Markets | NGI All News Access | NGI Data

Bulls Riding High on Heels of NatGas Storage Data

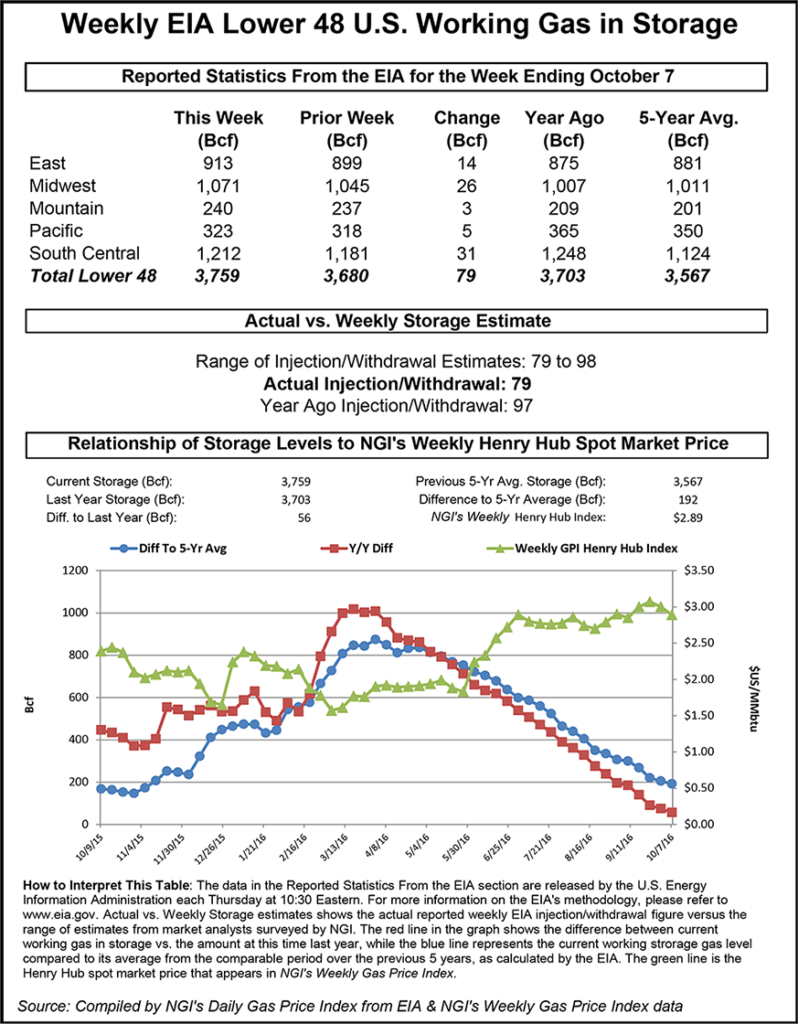

Natural gas futures gained ground Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was less than what traders and analysts were anticipating.

EIA reported a 79 Bcf storage injection in its 10:30 a.m. EDT release, less than what surveys and estimates by traders and analysts were expecting by about 8 Bcf. November futures reached a high of $3.320 immediately after the figures were released, and by 10:45 a.m. November was trading at $3.308, up 9.8 cents from Wednesday’s settlement.

“We were looking for an 87 Bcf number, so the market got a little boost. Right off the bat we made $3.32 and its staying there,” a New York floor trader told NGI.

“We have volume already of 100,000 [November] contracts, which is double the normal volume we have at this time. Usually we have 60,000 contracts traded at this time; $3.50 is the next level higher, but you will get pops along the way. December got up to $3.517. At expiration we could already be at $3.50.”

Others see reporting issues in play. “The data for last week was a clear bullish surprise, a 79 Bcf build instead of the 87-88 Bcf consensus forecast,” said Tim Evans of Citi Futures Perspective. “Coming after a larger-than-expected 80 Bcf refill in the prior week suggests there may have been some issues at the margin between the two periods rather than an overall shift in supply versus demand.”

Inventories now stand at 3,759 Bcf and are 56 Bcf greater than last year and 192 Bcf more than the five-year average. In the East Region 14 Bcf was injected, and the Midwest Region saw inventories increase by 26 Bcf. Stocks in the Mountain Region rose 3 Bcf, and the Pacific Region was higher by 5 Bcf. The South Central Region added 31 Bcf.

Salt cavern storage was up 16 Bcf at 305 Bcf, while the non-salt cavern figure was up 14 Bcf at 907 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |