Markets | NGI All News Access | NGI Data

Natural Gas Futures Hanging Tough Following Outsized Storage Build

Natural gas futures at first retreated, then rebounded slightly Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was greater than what traders were anticipating.

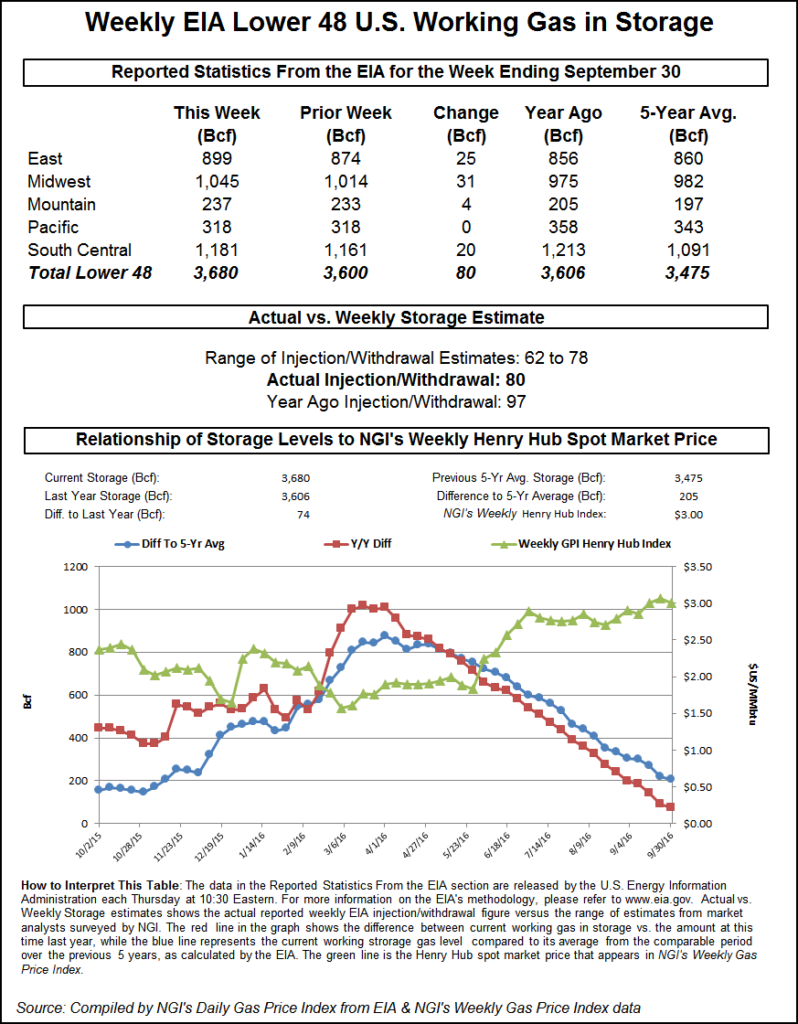

EIA reported an 80 Bcf storage injection in its 10:30 a.m. EDT release, greater by about 10 Bcf than what surveys and estimates by traders and analysts were expecting. November futures reached a low of $2.972 immediately after the figures were released, but by 10:45 a.m. November was trading at $2.994, down 4.7 cents from Wednesday’s settlement.

“It’s trying to get itself back over $3,” said a New York floor trader shortly after the number was released. “If it can get back over $3.01, you will see confidence come back. To me the market still looks good. It did its dance when the number came out and now it’s holding.”

“The larger-than-expected 80 Bcf build suggests that producers may be ramping up supply ahead of the winter or that power sector demand has faded more quickly than anticipated as temperatures cool seasonally,” said Tim Evans of Citi Futures Perspective. “Either way, it suggests more robust storage injections for the weeks ahead.”

Inventories now stand at 3,680 Bcf and are 74 Bcf greater than last year and 205 Bcf more than the five-year average. In the East Region 25 Bcf was injected, and the Midwest Region saw inventories increase by 31 Bcf. Stocks in the Mountain Region rose 4 Bcf, and the Pacific Region was unchanged. The South Central Region added 20 Bcf.

Salt cavern storage was up 14 Bcf at 289 Bcf, while the non-salt cavern figure was up 8 Bcf at 893 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |