NGI All News Access | Infrastructure

American Electric Power Sells Four Plants For $2B-Plus to Private Equity JV

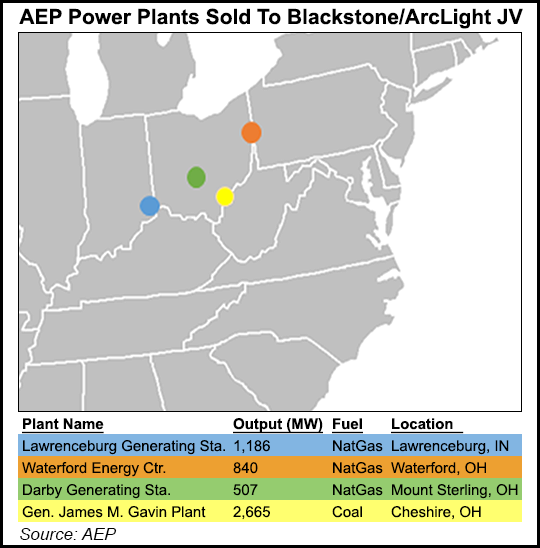

American Electric Power Co. (AEP) is selling four power plants in Indiana and Ohio, with a combined 5,200 MW of generating capacity, for $2.17 billion to a joint venture (JV) of private equity firms Blackstone Group LP and ArcLight Capital Partners LLC.

AEP said earlier this year it was exploring a potential sale of the plants. Three of the facilities are natural gas-fired, while the fourth is a coal plant. The company said Wednesday it is also continuing a “strategic evaluation” of its remaining 2,677 MW of generation in Ohio, where it has strived for better cost-recovery mechanisms and legislative changes to keep uncompetitive plants profitable and sustain new investments.

“AEP’s long-term strategy has been to become a fully regulated, premium energy company focused on investment in infrastructure and the energy innovations that our customers want and need,” said CEO Nicholas Akins. “This transaction advances that strategy and reduces some of the business risks associated with operating competitive generating assets.”

The plants included in the sale are the 1,186 MW gas-fired Lawrenceburg Generating Station in Indiana; the 840 MW gas-fired Waterford Energy Center in Washington County, OH; the 507 MW gas-fired Darby Generating Station in Madison County, OH, and the 2,665 MW coal-fired Gen. James M. Gavin Plant in Gallia County, OH.

The sale is expected to close in 1Q2017, pending regulatory approval. AEP said it expects to net $1.2 billion in cash after taxes, repayment of debt associated with the assets and transaction fees. The company said it is considering its options for investing those proceeds and added that details would be shared during an analyst day in November.

In April, the Federal Regulatory Energy Commission blocked controversial power purchase agreements (PPA) approved by Ohio regulators that would have guaranteed cost recovery for AEP and FirstEnergy Corp. power produced at uneconomic coal and nuclear generating units in the state (see Daily GPI, April 28; March 31). Akins later said the vast majority of electricity produced during peak cycles is generated by coal- and nuclear-fueled generators in the region. He said fundamental changes need to occur in the market to resolve that issue (see Daily GPI, Aug. 3).

The company is trying to advance legislation in Ohio that would make it easier for companies to invest in new generation. Until the state’s power market is restructured, Akins said earlier this year, the company will not be investing in new generation there. He added that the company would likely sell the nine generating units in Ohio covered in the blocked PPAs and other remaining plants if state lawmakers don’t act on reforms. The sale announced on Wednesday was expected to proceed no matter what, and the assets are not covered by the PPAs.

AEP is one of the nation’s largest electric utilities, delivering power to nearly 5.4 million customers in 11 states. Blackstone and ArcLight have long focused on energy infrastructure. Combined, they have owned and operated more than 38,000 MW of power generation across the world.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |