NatGas Cash Firm; Futures Enjoy Solid Gains Following NGSA Report

Next-day physical natural gas managed to work higher in Wednesday’s trading with just a handful of eastern points posting losses — but most locations logged gains typically seen on either side of a nickel.

The NGI National Spot Gas Average gained 5 cents to $2.53. New England points led the way higher as ongoing pipeline maintenance resulted in severely curtailments. Futures rallied as industry reports surfaced of an expected cold winter, and at the close November had risen 7.7 cents to $3.041 and December also added 7.7 cents to $3.260. November crude oil gained $1.10 to $49.83/bbl.

Futures made a solid advance as the Natural Gas Supply Association (NGSA) said in a report that it expected a winter 12% colder than last year’s along with increased industrial demand (see related story). Prospects have brightened for natural gas producers heading into the official start of winter at the end of the month.

Because of colder weather and growth in demand for natural gas, the producer association anticipates upward pressure on prices compared to last winter, said NGSA Chairman Bill Green, who is also vice president of downstream marketing for Devon Energy Corp. Last winter, natural gas at the Henry Hub averaged $1.98/MMBtu — a 16-year low.

NGSA’s 16th annual Winter Outlook is intended to give a look ahead at the winter wholesale gas market. Using published data and independent analyses, the outlook evaluates the combined impact of weather, economic growth, customer demand, storage inventories and supply activity on the direction of natural gas prices compared to last winter. Price projections are not given, though.

Traders will also keep a close eye on the flow of Canadian gas to the United States following word Wednesday that Alliance Pipeline will shut down its system from 8 a.m. CST next Wednesday (Oct. 12) until 8 a.m. CST Oct. 19, cutting an estimated 1.9 Bcf/d of gas, to facilitate pipe removal and tie-ins of new pipe at a crossing of a major highway project near Regina, Saskatchewan (see related story).

“Flows across the U.S./Canada border have averaged 1.7 Bcf/d over the previous two weeks, and the Tioga and Bantry receipt points in North Dakota have a combined average of 0.2 Bcf/d,” Genscape Inc. said. Alliance delivers most of the gas to Vector (0.7 Bcf/d 14-day average), ANR (0.6 Bcf/d 14-day average) and Nicor (0.14 Bcf/d 14-day average), the analysts said.

Futures traders are optimistic now that November futures are perched solidly above $3. “$3.04 is a good close, and we are looking at $3.08 to $3.12 on the next push up,” a New York floor trader told NGI. “I think it has a little more to go. I think we’ll see the $3.18 to $3.19 area and then see how it acts.”

Near-term weather forecasts are calling for a somewhat cooler East.

The southern U.S. remains warm with highs in the 80s to near 90 F, resulting in light cooling demand, but far from hot,” said Natgasweather.com in a Wednesday midday report.

“Mild to warm temperatures are expected to regain ground over much of the country late next week into the following weekend as high pressure briefly returns to dominate much of the U.S., apart from the West and East Coasts where weather system are expected, just not very cold ones.

“There are signs a bit stronger cooling will arrive into the northern and eastern U.S. beginning around Oct. 17-18, but the weather data would need to be more convincing for the markets to see it as a real threat. Overall, there will be swings in natgas demand from slightly below normal to slightly above the next few weeks, but without widespread subfreezing temperatures, which is necessity to drive strong nat gas demand.”

Bottom line in the near term, both heating and cooling load is expected to be well below normal. The National Weather Service for the week ending Oct. 8 forecast that New England would see a combined total of heating degree days (HDD) and cooling degree days (CDD) of 53, or 27 below normal. The Mid-Atlantic was anticipated to have a combined load of 29 degree days, or 38 fewer than its normal seasonal tally, and the greater Midwest from Ohio to Wisconsin was forecast to see a total of 35 degree days, or 37 under its normal tally.

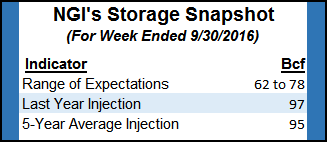

Tim Evans of Citi Futures Perspective is standing aside the market for now, awaiting a low-risk entry point, but he sees constructive forces in play as estimates of Thursday’s storage report are coming in at about 65 Bcf, “well below last year’s 97 Bcf and a five-year average of 95 Bcf.”

In physical market activity,next-day New England deliveries soared as Algonquin Gas Transmission (AGT) reported severe curtailments at its Stony Point compressor station.

“AGT has restricted 100% interruptible, 100% secondary out of path, 100% secondary in path and approximately 8% of primary firm nominations sourced from points west of its Stony Point Compressor Station (Stony Point) for delivery east of Stony Point,” the company said on its website. “No increases in nominations sourced west of Stony Point for delivery east of Stony Point, except for Primary Firm No-Notice nominations, will be accepted.”

Gas at the Algonquin Citygate gained a stout 55 cents to $2.45, and deliveries to Iroquois, Waddington added 15 cents to $2.43. Gas on Tenn Zone 6 200L rose 42 cents to $2.25.

Marcellus points continued to languish under $1. Gas on Dominion South was quoted at 93 cents, up 3 cents, and deliveries to Tennessee Zn 4 Marcellus fell 5 cents to 84 cents. Transco-Leidy Line packages came in at 92 cents, up 3 cents.

Major market hubs were a little stronger. Gas at the Chicago Citygate rose 6 cents to $2.81, and deliveries to the Henry Hub added 3 cents to $2.86. Gas at the SoCal Citygate gained 4 cents to $2.90.

The Thursday release of storage data should give traders more data to hone their estimates of season-ending supply. Last year 96 Bcf was injected, and the five-year pace stands at a plump 95 Bcf. Analysts at Citi Futures Perspective calculated a 62 Bcf increase, and PointLogic is looking for a 73 Bcf injection. A Reuters survey of 19 traders and analysts revealed an average 70 Bcf with a range of 62 Bcf to 77 Bcf.

At 5 p.m. EDT Wednesday, the National Hurricane Center (NHC) reported that Hurricane Matthew was 205 miles south-southeast of Nassau and moving to the northwest at 12 mph. Maximum sustained winds were pegged at 120 mph, and NHC projected Matthew would rip through the Bahamas before hitting the east coast of Florida, Georgia and the Carolinas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |