NGI Weekly Gas Price Index | Markets | NGI All News Access

Weekly NatGas Continues ‘On The Road To Recovery’

Weekly natural gas trading for the week ending Sept. 9 continued the trend of the prior two weeks with modest, single-digit gains. The NGI Weekly Spot Gas Average rose 6 cents to $2.61, and the week’s market points with the greatest gains and losses belonged to our neighbors to the North. Gas at Westcoast Station No. 2 soared $C1.31 to $C1.86/Gj and gas at Empress shed $C0.41 to $C2.53/Gj.

Regional swings in the Lower 48 were wide as well with the always volatile Northeast surging 69 cents to average $2.73 and California down 5 cents to $2.82.

The producing basins and market centers in the nation’s mid-section were lower by a few pennies and the week’s greatest gains were reserved for the East and Southeast.

The Rockies were down 4 cents to $2.56 and South Texas and East Texas eased 3 cents on the week to $2.78 and $2.77, respectively.

The Midwest, Midcontinent, and South Louisiana were lower by just a couple of pennies to $2.81, $2.68, and $2.79, respectively, but Appalachia managed a hefty 12 cent gain to $1.46. The Southeast added 17 cents to $2.87.

October futures rose all of a half cent on the week to $2.797.

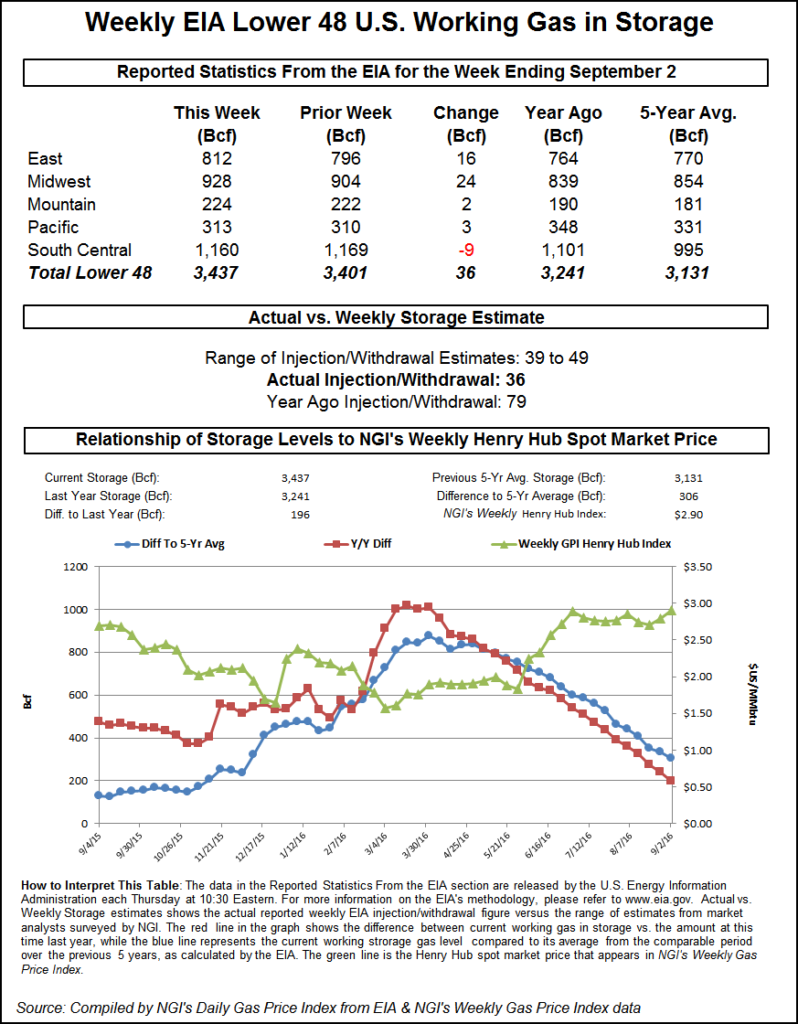

Thursday the Energy Information Administration (EIA) in its 10:30 a.m. EST release of inventory data reported a refill of a lean 36 Bcf for the week ending Sept. 2, about 10 Bcf less than expectations, and that was enough to bring the bulls off the bench. At the close on Thursday October had risen 13 cents to $2.806 and November was up 10.6 cents to $2.917.

Once the EIA figures sliced through the market, traders lost no time bidding the market higher. October futures reached a high of $2.790 immediately after the figures were released but by 10:45 a.m. October was trading at $2.774 up 9.8 cents from Wednesday’s settlement.

“We were hearing 43 Bcf and are trading above $2.75 which might be an indication of a little boost,” said a New York floor trader.

“The 36 Bcf net injection into US natural gas storage for the week ended September 2 was less than expected,” said Tim Evans of Citi Futures Perspective. “It followed a larger than expected 51 Bcf refill in the prior week, suggesting either some shift at the margin between the two reporting periods or greater sensitivity to temperatures than anticipated. Production losses from the Gulf of Mexico may have played a small role, but we note that maximum offline was 360 MMcf/d.”

Inventories now stand at 3,437 Bcf and are 196 Bcf greater than last year and 306 Bcf more than the five-year average. In the East Region 16 Bcf were injected and the Midwest Region saw inventories increase by 24 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was up by 3 Bcf. The South Central Region dropped 9 Bcf.

Forecasters see an eventual return to normal injection patterns. “[A]fter natgas demand again increases to stronger than normal levels this week, a more seasonable pattern is expected to become established for the second half of September where much of the natgas demand will be driven by the warmer southern U.S.,” said Natgasweather.com in an update. “There have yet to be any signs of significant early season cool fronts coming to the northern U.S., which overall will keep weather sentiment bearish as larger builds in supplies arrive, a few of which will finally be near normal.”

In Friday’s physical trading, weekend and Monday natural gas slid lower as traders didn’t see the need to make incremental purchases given moderating weather forecasts.

Modest strength in the Midcontinent, Midwest and Louisiana were unable to offset double- or even triple-digit declines at Northeast points. Futures found the rarified air near $2.90 a difficult threshold, and at the close October had eased nine-tenths of a cent to $2.797 and November was off 2.7 cents to $2.890. October crude oil had trouble holding on to Thursday’s robust gains and fell $1.74 to $45.88/bbl.

Futures traders say the bull is not done quite yet. “I think we’ll get one more push because of the hot weather, but you will get to $2.90 to $2.92 and then fail,” a New York floor trader told NGI. “I think it is still a short term buy, maybe a week. You still have the hot weather out there and there may be some short-covering from some late, late, shorts. I still like it to the upside, but then we’ll move lower.”

Weekend and Monday gas in the Mid-Atlantic weakened as traders buying for power plant usage noted a big drop in Monday on-peak power as well as forecasts for a hefty addition of wind generation. Intercontinental Exchange reported that Monday on-peak power at the PJM West terminal fell $8.84 to $34.84/MWh.

Gas for weekend and Monday delivery on Tetco M-3 Delivery fell 17 cents to $1.29, but gas on Transco Zone 6 New York dropped $1.13 to $1.57, and deliveries farther south to southeasternmost Pennsylvania, Trenton and southern New Jersey (Transco Zone 6 non New York North) plunged $1.14 to $1.59.

“We’re going into the weekend, and demand is dropping off somewhat,” said an pipeline veteran. He added that if people needed to buy gas over the weekend, “it’s mostly just text messages on their phone. You can wake up in the morning at 7 a.m., have a deal done in 15 minutes and go back to sleep.”

Gas buyers needing weekend supplies for power generation across PJM Interconnection would have a combination of warmth followed by a cool-down and a jump in wind generation to deal with. “A summer like pattern is expected to continue [with] mid-summer-like hot and humid conditions again [Friday],” said WSI Corp. in its Friday morning forecast. “This air mass and a weakening frontal boundary will support partial hazy sunshine and a chance of showers and thunderstorms, mainly over western PJM. Max temperatures will top out in the 80s to mid 90s.

“A cold front will sweep across the power pool from west to east during the weekend with a chance of a broken line of showers and thunderstorms. This will usher a drier and cooler air mass into the power pool for Sunday into Monday, though max temps will still top out in the mid 70s and 80s.

“After a brief lull today, a northwest wind behind a cold front will lead to a sharp surge of wind generation during Saturday. Output is forecast to top out in excess of 3 GW. Wind gen will relax during Sunday into early Monday, but a warm south-southwest wind will cause wind gen to ramp back up early next week.”

New England market points for weekend and Monday delivery were soft as well. Gas at the Algonquin Citygate fell 48 cents to $3.00, and deliveries to Iroquois Zone 2 were lower by 26 cents to $3.04. Gas on Tennessee Zone 6 200 L changed hands 58 cents lower to $2.87.

Other market centers were mainly in the plus column. Gas at the Chicago Citygate added 3 cents to $2.84 and packages at the Henry Hub rose 8 cents to $2.92. Gas on El Paso Non-Bondad (San Juan) was flat at $2.62, and gas priced at the SoCal Border Average rose a penny to $2.70.

Current futures prices approaching $3 are welcome news to producers and traders who as recently as March had to endure spot futures as low as $1.61. Elsewhere in the gas patch, however, the economic landscape needs to make a much more impressive improvement especially if the beleaguered drilling and oilfield services sectors are to return to conditions approaching normalcy.

The oil and gas services industry has begun to pick itself up from the muck and mire from a “100-year low in activity,” but it has found its bottom, according to Halliburton Co. and Baker Hughes Inc. executives.

Oilfield services are “on the road to recovery,” Halliburton President Jeff Miller said at this week’s Barclays CEO Global Energy-Power Conference in New York City. “But at the same time, I would describe this as sorting through the wreckage of the worst downturn that we’ve ever seen. We see the after-effects just about everywhere that we look. There have been more than 350,000 layoffs in the industry, mostly weighted toward oilfield services, some companies laying off as much as 80% of their workforce.” Halliburton has laid off about 40% of its global staff.

The argument for a “road to recovery” got a boost Friday with the release of rig count data. In a flip from the previous week’s rig count, the latest tally from Baker Hughes showed offshore rigs making a comeback, gaining eight units, while the land rig category added just three for a total gain of 11 rigs to 508 active in the United States. Louisiana led the states among gainers.

The Pelican State saw the return of eight rigs to end the week at 43 active, up from 35. That’s still down 30 rigs from a year ago when the total was 73. But Don Briggs, president of the Louisiana Oil and Gas Association will likely take what he can get.

“As of September 2016, Louisiana lost more than 20,000 oil industry workers as the number of active rigs in the state declined more than 70% to a historic low of just 35 rigs,” Briggs said in a column published just before Friday’s rig count release. In it, he noted that some have compared the latest downturn to the “crash of 1986.”

Traders are looking to position themselves on the short side of the market. “The market is following through to the upside overnight in contrast to the sharp downside reversal in the liquids,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients. “The chart improvement implied by today’s one-week highs would suggest some upside follow-through, with the October contract working up into the $2.85-2.90 area within the next couple of sessions. However, we are having much difficulty building a case for values north of the $2.90 level given limited support from the weather factor.

“While updates to the six-14 day temperature views are suggesting a swing back to above normal trends across the eastern half of the U.S., we will further emphasize that CDD accumulation will be downsized seasonally and that the daily temperature updates will be diminished in importance going forward.

“We shifted off of a bearish stance yesterday via the October contract’s advance to above the $2.79 level. We will look to re-engage into the short side should this current price rally advance sustain into the $2.85-2.90 zone. While conceding to a much smaller injection per yesterday’s EIA release than we had anticipated, we believe that this number has been well discounted and that the market will need to focus attention on next week’s report that will be providing a sharp upswing in storage given this week’s comparatively mild and broad based temperature trends.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |