NGI Data | Markets | NGI All News Access

Futures Relinquish Early Gains Following Release of NatGas Storage Stats

Natural gas futures temporarily gained ground Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was lower than what the market was expecting.

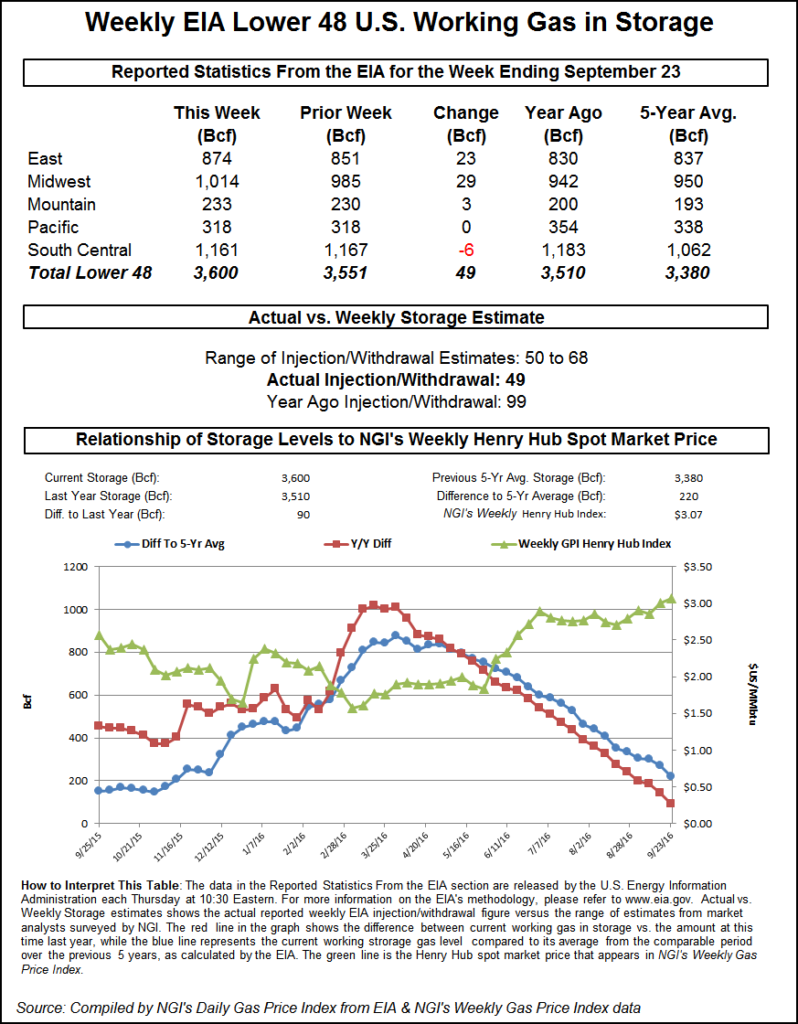

EIA reported a 49 Bcf storage injection for the week ending Sept. 23 in its 10:30 a.m. EDT release, less than what surveys and estimates by traders and analysts were expecting by about 6 Bcf.

November futures reached a high of $3.032 immediately after the figures were released, but by 10:45 a.m. EDT November was trading at $2.993, down nine-tenths of a cent from Wednesday’s settlement.

“We were trading $2.99 when the number came out, and it’s ‘now you see it, now you don’t,'” said a New York floor trader describing the market’s momentary move. “$3 is the pivot point, which we need to stay above for a few days to generate any upward momentum. I’m not getting much in the way of a bullish vibe.”

“The number indicates slight tightening on a week-over-week basis and has helped support prices, but expectations of a larger injection next week may limit upside above $3 through the day today,” said Harrison, NY-based Bespoke Weather Services.

Inventories now stand at 3,600 Bcf and are 90 Bcf greater than last year and 220 Bcf more than the five-year average. In the East Region 23 Bcf was injected, and the Midwest Region saw inventories increase by 29 Bcf. Stocks in the Mountain Region rose 3 Bcf, and the Pacific Region was unchanged. The South Central Region decreased 6 Bcf.

Salt cavern storage was down 3 Bcf at 275 Bcf, while the non-salt cavern figure was down 4 Bcf at 885 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |