NatGas Cash Slip Slidin’ Away; October Futures Off Board at $2.95

Physical natural gas for delivery Thursday continued to slide lower on Wednesday, posting a 9-cent loss on top of Tuesday’s 5-cent setback as broad weakness extended from the Rockies and California to the Midcontinent, Gulf and Appalachia. Only the Northeast was able to post double-digit weather driven gains.

TheNGI National Spot Gas Average fell 9 cents to $2.53, and after settling just inches away from $3.00 Tuesday, October futures succumbed to weakness as well, falling 4.4 cents to expire at $2.952. November shed 4.8 cents to $3.002. November crude oil bounded higher by $2.38 to $47.05/bbl on indications of an OPEC production cut (see related story).

The rally in crude oil prompted natural gas market bears to take a second look.

“With oil rallying up as much as it does, it puts a little pause in anyone wanting to sell this market,” said McNamara Options trading director Alan Harry in New York. “It’s going to be tough to get people to sell natural into the ground when we’ve got crude oil rallying like it did.

“What I think will happen is that it will bounce around in a range with $2.90 the low and $3.10 the high.”

Harry said he was “looking for a break out either way before something happens. I’m looking at Oct. 10 as the last of the cooling degree days (CDD), and after that it’s going to tail off a lot. When that happens I think you will see the cash market weaken, and at that point it will be a speculative play to keep the futures up. If crude oil is not that much higher, I don’t think the market will stay up.”

No one in New England was talking CDDs as forecast temperatures dropped as much as 10 degrees below normal and prices skyrocketed. AccuWeather.com forecast that Boston’s high of just 59 Wednesday would hold Thursday before easing to 58 on Friday, 10 degrees below normal. New York City’s Wednesday high of 70 was predicted to drop to 65 Thursday before sliding to 64 Friday, 6 degrees below normal.

New England quotes jumped. Gas at the Algonquin Citygate added 54 cents to $2.36, and gas on Iroquois, Waddington jumped 68 cents to $2.50. Gas on Tenn Zone 6 200L rose 70 cents to $2.44.

Appalachian points did not follow suit on Wednesday for Thursday delivery.

Tennessee Zone 4 313 Pool set a 30-day low of 87 cents, down 2 cents, and 2 cents below the previous mark, and Tennessee Zone 4 200 L came in at 86 cents, 11 cents below Tuesday and 11 cents under its previous 30-day low.

Major market centers also fell into the loss column. Gas on Dominion South fell 3 cents to 79 cents, and gas at the Chicago Citygate dropped 9 cents to $2.87. Deliveries to the Henry Hub were quoted at $2.98, down 5 cents, and packages on El Paso Permian changed hands 9 cents lower at $2.70. Gas at the SoCal Citygate retreated 9 cents to $2.99.

“The latest weather data hasn’t brought any surprises as it maintains a warm overall pattern through the first week of October, but still with minor intrusions of cooler fall-like conditions, much like what’s currently occurring over the north-central U.S., and then over the West next week,” said Natgasweather.com in a Wednesday morning report.

“Also of interest, a strengthening tropical system is tracking toward the Caribbean and will need close watching over the coming days as the expected track takes it just off the Southeast Atlantic Coast.”

The biggest change is in the populous Mid-Atlantic and Midwest.

“Across the northern U.S., a weather system has stalled over the Midwest and Mid-Atlantic regions, and as a result will continue to bring heavy showers with highs of only 60s to lower 70s. This has resulted in much lower power burns compared to last week due to mostly comfortable temperatures covering a majority of the U.S., highlighted by highs of 90s being confined to only portions of the West and South.”

Demand got a little weaker in the Gulf Coast as the Sabine Pass liquefied natural gas (LNG) export terminal “is now fully shut down for maintenance but will continue loading vessels with LNG from storage,” said industry consultant Genscape Inc. in a Wednesday morning report. “No liquefaction is currently taking place at Sabine as part of the four-week maintenance that began last weekend, Sept. 17, [and] this is the first time the entire Sabine facility has been shut down since September 2015.

“All flares and compressors are shut down as seen by the [infrared] camera image. With the Train 1 and 2 flare turning off last week and the Train 3 and 4 flare shutting down the week before, it is expected that they have begun the repairs to fix the design flaws in both of these flares.”

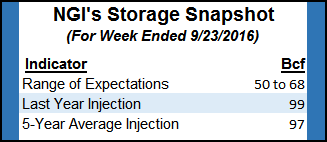

Thursday’s Energy Information Administration (EIA) storage report should give traders a better idea of supplies for the upcoming heating season. Last year a whopping 99 Bcf was injected and the five-year pace stands at an equally impressive 97 Bcf.

IAF Advisors calculated a build of 52 Bcf, and Ritterbusch and Associates is expecting a build of 65 Bcf. A Reuters survey of 17 traders and analysts showed an average 55 Bcf with a range of 50 Bcf to 65 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |