NGI The Weekly Gas Market Report | Markets | NGI All News Access

Heat Key to NatGas EOS Storage Missing 4 Tcf Mark

While record power burn has slashed the 1,004 Bcf natural gas storage surplus over 2015 levels the industry saw at the beginning of April to just 90 Bcf as of Sept. 23, the warmer-than-normal weather many forecasters are predicting for October could reignite fears of inventories reaching a critical 4 Tcf by the end of the injection season, analysts say.

Historically, September and October are known as shoulder-season months in the natural gas industry, a time when temperatures are mostly mild. With this, the market expects demand to decline along with cooling degree days.

“The tapering of demand does not cause 4 Tcf concerns to resurface. However, hotter-than-normal weather, which we have had for the past two months, starts to become a bearish factor should it continue,” said Wood Mackenzie’s Gabriel Harris, senior natural gas analyst.

“As it happens, many of the important weather forecasting groups for the gas trading community are in agreement in forecasting a warmer-than-normal October. This does cause some concern around the 4 Tcf mark being surpassed,” he said.

Indeed, much of the U.S. east of the Rockies is expected to see very comfortable temperatures during the first week of October, while some areas in the far southern part of the country could see daytime temperatures return to the low 90s, forecasters with NatGasWeather said. In fact, the weather agency is expecting the next couple of weeks to bring about the largest storage builds of the injection season so far. As of Sept. 23, inventories stood at 3.6 Tcf.

Next week, however, is shaping up to bring about the first glancing blow of cooler air to the northern U.S., and that weather system could last at least a few days to bring about some localized heating demand, NatGasWeather said.

Beyond that, the latest weather models are becoming more convincing that cooler weather may arrive in the northern U.S., but only bringing temperatures to slightly below normal levels, according to the team at Bespoke Weather Services.

“Anywhere east of the Mississippi is more likely to see temperatures a bit below average, though this trend could be rather transitory as climate guidance shows colder weather may struggle to have much staying power and weather model accuracy has fallen back below average.”

So what could happen if storage reaches or exceeds that critical 4 Tcf mark? For one, prices could be in store for significant downside pressure, especially if 4 Tcf is reached at a time when temperatures are expected to remain mild, limiting heating degree days.

“I think you’ve got some pretty good resistance on the way down,” said Zane Curry, director of markets and research at Mobius Risk Group.

Curry said the market could see some consolidation around $2.78 and then again in the $2.60 range. “The real fundamental threshold would be around the $2.50 mark, which is a pretty key coal-to-gas threshold.” How low prices could fall is dependent on when and if storage reaches 4 Tcf. “The earlier it occurs, the earlier that concerns arriving will lead to a lower price.”

However, Curry said just because the industry may avoid seeing end-of-season inventories reach 4 Tcf, that doesn’t mean it won’t happen before winter kicks into high gear. “Three of the last five years have shown injections in November. So even if we don’t see 4 Tcf at the end of October, you could still see it happen,” he said.

Indeed, while storage inventories hit a record 3.931 Tcf during the week ending Oct. 30, 2015, stocks exceeded 4 Tcf during the two weeks ending Nov. 13 and Nov. 20, 2015, according to the U.S. Energy Information Administration. Mobius is projecting EOS inventories in the 3.95-4 Tcf range.

Coal Versus Gas Prices

A drop in gas prices could prove to be an important driver on the power generation front, however, as strength in both the cash and futures markets throughout September left analysts wondering whether power generation could be threatened.

“We do have some uncertainty around October power burns that are not dependent on weather,” WoodMac’s Harris said. “This shoulder season, prices are a bit stronger than the last couple of shoulder seasons. So, we are expecting more marginal coal plants to be running a higher percent of time in October than in the last 24 months,” Harris said.

This should allow natural gas demand to back off substantially from September levels. “But if we are wrong, then power burns could be a little stronger than we are currently modeling for October-November,” he said. Wood Mackenzie is projecting end-of-season storage to reach 3.920 Tcf.

Societe Generale’s Breanne Dougherty, commodities research analyst, agreed gas prices at or above $2.75 in September and October have a strong potential to eat into power generation loads, which would effectively loosen out fundamentals and provide for a stronger-than-preferred injection pace.

“While the injection pace has been slowed nicely thus far this season, it is important that the tightening hold over the remaining weeks,” Dougherty said. “Of course, the fall part of the season is critical as it is the part of the season with the most demand elasticity and is also at the tail end of the season, forcing it to be vulnerable to any potential containment pressure if it does emerge.” The tighter things can be made, the better, she said.

Still, SocGen, in a September note to clients, maintained its bearish view on prices through the end of October. To be sure, the Nymex November contract has fallen some 22 cents since Sept. 21, and as of Sept. 30’s close, the November contract sat 4 cents below its Q2 average, according to Mobius.

For its part, Societe Generale is projecting end-of-season storage inventories to reach at or above the record seen last year. “While an EOS around the record of last year indicates a very well supplied start to winter season, it also implies that there has been a material tightening of the underlying fundamentals,” Dougherty said.

The most important thing to note is that the tightening has come courtesy of both strong power generation, aided by low prices, and the tilt in production, she said.

While there could be some demand loss to come as the year-on-year price advantage lessens and then flips, it will be very challenging to bring looseness back into the ledger through a production shift, Dougherty said. “The curve has risen to our price view for 1Q2017, but we remain more constructive on Cal 17 as a whole,” she said.

The Nymex November-March winter strip settled at $3.23 on Sept. 28, the last day October traded in the prompt-month position. This is roughly 35 cents above where the November-March strip traded at the same time last year.

The prospect of storage ending about on par with last year (perhaps even to a slight deficit) along with stronger demand and lower production has given prompt November and the winter strip a boost, analysts at data and analytics company Genscape said. “At the close of September trading, November finished just a tick over $3, compared to last year same time at $2.52. However, this is still below the prior five-year average at $3.43,” Genscape said.

Prompt winter is also stronger than this same time last year, at $3.23 vs $2.74, but also below the five-year average of $3.66, Louisville, KY-based Genscape said. But while higher prices will push power burn lower, around 4 Bcf/d at current prices, a normal winter would offset a big chunk of this, making power burn down closer to around 2 Bcf/d, Genscape’s Eric Fell, senior natural gas analyst, said.

“The market needs power burn to be significantly lower given the structurally bullish picture, especially if you assume either a normal or cold winter,” Fell said. In particular, exports to Mexico and LNG will be up around 2 Bcf/d combined, Fell said. Industrial demand is also growing structurally (June was up 0.7 Bcf /d year over year), and last winter was the second mildest winter ever recorded from a GWHDD perspective, so a normal winter would add nearly 6 Bcf/d of residential/commercial and industrial demand combined, he said.

Still, Mobius’ Curry noted that power burn is not solely based on Nymex pricing, as overall U.S. power burn is affected by regional pricing.

“Is Northeast power burn going to be impacted by Henry Hub at $3? No. Could that threaten Southeast power burn? Absolutely,” he said.

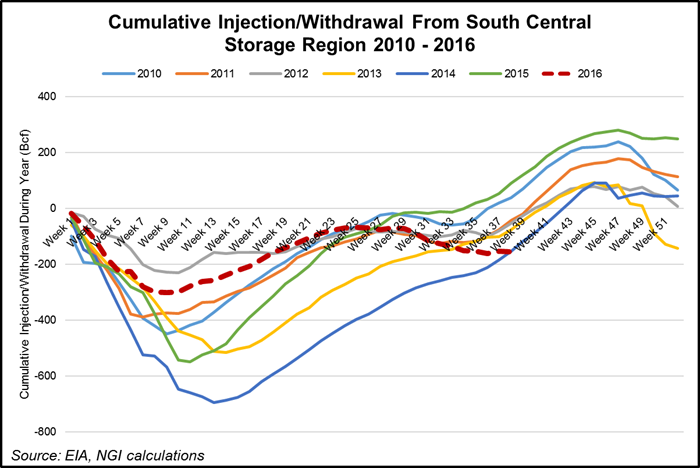

Roughly a third of U.S. power burn is driven from the Southeast, Curry said. In fact, power burn is such an integral part of that region’s fundamental landscape that the South Central is the only region that has been in a state of almost continuous withdrawals over the course of the entire year, according to NGI’s Nate Harrison, natural gas analyst. The downtrend hasn’t occurred this year alone.

South Central Storage Deficit

“Aside from the aberration of 2015, it seems that the cumulative injections in this region are on bit of a downtrend. Thus far in 2016, the region hasn’t actually added anything to storage on cumulative basis at all,” Harrison said. WoodMac’s Harris said this summer has indeed brought about the largest withdrawals ever in the South Central region, and Salt South Central inventories have recently fallen below year-ago levels.

“This deficit is continuing to widen. We see it becoming more normal to see withdrawals in the summer and winter, with sharper injections in the shoulder seasons in the coming years,” Harris said.

Most new storage built in the last eight years has been Salt Cavern storage in the South Central region that has better cycling capabilities, and WoodMac expects this new storage to be utilized more than the older less flexible facilities, Harris said.

What’s behind the drawdown in supplies this year? For starters, gas-fired power generation in the Southeast has grown exponentially. What hasn’t grown, however, are storage fields.

“Gas could be stored in Illinois and in Indiana, and in Appalachia (and some Appalachian gas will flow to the Southeast once some of these Appalachia to Southeast pipeline projects are in place), but those are the fields the Midwest and Appalachia count on in the winter,” NGI’s Patrick Rau, director of strategy and research, said.

Storage gas to handle peak power demand days in the Southeast really has to come from the South Central region, and with more gas-fired facilities taking over coal plants, along with more exports to Mexico and via LNG, it shouldn’t come as a surprise the South Central shows withdrawals during the summer, Rau said.

“Summer has been traditionally a time of reduced storage injections in the South Central anyway, and the summer of 2016 saw an average withdrawal of 5.2 Bcf. If 2016 is the new normal, then don’t expect the summer to be a time of storage injections in the South Central going forward,” he said.

Meanwhile, an additional 3 Bcf of export capacity to Mexico is expected to go online in the first quarter 2017, Rau noted. “That won’t operate at 100% capacity necessarily, but that is even more competition for summer time South Central gas,” he said.

Running Short in 2017

Another likely reason for the steady withdrawals in the South Central region? Declining production. In fact, the declining production picture is one spread across the U.S. Genscape is modeling domestic production to decrease but Canadian imports to increase for a net decline in supply versus last year.

BTU Analytics’ Matt Hoza, senior natural gas analyst, agreed the U.S. will be short gas supplies through 2017, especially since production from the prolific non-Northeast has dropped off precipitously. In addition, the Lakewood, CO-based company is expecting the current backlog of drilled but uncompleted (DUC) wells to be depleted by the first or second quarter of 2017, assuming normal weather.

SocGen’s Dougherty said that while DUCs will play a central role in the near-term production story, the rapidly declining rig count over the last year is perhaps the most important narrative the industry should be watching. Rigs in every key shale play, with the exception of the Utica, have fallen below where they were in January 2010, Dougherty said.

“Given the shale base is a declining one, we believe sustainable growth will require more than the DUC inventory can provide. Producers will have to start spending and drilling,” Dougherty said. “Even if producers were drilling, we still expect the Northeast to be constrained by infrastructure as greenfield projects such as Rover get delayed,” Hoza said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |