Regulatory | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

New Hampshire Regulators Nix Access Northeast Capacity Contract

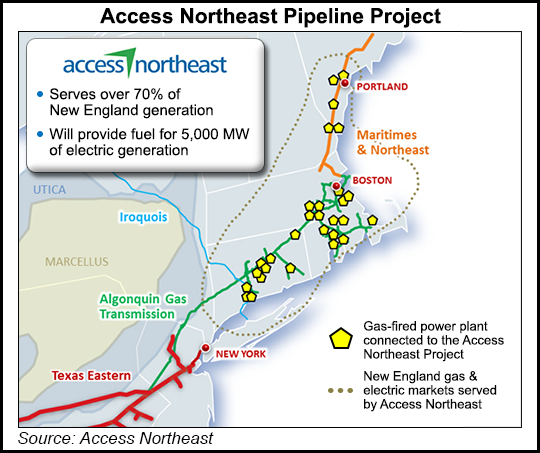

Algonquin Gas Transmission LLC’s Access Northeast expansion project was dealt another blow last week when regulators in New Hampshire refused to approve a 20-year transportation and storage capacity contract between the Spectra Energy pipeline and Eversource Energy, with costs to be borne by ratepayers.

“We acknowledge that the increased dependence on natural gas-fueled generation plants within the region and the constraints on gas capacity during peak periods of demand have resulted in electric price volatility,” the New Hampshire Public Utility Commission (PUC) said in its order, which was issued Thursday. “Eversource’s proposal is an interesting one, with the potential to reduce that volatility; but it is an approach that, in practice, would violate New Hampshire law following the restructuring of the electric industry.”

Eversource, the pipeline and other supporters of the capacity agreement argued that the statute enabling electric utility restructuring in the Granite State is intended to lower energy prices. They said electric distribution companies’ (EDC) purchase of natural gas transportation and storage capacity to be used by power generators would further that cause.

Opponents of the Eversource proposal argued that the restructuring statute’s most important objective is to get the EDCs out of the power generation business completely. They argued that the idea “…of an EDC charging customers for the costs of a gas capacity contract is fundamentally inconsistent with the requirement that assets included in rate base must be ‘used and useful.'” The opponents argued that the proposed capacity contract and the release of capacity to wholesale power generators are preempted by the Federal Power Act and the Natural Gas Act.

Fundamentally, the argument came down to whether the 1996 restructuring statute is primarily intended to reduce consumer costs (through EDCs taking natural gas capacity, for instance), or whether its primary intent is to foster competition through restructuring and unbundling.

The PUC sided with the opponents, arguing that competition is the key.

“The competitive generation market is expected to produce a more efficient industry structure and regulatory framework, by shifting the risks of generation investments away from customers of regulated EDCs toward private investors in the competitive market,” the PUC said, adding that this should yield lower prices for consumers.

“A more efficient structure involves placing investment risk on merchant generators who can manage that risk, and allowing customers to choose suppliers, thus enabling customers to pay market prices and avoid long-term over market costs,” the PUC said.

This is not the first setback for Access Northeast, which needs long-term contracts to underpin project financing.

In late August, the Federal Energy Regulatory Commission rejected a blanket capacity release waiver sought by Algonquin (see Daily GPI, Sept. 1).The waiver was part of a plan to allow EDCs owned by Eversource and National Grid to contract for firm capacity on Access Northeast and then release that capacity to New England power generators. Eversource and National Grid have signed on with Spectra to co-develop Access Northeast, a roughly 1 Bcf/d brownfield expansion of Algonquin’s system [PF16-1].

Separately, an August Massachusetts Supreme Court ruling invalidated capacity contracts on Access Northeast when it overturned a natural gas-electricity harmonization plan approved by the Massachusetts Department of Public Utilities (see Daily GPI, Aug. 30; Aug. 18).

Earlier in the summer, regulators in Maine went the other way — over the recommendation of regulatory staff — and voted to put ratepayers on the hook for pipeline development (see Daily GPI, July 21). However, for Access Northeast or a similar project to proceed with EDC contracts, it needs the support of regulators in other states.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |