NGI Data | Markets | NGI All News Access

NatGas Cash, Futures Slide; October Dips Below $3

Physical natural gas retreated from Wednesday’s one-year highs, and for the most part market points outside the Northeast were a few pennies lower in Thursday’s trading.

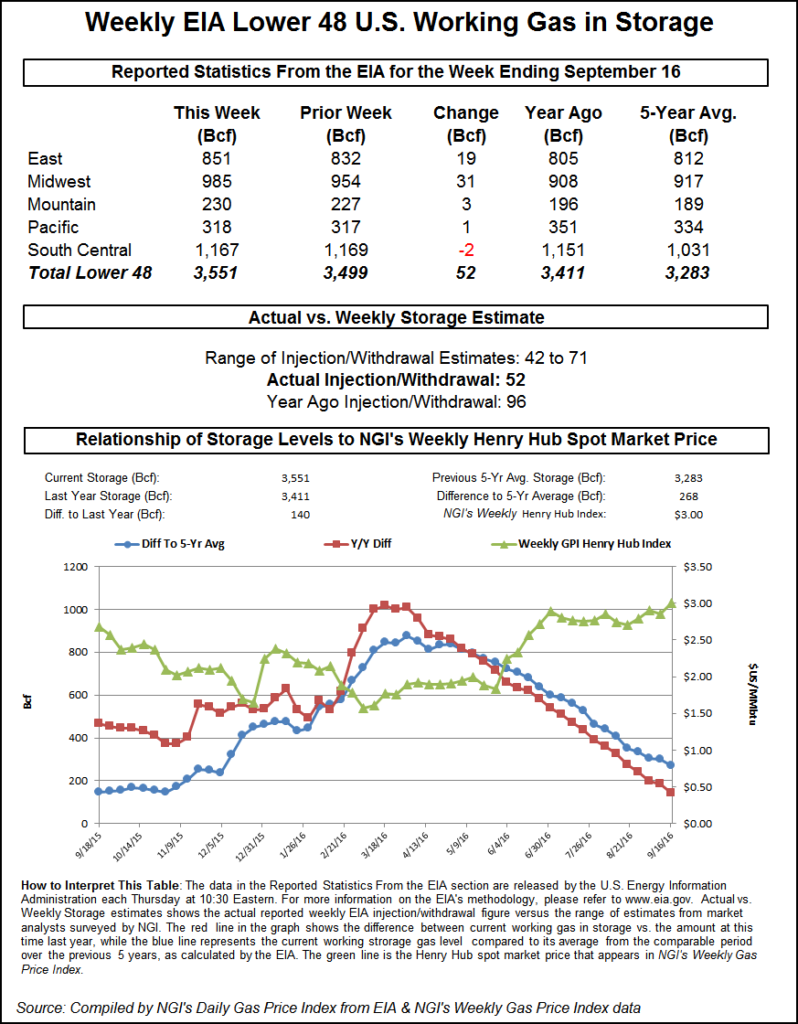

The double-digit declines in New England and New York skewed the market, and the NGI National Spot Gas Average fell 3 cents to $2.78. Weakening power demand helped fuel the decline in the Northeast. The Energy Information Administration (EIA) reported a storage injection of 52 Bcf, almost exactly in sync with what traders were expecting, but that was not what the bulls were looking for.

At the close, October had fallen 6.7 cents to $2.990 and November had dropped 7.1 cents to $3.061. November crude oil gained 98 cents to $46.32/bbl.

The day’s primary market driver was the EIA storage report. October futures reached a low of $3.012 immediately after the storage report was released and by 10:45 a.m. EDT October was trading at $3.026, down 3.1 cents from Wednesday’s settlement.

“We were hearing a 45 Bcf build,” said Alan Harry, director of trading at McNamara Options in New York before the figure was released. “I think we are very overbought [and] $3.10-3.12 should be the next stop and then lower.”

“After two weeks of bullish misses, we saw it as unlikely that a third would follow, and though this number comes in far below the five-year average and even the 2012 print for the same week, it may not support prices above the $3 level for long,” said Harrison NY-based Bespoke Weather Services.

“It surprised me because the number was pretty much on target. Not sure why the market took a free fall,” said a New York floor trader.

“We are below the $3 level again, and now we are going to be looking at [support] $2.75 and $3 [resistance] although $3 is not such a big deal since we’ve been through it a couple of times. Maybe $3.10 would be better since we’ve been through $3 a number of times. We may even come in tomorrow above $3.”

Others were also uncertain why the market fell after the release of the data. “I wasn’t expecting that although every time we get above $3 it can’t seem to gather momentum to keep going,” said Steve Blair, vice president at Rafferty Commodities Group in New York.

“I don’t think it’s all attributable to coal-switching, and even though we won’t have a glut of gas that will overflow storage capacity, we still have a lot of gas. I think the market has it in its head that we are coming to a close for the power generation sector of the market. I think the market fell under its own weight.”

Inventories now stand at 3,551 Bcf and are 140 Bcf greater than last year and 268 Bcf more than the five-year average. In the East Region 19 Bcf was injected, and the Midwest Region saw inventories increase by 31 Bcf. Stocks in the Mountain Region rose 3 Bcf, and the Pacific Region was up by 1 Bcf. The South Central Region decreased 2 Bcf.

The traditional storage injection season is rapidly drawing to a close, and indications are that it will be a stretch to reach last year’s record build of 3,954 Bcf. With supplies currently at 3,551 and just five weeks left until the end of October, more than 75 Bcf would have to be injected weekly. This week’s injection showed that reaching last year’s inventory levels is becoming even more elusive.

Last year a whopping 96 Bcf was injected, and the five-year pace is an 83 Bcf build. Analysts at ICAP Energy calculated a 46 Bcf build, and industry consultant Bentek Energy, utilizing both its flow model and supply-demand model, estimated a 48 Bcf increase. A Reuters poll of 21 traders and analysts scored a bullseye with an average 52 Bcf with a range of 44 to 71 Bcf.

In physical trading, forecasts of lower power requirements kept eastern quotes suppressed. ISO New England forecast that Thursday’s peak load of 17,600 MW would fall to 16,700 MW Friday and drop to 13,730 MW Saturday. New York ISO said peak load Thursday of 23,105 MW would drop to 22,396 MW Friday before sliding to 17,820 MW Saturday.

Next-day gas at the Algonquin Citygate shed 46 cents to $2.78, and gas on Iroquois, Waddington fell 32 cents to $2.84. Gas on Tennessee Zone 6 200 L skidded 52 cents to $2.64.

Gas on Texas Eastern M-3, Delivery lost 14 cents to $1.16, and gas bound for New York City on Transco Zone 6 gave up 34 cents to $1.16.

Most market points, however, showed just nominal changes. Gas on Dominion South fell 6 cents to $1.14, and parcels at the Henry Hub were unchanged at $3.14. Gas at the Chicago Citygate eased 3 cents to $3.06, and deliveries to Opal were seen 2 cents lower at $2.91. Friday deliveries to PG&E Citygate were quoted a penny lower at $3.55.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |