E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Riding Permian, Diamondback Raising Rigs, Production Guidance, with 2017 Output Even Stronger

Diamondback Energy Inc. has boosted its 2016 production for the second time since July and now expects 2017 output to be up by double-digits, the Permian Basin pure-play said Monday.

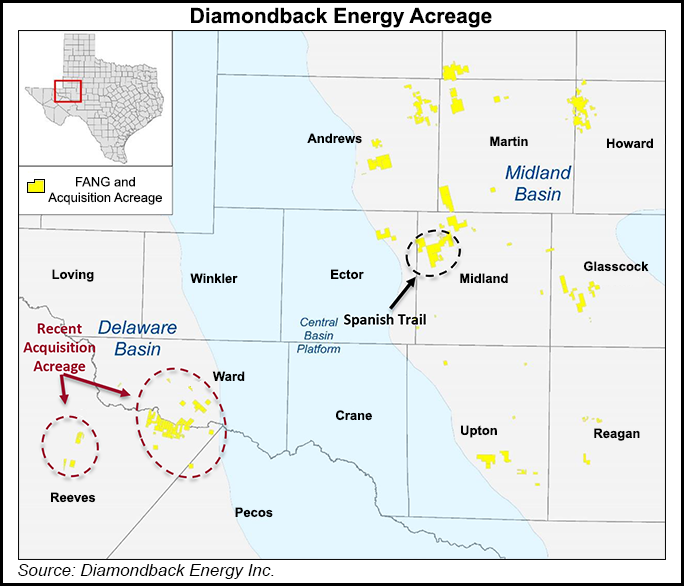

The explorer, which honed its expertise in the Midland sub-basin and has since expanded into the Delaware, said 3Q2016 production (73% weighted to oil) rose 22% sequentially to 44,923 boe/d from 36,851 boe/d. Subsidiary Viper Energy Partners LP’s output, 75% oil, jumped 16% to 6,255 boe/d from 5,380 boe/d.

“Diamondback’s continued strong well performance and increased completion cadence during the third quarter reflects our ability to turn our growth engine back on into a rising commodity price after reducing completion activity in early 2016,” CEO Travis Stice said. “We are now operating four rigs, with a fifth rig to be added in the coming weeks and a sixth rig to be added early next year.”

On “continued strong well performance,” production guidance for 2016 was raised by 6% to 41,000-42,000 boe/d from the July midpoint guidance of 38,000-40,000 boe/d. The company now intends to complete 65-70 horizontal wells (gross) this year. Capital spend for the year remains unchanged at $350-425 million, with full-year lease operating expense guidance falling to $5.50-6.00/boe from $5.50-6.25 “as a result of continued cost savings and efficiency improvements.”

Last week Diamondback was rumored to have made the highest bid at $2.5 billion for private equity-backed Silver Hill Energy Partners LLC, which is developing a project in the Delaware sub-basin. Diamondback gained entry into the Delaware this summer in a $560 million deal with an undisclosed seller (see Shale Daily, July 13).

“As has been rumored, we were engaged in discussions involving an acquisition but are not actively pursuing further negotiations at this time,” Stice said.

The Midland, TX-based operator’s existing asset base “allows us to drive production growth within cash flow into 2017 and beyond at the current forward strip prices. The ability to drive multi-year organic growth, within cash flow on our existing asset base, represents the standard we have always sought to achieve.”

Diamondback’s average realized prices during 3Q2016 were $42.11/bbl oil, $2.37/Mcf natural gas and $13.76/bbl natural gas liquids. Viper received $41.97 for its oil, $2.39 for gas and $12.56 for liquids.

For 2017, preliminary production guidance is set at 52,000-58,000 boe/d, which at the midpoint would be 30%-plus higher than the updated 2016 guidance. Next year 90-120 wells (gross) are expected to be completed, with average lateral lengths of 8,500 feet. Tentative capital spend is $500-650 million for a five-to-seven rig program, if West Texas Intermediate prices “remain above $45/bbl.”

Well costs in 2017 are expected to average $5-5.5 million for a 7,500-foot lateral horizontal well in the Midland and $6-7 million in the Delaware. “Leading-edge Midland Basin well costs remain below $6.0 million for a 10,000 foot lateral well and below $5.0 million for a 7,500 foot lateral well,” the company noted.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |