NGI The Weekly Gas Market Report | Markets | NGI All News Access

NGSA: NatGas Producers Eye Colder Winter, More Demand

A winter expected to be 12% colder than last year’s and increased industrial demand have brightened the prospects for natural gas producers heading into the official start of winter at the end of the month, according to the Natural Gas Supply Association (NGSA).

Because of colder weather and growth in demand for natural gas, the producer association anticipates upward pressure on prices compared to last winter, said NGSA Chairman Bill Green, who is also vice president of downstream marketing for Devon Energy Corp. Last winter, natural gas at the Henry Hub averaged $1.98/MMBtu — a 16-year low.

NGSA released its 16th annual Winter Outlook Wednesday morning. It is intended to give a look ahead at the winter wholesale gas market. Using published data and independent analyses, the outlook evaluates the combined impact of weather, economic growth, customer demand, storage inventories and supply activity on the direction of natural gas prices compared to last winter. Price projections are not given, though.

There will be enough gas to meet demand, of course, NGSA said. High levels of natural gas in storage also ensure supply reliability, the association said.

“The picture that emerged for the upcoming winter is one of a flexible natural gas market that is able to respond to changes in weather and customer demand with ample supply and full storage facilities.

Last winter’s record warmth gave consumers a break but pinched the pocketbook of anyone who was long natural gas. But producers were to blame for that, too. “Last winter, wholesale prices averaged less than $2/MMBtu, the lowest since the ’90s and that’s not just because the winter was so mild. It’s also because of abundant gas from shale, with even more gas on tap from storage and a flexible and responsive pipeline infrastructure system,” Green said.

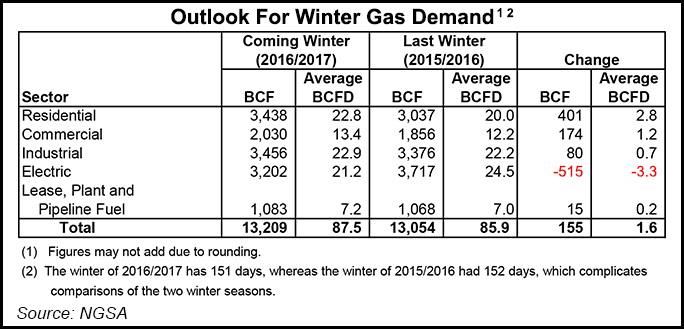

The key demand factor for the upcoming winter is weather that is projected to be 12% colder than last year, according to the Winter Outlook, which was prepared by Energy Venture Analysis Inc. (EVA). The firm projects record demand of 92.3 Bcf/d this winter, particularly because of an anticipated 4 Bcf/d increase in demand in the residential and commercial sectors combined due to the colder weather.

Expectations for growth in industrial demand of 0.7 Bcf/d contribute to the overall demand increase. Newbuilds and capacity expansions in the natural gas-intensive petrochemical and fertilizer industries continue to drive demand. NGSA said 71 capacity expansions and newbuild projects in the petrochemical and fertilizer industries are planned over the 2015-2021 time period, consuming an estimated 3.7 Bcf/d more of natural gas annually by 2021.

And growth in exports to Mexico as well as exports of liquefied natural gas (LNG) contribute to the increased demand, too. Winter over winter, EVA projects that Mexican exports will to grow 0.8 Bcf/d and LNG exports will average an additional 0.8 Bcf/d. “While LNG exports are growing, they remain a very small slice of overall demand,” Green said.

Not everyone is expected to be burning more gas, though. A decline in winter demand from the power generation sector of 3.3 Bcf/d is expected to somewhat offset demand growth elsewhere, NGSA said. The drop is attributable to less fuel-switching due to higher prices for natural gas anticipated by EVA.

“NGSA anticipates temporary fuel-switching to natural gas to continue this winter, but at about half the volumes that took place during last winter’s record-setting fuel switching,” Green said.

Key factors affecting supply this winter will be potentially record levels of natural gas in storage combined with a “slight drop” in production.

Production will drop slightly from last year’s record high. Green said, “The shale revolution has ushered in a remarkable era, as evidenced by dramatic growth in production over the last nine years. Despite the low rig count, this winter’s supply is expected to remain robust because of drilling efficiencies and new infrastructure coming online to move natural gas to customers,” he said.

Besides data from EVA, data from the U.S. Energy Information Administration was also used in the analysis. Data from IHS Economics was used in economic projections.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |