Markets | NGI All News Access | NGI Data

NatGas Cash Heads North, Futures Slip South; November Drops 3 Cents

Physical natural gas for Thursday delivery on average gained ground in trading Wednesday, but declines in the Rockies and California had to be offset by healthy advances at New England points. The NGI National Spot Gas Average gained 4 cents to $2.73, but futures found the going more arduous.

At the close, November futures had retreated 2.7 cents to $3.210, and December was off 1.9 cents to $3.410. November crude oil gave up 61 cents to $50.18/bbl.

Futures traders did not ascribe particular significance to the day’s trading.

“$3.25 to $3.26 is the next level of resistance, and above that you have $3.35 and $3.15 on the downside,” said a New York floor trader. “We have maintained above $3 for a while now and that is a good sign. And we have seen a little strength in the market.”

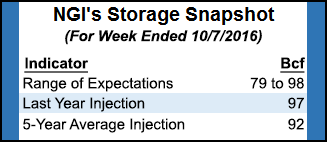

Traders will get a better idea of supplies for the upcoming heating season with Thursday’s Energy Information Administration (EIA) report on natural gas inventories. Last year 97 Bcf was injected, and the five-year pace stands at 92 Bcf. Even with last week’s 80 Bcf build, inventory gains still struggle to equal historical averages.

ICAP Energy estimated an increase of 88 Bcf, while industry consultant PIRA Energy is looking for an injection of 94 Bcf. A Reuters survey of 22 traders and analysts revealed an average 87 Bcf with a range of 79 Bcf to 95 Bcf.

New England points rose as next-day power loads were forecast to increase and on-peak power also gained. ISO New England reported that Wednesday’s peak load of 15,100 MW was expected to rise to 15,200 MW Thursday before ebbing to 14,350 MW Friday. PJM Interconnection forecast Wednesday’s peak load of 30,942 MW would reach 31,055 MW Thursday and ease to 29,350 MW Friday.

Gas at the Algonquin Citygate rose by 49 cents to $2.70, and deliveries to Iroquois, Waddington gained 48 cents to $2.79. Deliveries to Tenn Zone 6 200L added 43 cents to $2.56.

Marcellus points continue to find it difficult to breach the $1 ceiling. Gas on Dominion South was quoted at 91 cents, down a penny, and parcels on Tennessee Zn 4 Marcellus rose by 5 cents to 89 cents. Deliveries to Transco-Leidy Line changed hands a penny higher at 93 cents.

Gas at major trading hubs was mixed. Gas delivered to the Chicago Citygate rose a nickel to $3.15, and gas at the Henry Hub came in 3 cents higher at $3.17. On the other hand, gas at the Kern Delivery point shed 4 cents to $2.856, and packages at the PG&E Citygate fell 8 cents to $3.37.

Maintenance at the Sabine Pass liquefaction facility appears to be coming to an end.

Last Sunday at noon Train 3 and 4 flares re-ignited, according to industry consultant Genscape Inc. Delivery nominations resumed for gas days Sunday and Monday “of 5 MMcf/d in deliveries (going to this flare stack) after deliveries to Sabine went to zero on Sept. 20. Genscape’s proprietary monitors observed the Train 1 & 2 and Train 3 & 4 flares completely go out Sept. 24 and Sept. 17 respectively.

“Based on the resumed deliveries and the Train 3 & 4 flare re-ignition, it is expected that Train 3 could resume commissioning activities by Oct. 17 following the CEO’s mention of this being a four-week outage,” Genscape said. “As of now Genscape anticipates that the modifications are on track to be completed within the stated four week outage from the flares going out.”

Forecasters are expecting above-normal temperatures south and east of a line from northern Minnesota to Southern California.

“The latter part of autumn can be a very volatile period and current higher chaos levels in the 11-15 day are definitely testament to that,” said Commodity Weather Group President Matt Rogers in a Wednesday morning report to clients.

“The overnight models generally shifted warmer after seeing cooler shifts over the past two days. The six-10 day edges slightly warmer for the Midwest to East, but also for the West where we have three days of 90 for Burbank in the back half.

“Farther north, we continue to track a very stormy pattern for the upper half of California to the Pacific Northwest. The 11-15 day may be a touch warmer at times, but we did not shift as cool as the models yesterday nor are we changing as much in the warmer direction as the latest from overnight.”

For the week ending Saturday (Oct. 15), the National Weather Service is forecasting below-normal heating and cooling loads for major energy markets. New England is expected to see 89 combined degree days (DD), or eight fewer than normal, and the Mid-Atlantic is set to experience 77 DD, or five fewer than its normal tally. The greater Midwest, from Ohio to Wisconsin, is expected to take on 68 DD, or 19 under its normal quota.

Analysts see a continued low accumulation of heating DDs (HDD) as compressing basis and perhaps erecting barriers to further price strength.

“Starting in early September we typically see the HDD count across the country begin to grow as the nation slides into fall,” said EnergyGPS President Jeff Richter, based in Portland, OR. “However, this year has been characterized by above-normal temperatures and weak HDD growth.

“In early October this year’s deviation from normal became more pronounced as a warm spell moved across the country. Temperatures recovered slightly (more HDDs) over this past week, however the forecast…indicates another warm spell is set to hit around mid-October.

“As would be expected, the lack of HDDs across the U.S. has stifled residential/commercial gas consumption as heating demand has been slow to grow,” he said. “When HDDs started to pick up in early October residential/commercial demand began to grow, moving from the 7.5-8.5 Bcf/d range up to nearly 15 Bcf/d. However, the upcoming warm spell is forecasted to drive heating back down to sub 10 Bcf/d.

“The majority of the length will be added to the Northeast and Midwest gas grids where storage facilities are nearly full. As a result, the drastic decrease in residential/commercial consumption will drive down the basis prices as [the market] struggles to move the excess gas around the system.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |