NatGas Cash, Futures Wrestle Each Other Lower; November Loses 4 Cents Despite EIA Stats

Physical natural gas continued to grind lower Thursday as traders scurried to get deals done before the weekly Energy Information Administration (EIA) storage report.

Losses of a nickel were common throughout most market points, with the exception of New England and the Mid-Atlantic, which experienced double-digit losses. Several points recorded all-time lows, and the NGI National Spot Gas Average fell 3 cents to $2.50.

Futures bulls were treated to storage data that came in leaner than expected, but what the bulls quickly found out was that the market that giveth can quickly taketh away. EIA reported a build of 49 Bcf, about 6 Bcf less than expectations, and prices initially rose, but by the end of the day the screen was solidly in the red. The November contract shed 4.3 cents to $2.959 and December was off 3.8 cents to $3.161. November crude oil rose 78 cents to $47.83/bbl.

As soon as the storage report rumbled across trading desks, November futures reached a high of $3.032, but by 10:45 a.m. EDT November was trading at $2.993, down nine-tenths of a cent from Wednesday’s settlement.

“We were trading $2.99 when the number came out, and it’s ‘now you see it, now you don’t,'” said a New York floor trader describing the market’s momentary move after the release of EIA storage figures. “$3 is the pivot point which we need to stay above for a few days to generate any upward momentum. I’m not getting much in the way of a bullish vibe.”

“We were looking for a build of 55 Bcf and it came in a little less but the market still came off,” a trader told NGI. “That’s a failure and that’s not good. There’s a little support at $2.88 to $2.89 but not much. Look to the downside. It could get down to the $2.60s.”

“The number indicates slight tightening on a week-over-week basis and has helped support prices, but expectations of a larger injection next week may limit upside above $3 through the day today,” said Harrison, NY-based Bespoke Weather Services.

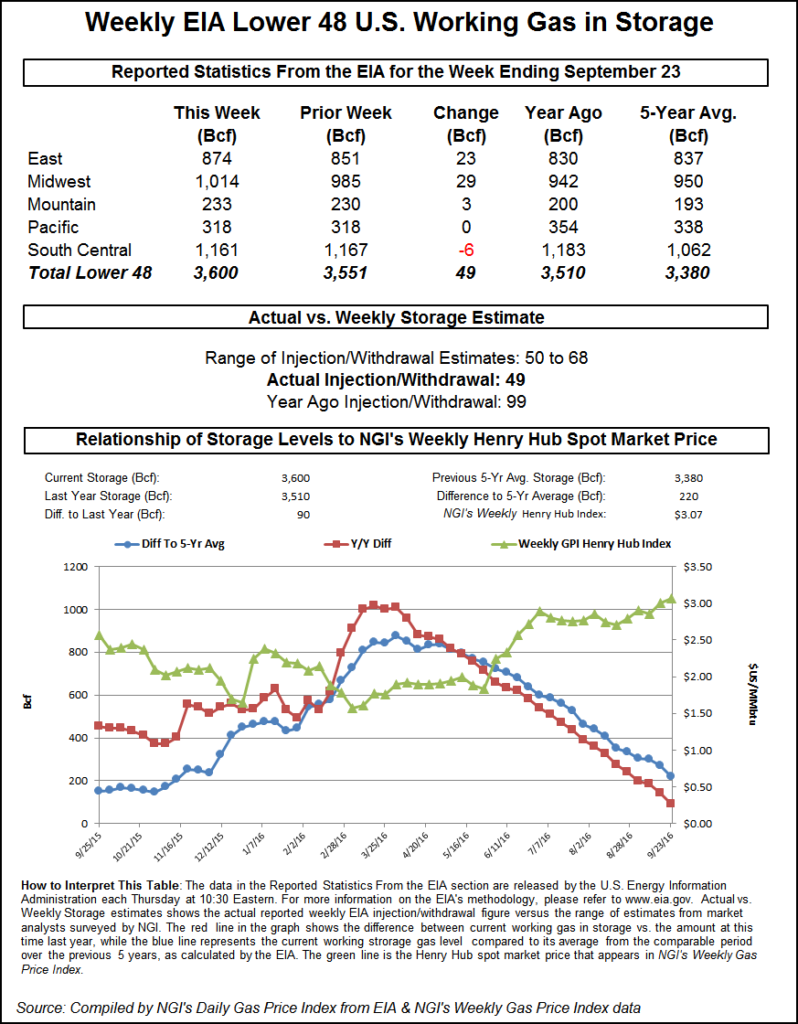

Inventories now stand at 3,600 Bcf and are 90 Bcf greater than last year and 220 Bcf more than the five-year average. In the East Region 23 Bcf was injected and the Midwest Region saw inventories increase by 29 Bcf. Stocks in the Mountain Region rose 3 Bcf, and the Pacific Region was unchanged. The South Central Region decreased 6 Bcf.

One factor leading to the bullish report was expectations that salt dome storage in the often opaque South Central Region would begin to fill. That was not the case as the South Central Region reported a draw of 6 Bcf.

The Desk Tealeaves report showed an average 54 Bcf injection, “a wee bit higher [as] the swings between builds and draws in the South Central Region has made this season tricky indeed. And while last week the region called a 2 Bcf draw, and some analysts are seeing a flat report out of the region this week, our latest Tealeaves see a small build, in line with our salt dome theory,” said John Sodergreen, editor.

Longer term, AllianceBernstein sees storage running a deficit to long-term averages with a commensurate rise in prices. “While gas storage has been above the five-year average in 2016, we expect that gas disposition will move sharply in the opposite direction in 2017. With supply falling while new export projects increase gas demand, storage will drain, falling well below the five-year average by mid-year. This will cause price to spike, possibly above $4/Mcf,” the firm said in a note to clients.

In physical market activity the Mid-Atlantic and New England were the hardest hit as weather forecasts called for maximum temperatures close to the 65 degree inflection point between heating degree days and cooling degree days. In effect, no heating or cooling load. Forecaster Wunderground.com predicted that Thursday’s high in Boston of 59 would hold Friday and ease to 58 Saturday, 10 degrees below normal. Philadelphia’s Thursday peak of 61 with load-killing rains as seen rising to 64 Friday and 67 Saturday, 2 degrees below normal.

Gas at the Algonquin Citygate shed 11 cents to $2.25, and gas bound for Iroquois, Waddington changed hands 19 cents lower at $2.31. Deliveries to Tenn Zone 6 200L were seen 40 cents lower at $2.04.

Several points hit all-time lows. Gas on Transco Zone 6 NY was quoted at 69 cents, down 17 cents, and 8 cents less than its all-time low. Tennessee Zone 4 200 L dropped 12 cents to 74 cents, just 2 cents above its all-time low. Gas on Tetco M-3 Delivery came in at 65 cents, down 14 cents, and 6 cents less than its all-time low.

Marcellus points also took it on the chin. Gas on Dominion South fell 13 cents to 66 cents, and gas on Tennessee Zn 4 Marcellus shed 14 cents to 62 cents. Gas on Transco-Leidy Line changed hands 13 cents lower as well to 63 cents.

Those low quotes on Dominion may become a thing of the past if efforts by Dominion to expand transportation bear fruit. Dominion Transmission Inc. (DTI) requested approval from FERC Wednesday to begin service on two expansion projects that would increase capacity on its system before the start of the winter season in the Marcellus and Utica shale region (see related story).

In separate filings Wednesday, DTI submitted requests for in-service to the Federal Energy Regulatory Commission for its Clarington (non-Tenn) project [CP14-496] and its Lebanon West II project [CP14-555].

In its 5 p.m. EDT report the National Hurricane Center (NHC) said now-Hurricane Matthew was 150 miles north-northeast of Curacao and was heading to the west at 17 mph. Winds had increased to 75 mph, and NHC predicted that it would make a sharp turn north when it reaches the western Caribbean toward the eastern end of Cuba.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |