Regulatory | Infrastructure | NGI All News Access

New Jersey Ratepayer Advocate Says PennEast Not Needed, Too Expensive

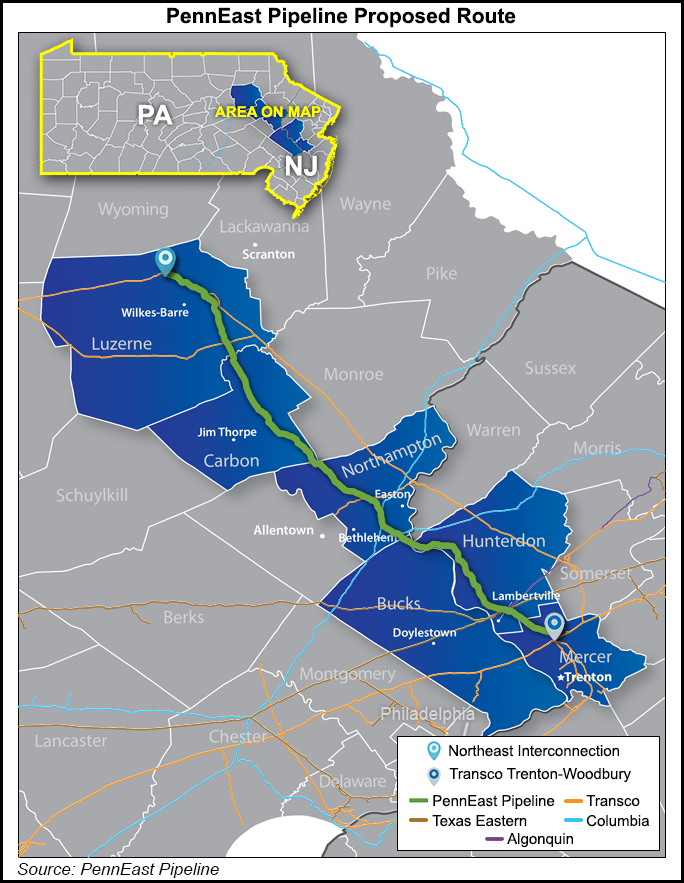

The proposed PennEast Pipeline, which would tap Marcellus Shale gas for the benefit of end-users in Pennsylvania and New Jersey, would be a bad deal for consumers in the Garden State, and the pipeline isn’t actually needed, the New Jersey Division of Rate Counsel told FERC.

“PennEast has failed to demonstrate that the project is in fact ‘needed,’ and the DEIS [draft environmental impact statement] gives overly short shrift to the ‘no action’ alternative. Moreover, the terms under which the project has been proposed are unduly generous to PennEast and unfair to consumers, the Rate Counsel said [CP15-558].

The project received a favorable DEIS from Federal Energy Regulatory Commission staff last July (see Shale Daily, July 22).

“FERC has done a thorough analysis and determined not only that need for the PennEast Pipeline exists, but that other pipeline solutions would not solve the regional energy needs the PennEast Pipeline is designed to meet,” PennEast spokeswoman Pat Kornick said in an email. “In its Energy Master Plan, the New Jersey Board of Public Utilities agrees that additional pipeline infrastructure is needed to enhance reliability and to access affordable energy resources. Every major business and labor organization in New Jersey also recognizes the need for the PennEast Pipeline.

“Additionally, the PennEast Pipeline is 90% subscribed, years before it has been approved or built, which in and of itself demonstrates need.”

The 114-mile, 36-inch diameter greenfield PennEast would transport 1.11 million Dth/d of eastern Marcellus Shale gas to markets in Pennsylvania and New Jersey. New Jersey Natural Gas Co. is the largest taker of capacity with 180,000 Dth/d. PSEG Power LLC and Texas Eastern Transmission each have 125,000 Dth/d. South Jersey Gas. Co. has 105,000 Dth/d, and Consolidated Edison Company of New York Inc., Elizabethtown Gas, and UGI Energy Services LLC each have 100,000 Dth/d.

PennEast is a joint venture owned by AGL Resources Inc. unit Red Oak Enterprise Holdings Inc. (20%); New Jersey Resources’ NJR Pipeline Co. (20%); South Jersey Industries’ SJI Midstream LLC (20%); UGI Energy Services LLC’s UGI PennEast LLC (20%); PSEG Power LLC (10%); and Spectra Energy Partners LP (10%). The partnership is managed by UGI Energy Services.

In its comments, Rate Counsel said FERC is obligated to thoroughly consider the “no action” alternative as prescribed by the National Energy Policy Act. The Commission has not done this, it said.

“Given that two-thirds of the capacity under precedent agreements is with affiliates of the [PennEast] owners, the DEIS should have included an independent analysis of the need for the capacity the proposed project will provide,” the counsel told FERC. “NJ Rate Counsel asserts that such an independent analysis would have revealed that the forecasted supply and demand requirements for New Jersey and Pennsylvania local gas distribution companies (LDC) can be met through existing supply arrangements.”

Rate Counsel presents data in its filing that it argues show “…that the forecasted demands of the LDCs that PennEast is designed to supply are already being met by existing gas supply arrangements and available transportation capacity.”

Additionally, the counsel argues that the project’s proposed rate of return is “excessive.”

The counsel said it is “…concerned that the DEIS does not address that the ‘need’ for the project appears to be driven more by the search for higher returns on investment than any actual deficiency in gas supply or pipeline capacity to transport it. Even if there were in fact a demonstrated need for the transportation capacity PennEast proposes to offer, a reasonable, compensatory rate should be sufficient to bring that capacity to market. By contrast…PennEast is requesting rates calculated using a substantially above-market return on equity of 14%, an equally above-market and unsupported 6.00% cost of debt, and a 60% equity-heavy capital structure.”

New Jersey Rate Counsel is not the only critic of the PennEast DEIS. The National Park Service and the Environmental Protection Agency detailed their concerns, with both saying that a significant amount of information is missing from the document that could better help the public understand it (see Daily GPI, Sept. 13).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |