NGI Data | Markets | NGI All News Access

NatGas Cash Sets One-Year Highs; Futures Hold Tuesday Gains

Physical natural gas for Thursday delivery continued to march higher in Wednesday’s trading, with broad-based gains of about a nickel prevalent throughout the market — with the exception of some double-digit declines in the Northeast.

Numerous points set one-year record highs, and the NGI National Spot Gas Average itself set its own one-year record high with a gain of 4 cents to $2.81. Futures managed to consolidate gains and hold the $3 level with October settling at $3.057, up 1.0 cents, and November rose 2.3 cents to $3.132. November crude oil gained $1.29 to $45.34/bbl.

Continuing warm temperatures helped boost numerous points to records for the year.

AccuWeather.com forecast that the Wednesday high in Chicago of 78 degrees would reach 84 Thursday before sliding to 79 Friday, 6 degrees above normal. The 95 high in Dallas Wednesday was predicted to ease to 94 Thursday and to 92 Friday, also 6 degrees above normal.

From Malin to the Mississippi Valley, one-year high quotes were prevalent. Gas at Malin traded at $2.97, 4 cents higher than its one-year high of $2.93, and gas at the Cheyenne Hub was quoted at $2.90, exceeding its one-year peak of $2.88.

Deliveries to NGPL Midcontinent changed hands at $2.98, 8 cents above its one-year high, and Transco Zone 4 was quoted a nickel higher than its one-year high at $3.12.

Traders in the Northeast had to deal with a soft power pricing environment, and quotes for next-day delivery tumbled. Intercontinental Exchange reported that on-peak Thursday power at the ISO New England’s Massachusetts Hub fell $4.78 to $39.25/MWh, and on-peak power at the PJM West terminal skidded $7.08 to $41.77/MWh.

Gas at the Algonquin Citygate fell 15 cents to $3.24, and gas on Tenn Zone 6 200L shed 6 cents to $3.96.

Deliveries to Transco Zone 6 NY came in 30 cents lower at $1.50, and packages on Transco Zone 6 non-NY North serving southeasternmost Pennsylvania and southern New Jersey lost 28 cents to $1.48.

For the most part, major market centers were solidly in the black. Gas on Dominion South added 3 cents to $1.20, and gas at the Chicago Citygate was quoted at $3.09, unchanged. Deliveries to the Henry Hub set a one-year high at $3.14, up 6 cents. Kern Receipts rose a nickel to $2.92, and gas priced at the SoCal Border Avg. Average added 8 cents to $3.02.

Futures traders noted all contracts were solidly perched above $3.

“We are at $3 all across the board,” said a New York floor trader. “The next contract under $3 isn’t until March 2018. $3 should act as a support level and $3.15 is now short term resistance.”

Industry consultant Genscape Inc. said “there haven’t been any obvious shifts to fundamentals. The prompt contract picked up 11 cents [Tuesday], while the winter strip added 8 cents. It is possible forwards followed cash higher, as Henry Hub also added 11 cents, with many Midwest, Texas and eastern hubs following suit.

“There was word that cash rallied in response to sizable intraday revisions to power burn nominations. As we noted Monday, burn levels have remained elevated this month due to a combination of above-normal temperatures and sustained coal-to-gas switching price levels.”

For the next seven days, Natgasweather.com is forecasting that the warm temperatures, particularly in the South, will eventually give way.

“High pressure continues to dominate the southern U.S., with very warm highs of upper 80s to 90s,” said the forecaster. “Across the Great Lakes, Mid-Atlantic and Northeast, comfortable temperatures of 70s to lower 80s will continue. A weather system will bring showers and cooling over the west-central U.S. late in the week, where highs will only reach the upper 50s and 60s, to drive light early season heating demand. Cooling will then spread into the southern Plains and Texas this weekend to ease current hot conditions.

“Also of interest, a shot of cooler Canadian air is expected over the Northeast late this weekend into early next week, focused over New England to bring light cooling demand.”

Genscape analysts expect to see a gradual easing of power burn.

“On the demand front, this [weather] is expected to equate to gradual declines. Our forecast for New England has demand declining daily to a low of 1.77 Bcf/d on Saturday, and Appalachia bottoms out Saturday at 5.9 Bcf/d. Southeast/Mid-Atlantic reaches its low on Sunday at 12.85 Bcf/d. And Midwest demand is expected to reach a low of 7.12 Bcf/d on Sunday.”

In a much anticipated meeting Wednesday, the Federal Reserve Board kept interest rates unchanged, but Chairwoman Janet Yellen said one increase is “appropriate” this year barring any major new risks to the economy. The Dow Jones Industrial Average jumped 164 points to 18,294.

“If you think the Fed is not going to raise rates so the economy can crawl higher you don’t want to be short crude oil or natural gas because a revived economy will raise all boats,” said United ICAP Vice President Walter Zimmermann. “What commodity prices are more reactive to rather than the supply and demand of each commodity is the ”financialization’ of the commodity sector, the stock market, and the U.S. dollar.”

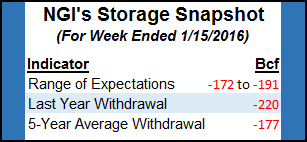

Financialization or not, traders will be taking a close look at Thursday’s gas storage numbers. A Reuters poll of 21 traders and analysts showed an average of 52 Bcf with a range of 44 Bcf to 71 Bcf. Last year 96 Bcf was injected and the five-year average is for a 83 Bcf build.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |