NGI The Weekly Gas Market Report | E&P | NGI All News Access

DUCs, Associated Volumes From Oil Production Likely Bearish For Natural Gas

The worst may be over for the oil market as drilling activity begins to inch up across the United States, but the bullish narrative is bearish for natural gas prices as associated volumes begin to grow, according to energy analysts.

Besides associated gas volumes growing from renewed oil drilling, Societe Generale’s Breanne Dougherty said there also is a debate about the effect of drilled but uncompleted (DUC) wells on associated volumes. Also unknown is how soon, how fast and how much independent gas producers want to re-engage after struggling for years with oversupply and balance sheet stress.

“Anyone’s near-term production view is highly vulnerable to assumptions being made on several factors,” Dougherty said.

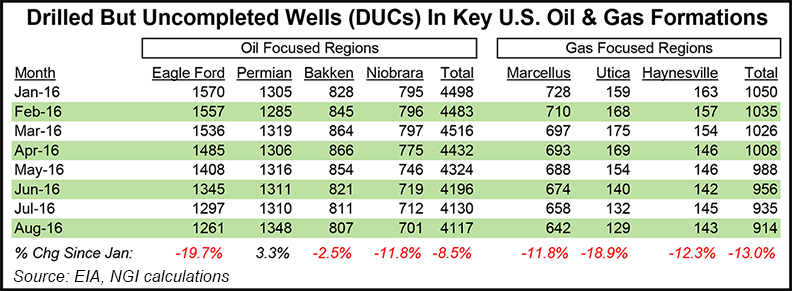

The Energy Information Administration, beginning with this month’s Drilling Productivity Report (DPR), is tracking DUCs across the key seven shale plays (see Shale Daily, Sept. 12). For North American gas, the DUC data offered some interesting takeaways, she said. For instance, Northeast DUCs in the Marcellus and Utica are lower than they were in December 2013.

“Looking to most recent trends in the region, there are 116 less DUCs in the Northeast than there were in January of this year, a 13% drop in seven months,” she said. The Eagle Ford Shale “has recorded a 20% fall in DUCs between January and August.”

The change in behavior by the gas producers, including in the gas Haynesville Shale, is reflected in the decline in DUCs, as the Eagle Ford, Marcellus and Utica were the dominant contributors to the North American gas growth engine until 2015. Meanwhile, the oil-rich Permian hasn’t yet recorded a DUC decline, per the DPR data.

“Bottom line, natural gas production data is showing the impact of retrenchment, but a stronger than expected associated gas growth, driven by oil dynamics, is a bearish risk to our near-term outlook,” Dougherty said.

Based on current oil prices and forecasts for 2017, Societe Generale analysts don’t think there is enough of a price signal “to stimulate a level of oil engagement capable of delivering a volume of associated gas within the next six months to materially impact the gas production trajectory.”

The risk of such a scenario at the earliest is weighted to the second half of 2017, and “most likely” the end of 2017 into 2018.

“This exposes the natural gas market, under anything other than a mild winter ’16-’17 weather scenario, to sustained tightening fundamentals through at least the first half of 2017.”

But Barclays Capital’s Nicholas Potter said the market already has seen what the Permian Basin can do for associated gas volumes. Next in line would be more gas flowing from Oklahoma’s oily SCOOP — the South Central Oklahoma Oil Province — and the STACK — the Sooner Trend of the Anadarko Basin, mostly Canadian and Kingfisher counties.

“We expect increased associated gas volumes as oil-focused activity ramps up in Oklahoma’s SCOOP and STACK plays,” Potter said. Exploration and production companies are focused on the core of the core in the premium oil plays, led by the Permian Basin in Texas and Oklahoma’s STACK AND SCOOP.

Oil and liquids are trading at a premium to gas on a per MMBtu basis, with West Texas Intermediate prompt $7.56/MMBtu versus Henry Hub prompt of $2.89/MMBtu. Producers are allocating their capital expenditures accordingly, Potter said.

“However, as we have seen with the Permian, a ramp-up in oil activity can have a considerable effect on the market in the form of incremental associated gas volumes.”

Permian oil production since early 2010 has risen from about 885,000 b/d to slightly under 2 million b/d in August, Potter noted. Over those six years, 2.5 Bcf/d of incremental Permian gas has comet online. And as operators move more oil rigs into Oklahoma, it’s only a matter of time before associated gas volumes follow.

“SCOOP/STACK associated gas should largely offset falling conventional gas production in eastern Oklahoma next year,” he said. Through June, Oklahoma’s marketed gas production has averaged 6.8 Bcf/d, down slightly from 2015, as gassier plays in the eastern part of Oklahoma continued to decline. However, as activity intensifies, associated gas output may offset some of the decline.

“Beyond 2017, these associated SCOOP/STACK gas volumes could have broader market effects, on regional basis points in the Midcontinent and on Henry Hub,” Potter said. The lag was evident between a ramp-up in rigs in the Permian and associated gas additions, which began to affect the market in 2014.

As producers increase activity in Oklahoma this year and next, “incremental gas volumes will likely be a 2018 and beyond story,” he said. And the numbers in general have been impressive. The Permian became more attractive with longer lateral lengths and more clustered fracture stages.

For example, Devon Energy Corp.’s pilots in the Meramec formation of the STACK have been strong. In its third Meramec pilot, dubbed the Pump House, Devon used a seven-well pattern across a single-section interval of the upper Meramec in Kingfisher County, with initial production (IP) over 15 days averaging 2,200 boe/d per well (55% oil) at a cost of $6 million each (see Shale Daily, Sept. 8).

“Assuming 20-30% is gas, that would imply a 2,300-3,500 Mcf/d (15-day gas IP),” Potter said. Associated gas growth in turn would need to be met with increased pipeline takeaway capacity, but failing to build enough may result in weaker basis pricing further out on the curve.

“The current curve suggests that the market is not pricing in any infrastructure bottlenecks in the region,” according to Potter. Of course, risks exist to developing both oil and gas in Oklahoma, specifically around earthquake activity (see Shale Daily, Sept. 13).

“Whether or not oil and gas extraction is the cause, the risk of higher compliance costs by state or federal authorities could curb activity. From the state’s perspective, we think blanket bans are unlikely” because of the economic activity that drilling brings to the region.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |