November Sinks Under $3 as Shoulder Season Gets Under Way

It’s no surprise that natural gas couldn’t sustain $3 as the shoulder season got into full swing this week, with November forward prices averaging 7.3 cents lower at $2.74 between Sept. 23 and 29, according to NGI’s Forward Look.

Not surprisingly, the Nymex November futures contract saw somewhat of a volatile week as it transitioned into the prompt-month position. After swinging as much as nearly 5 cents in either direction over the last five days, the November contract ultimately ended the period down 5.4 cents.

The slide in natural gas futures and forwards occurred despite a bullish storage report from the U.S. Energy Information Administration (EIA).

EIA reported a 49 Bcf injection into storage for the week ending Sept. 23, much lighter than the 55 Bcf expected by the market.

The weakness in the futures curve continued Friday morning, and November was in the red by more than 5 cents by midday.

“We will look for support around the $2.92 level today as we did see some tightening in EIA expectations, with the ICE swap for the next couple EIA reports coming in just a bit and scrapes looking very marginally tighter,” analysts at Bespoke Weather Services said.

With inventories now at 3.6 Tcf, the storage surplus over year-ago levels is now just at +90 Bcf, while the surplus to the five-year average is down to +220 Bcf.

But futures and forwards could see additional downside as softer demand is waiting in the wings and already pressuring cash markets.

After reaching as high as $3.16 earlier in the week, Henry Hub cash slid to the mid-$2.90s Thursday as temperatures in key demand regions slide to seasonal levels.

“Weekend spot prices in the shoulder season are typically soft, and early October degree-day forecasts are adding the potential for steeper-than-normal declines,” said analysts at Mobius Risk Group.

For reference, the period from Oct. 1 to 15 is currently forecast to accumulate 111 total degree days. If this materializes, it would be the third-lowest total since 1950, the company said.

Forecasts show a weather system stalled out over the Midwest and Mid-Atlantic regions with showers and slightly cool temperatures with highs only reaching the 60s to lower 70s.

Temperatures in the Southeast, meanwhile, are expected to top out in the low to mid-80s for the next few days, after hitting the low 90s just a few days prior.

This region has been integral to resilience in natural gas prices this summer, Mobius said.

From June-August, consistently warm conditions fueled 11.2 Bcf/d of power burn in the Southeast, and the last several days, aggregate power burn in the region has dropped below 9.5 Bcf/d, the analysts said.

Milder conditions over the next seven to 14 days could lead to further power burn declines, which would likely generate larger weekly storage injections, Mobius said.

“As summer heat fizzles, demand for cooling over the next week will drop to the lightest levels since last spring, which could pressure prices short-term, especially the cash markets,” forecaster NatGasWeather said.

But the second week of October could bring about the first glancing blow of Canadian air to the northern United States, the forecaster said.

With more comfortable temperatures playing out this past week, and again next, storage injections will likely bring the largest builds this second shoulder season. Still, injections will only reach the 70s Bcf, well under five-year averages in the mid-90s Bcf, NatGasWeather said.

“This will keep supplies in steady decline, enough so that we expect they will be less at the end of this build season compared to where they were at the end of last season,” it said.

Indeed, Mobius said there is likely to be a hyper focus on weekly injections and where they are in respect to the 65 Bcf mark.

“Any injection materially higher than 65 Bcf will suggest breaching 4 Tcf is a valid concern, and any injection below 65 Bcf will lower the probability of testing prior end-of-season highs,” Mobius said.

Also of concern with respect to near-term prices is next Thursday’s EIA inventory report.

With preliminary data suggesting that the week ending Sept. 30 is shaping up to be in the upper 60s Bcf or low 70s Bcf, this level could be high enough to rekindle fears of breaching 4 Tcf, Mobius said.

In fact, unless weekly storage reports miss consensus estimates by a major margin, there likely won’t be too much in the way of bullish storage reports moving the market until withdrawal season starts, said NGI Director of Strategy and Research Patrick Rau.

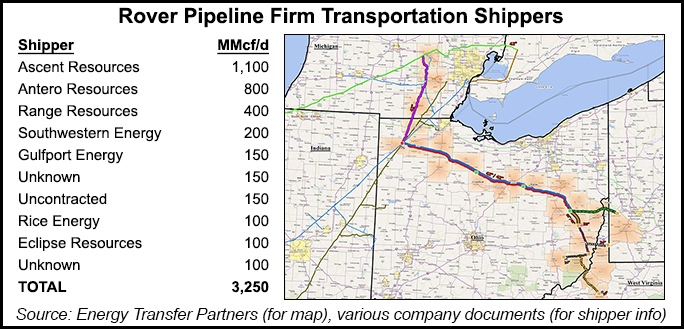

Meanwhile, gas production in the Appalachia continues to creep up, and that should receive a further boost in the coming months as producers with firm capacity on the 3.25 Bcf/d Rover Pipeline start ratcheting up their drilling and taking down their DUCs to fill that system, which we expect to begin coming online in mid-2017, Rau said.

On the weather front, if decent cool shots arrive during late October and early November, supply-demand balances appear tight enough that surpluses will be very close to flipping to deficits just prior to the official start of winter, NatGasWeather said.

“As a result, we view the supply environment as becoming increasingly bullish over time,” the agency said. “However, after the recent early September rally that pushed prices well over $3 in both the front contract, and even more so in the winter strip, it seems the recent lull in natural gas demand has pressured prices in recent days, and could continue to do so for a little while longer, particularly the cash markets.”

Looking more closely at the futures and forwards markets, the Nymex saw its most significant losses at the front of the curve, as November futures fell 5.4 cents between Sept. 23 and 29 and December lost 6 cents. The balance of winter (December-March) was down 5 cents, while futures strips further out the curve were only down by a couple of cents.

On a national level, November forward prices slid an average 7.3 cents during that time, December fell 7 cents and the prompt winter slipped 6 cents, according to Forward Look.

The most pronounced declines were seen in the Northeast, where several pipeline projects are expected to come online over the next month.

Two of those are expected to be Dominion Transmission Inc.’s (DTI) Clarington project and Lebanon West II project in the Marcellus and Utica shale region.

Dominion on Wednesday requested approval from the Federal Energy Regulatory Commission to begin service on the two expansion projects on or before Oct. 28 (see Daily GPI, Sept. 29).

The Clarington project, which received a certificate of public convenience and necessity from FERC last August, would add 250,000 Dth/d of capacity to DTI’s mainline system through new compression facilities, interconnects and associated equipment.

DTI has proposed the project to offer additional firm transportation service to Consol Energy Inc., delivering gas from a new interconnect in Lightburn, WV, to new interconnects with Texas Eastern Transmission Co. and Rockies Express Pipeline LLC (see Daily GPI, Aug. 21, 2015).

The Lebanon West II project received FERC approval last November. That project would add 130,000 Dth/d of firm transportation service from DTI’s MarkWest Liberty Bluestone Interconnection in Butler County, PA, to the Lebanon-Texas Gas Interconnection with Texas Gas Transmission Corp. in Warren County, OH (see Daily GPI, Nov. 23, 2015).

Meanwhile, Spectra Energy Corp. has confirmed first flows on its Gulf Market Expansion Project will begin Oct. 1.

The project was originally scheduled to come online Sept. 23, but pipeline flows do not indicate the expansion is being utilized yet, data and analytics company Genscape said.

The Gulf Market Expansion Project will create an additional 0.35 Bcf/d capacity to flow gas from Ohio to Louisiana, helping meet the demand growth in the power, industrial and LNG export sectors in the Gulf region, Louisville, KY-based Genscape said.

The new infrastructure, coupled with falling production and mild weather, sent prices in the region tumbling.

At Dominion South, November forward prices plunged 16.8 cents between Sept. 23 and 29 to reach $1.236, December tumbled 11 cents to $1.753, and the prompt winter dropped 7 cents to $2.04, Forward Look data shows.

At TETCO M2, 30 Receipt, November lost 17.5 cents to hit $1.25, December fell 12 cents to $1.809, and the prompt winter slid 7 cents to $2.12.

Spectra’s Gulf Market Expansion is expected to provide some support to M2 prices once online.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |