Canadian NatGas Rigs Return in Force; U.S. Rigs Climb, Too

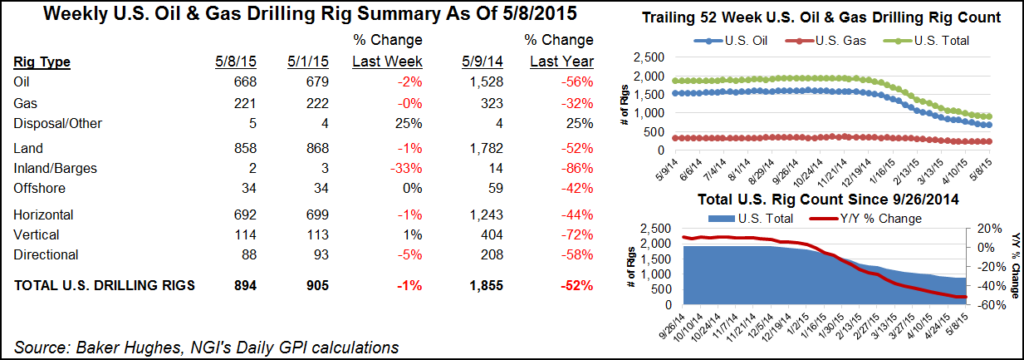

U.S. producers continued to favor oil over natural gas in their rig additions, according to the most recent count from Baker Hughes Inc. But Canada saw plenty more gas rigs return in the latest count.

Canada saw 17 natural gas rigs come stampeding back, bringing the country’s gas rig total to 78. Oil rigs came back, too. Seven rejoined the hunt to bring that tally to 84.

Alberta was the big mover in Canada, adding 20 rigs to end at 113 active, a 22% increase from the previous week. British Columbia added four rigs to end at 14. The other drilling provinces were flat with the previous week’s tallies.

The Permian Basin and New Mexico led among the U.S. plays and states adding drilling rigs during the week ending Sept. 30, but only just, as changes were modest across the board. The Permian saw the return of two rigs, to bring its tally to 204, and New Mexico, which accounts for a portion of the Permian, saw its rig count increase by three to end at 30 active.

Overall, the United States added nine land-based rigs and two in the offshore to raise the U.S. count by 11 units to 522 active, with 497 of these on land. Seven oil rigs returned along with four natural gas units. Two directionals, five horizontals and four verticals came back.

Oklahoma — where the SCOOP (South Central Oklahoma Oil Province) and STACK (Sooner Trend of the Anadarko Basin, mostly Canadian and Kingfisher counties) continue to garner attention — saw its rig count rise by one unit for the week to rest at 68. North Dakota, home to the Bakken Shale, added two rigs. Texas saw the departure of one.

Rising oil rig counts have implications for natural gas to the extent that the wells they drill also produce associated gas. Analysts at Barclays Commodities Research noted this in a Thursday Gas and Power Kaleidoscope note. Barclays said associated gas upticks are more likely to be a factor in 2018.

“Additionally, attention seems to be largely on the Permian where gas IPs [initial production rates] are considerably lower than in South Texas (i.e., Eagle Ford). Eagle Ford gas IPs have been around 2,000 Mcf/d compared to Permian gas IPs, which have been closer to 700 Mcf/d,” Barclays said.

“The bulk of the rig additions have been based in the Permian, where associated gas output has been holding strong at around 6.8 Bcf/d. However, despite Permian increases in associated gas production, these are largely being offset by larger declines in conventional production in East Texas and South Texas. The same can also be said for the Midcontinent, where, despite growing optimism with regard to the SCOOP/STACK, conventional declines in eastern Oklahoma far outweigh associated gas increases at this point.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |