading into the official start of winter at the end of the month, according to the Natural Gas Supply Association (see Daily GPI, Oct. 5). Because of colder weather and growth in demand for natural gas, the producer association anticipates upward pressure on prices compared to last winter.

The upcoming winter could be an extended one from the northern Plains to the natural gas-hungry population centers of the eastern United States, with cold and snowy conditions stretching into the spring, while the southern half of the nation is expected to be relatively mild and dry, according to a recent long-term forecast issued by AccuWeather (see Daily GPI, Sept. 29).

“Inventories of natural gas, heating oil and propane are starting the winter at high levels compared with five-year averages…ample inventory levels should help dampen price volatility in the case of colder-than-forecast weather,” Sieminski said.

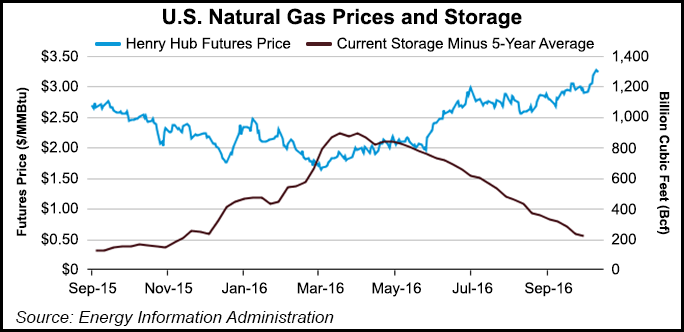

EIA said Thursday that natural gas inventories had reached 3,759 Bcf, which was 56 Bcf greater than last year and 192 Bcf more than the five-year average (see related story). EIA projects natural gas inventories will total 3,966 Bcf at the end of October, which would be near a record high going into the heating season.

“Last winter’s warm weather left natural gas inventories at record high levels in April, the beginning of the refill season,” EIA said in its Short-Term Energy and Winter Fuels Outlook, which was also released Thursday. “Injections for most weeks over the summer were lower than the five-year (2011-15) average rate. Under the base case winter forecast, EIA expects inventories to end the winter at 1,896 Bcf. In the event of a colder-than-forecast winter, high stock levels should help moderate price volatility.”

EIA said it expects the share of U.S. total utility-scale electricity generation from natural gas will average 35% this year, and the share from coal will average 30%. Last year, both fuels supplied about 33% of total U.S. electricity generation.

Most U.S. households can expect higher heating expenditures this winter compared to last winter, EIA said.

“Winter heating expenditures for most fuels were especially low last winter, when energy prices were relatively low and warm weather reduced heating demand to the lowest level nationally in at least 25 years. Although expenditures for non-electric fuels are expected to be higher than last winter, expenditures are comparable to or lower than the average winters from 2010–11 through 2014–15. By comparison, electric heating prices and expenditures are expected to remain relatively stable,” EIA said.

EIA expects marketed natural gas production to average 77.5 Bcf/d in 2016, a decrease of 1.6% from the 2015 level, which would be the first annual decline since 2005. Forecast production increases by 3.7 Bcf/d in 2017, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |