Wild Week in NatGas Forwards Subsides After Storage Sends Markets Surging

Even though natural gas forwards prices were up just 2 cents on average between Sept. 2 and 8, the short holiday week proved to be quite jarring as a surprise storage report lit a fire under forward curves that had appeared to be settling into shoulder season in the days prior to its release, NGI Forward Look data shows.

Markets returned from the Labor Day weekend to forecasts of cooler weather and returning production following Hurricane Hermine, which made landfall along the Florida Panhandle early Sept. 2, away from critical oil and gas infrastructure.

Futures and forwards markets shed some weight on both Tuesday and Wednesday, but the slide came to a screeching halt Thursday when the U.S. Energy Information Administration reported a much smaller-than-expected build to storage inventories. EIA’s reported 36 Bcf build was well below most market estimates in the low 40-Bcf area, and points to a tightening supply-demand balance week over week.

“Eastern heat likely combined with production reductions thanks to Hermine to result in the bullish miss,” said Bespoke Weather Services’ co-founder Jacob Meisel,. “Data next week will confirm whether this was a one-off bullish miss or a tightening trend as we head into the shoulder season.”

But data and analytics company Genscape said the lean storage build was right in line with its estimates as the previous week’s hefty build was likely an error or inventory revision. “Last week’s report coincided with the end of the month, and there is a good chance that some reporting operators’ end-of-month inventories were higher than they had been estimating,” Genscape said.

The weekly EIA stat is an inventory report (not a weekly injection/withdrawal report) and respondents are requested (not required) to report prior period inventory revisions greater than 500 MMcf, the Louisville, KY-based company explained.

“We believe that inventories often get reported as is (without a revision to prior inventories), as reporting revisions creates more work for the operator. Also, the EIA’s threshold for reporting a revision is 4 Bcf, so there can be up to 3.5 Bcf of revisions reported to the EIA any given week without being known,” Genscape said.

Nymex October futures jumped 13 cents on the storage news, essentially returning prompt-month prices to where they were at the beginning of September.

“After the price collapse earlier this week, it’s no surprise that today’s storage report generated a strong upward move in prices,” analysts at Mobius Risk Group said late Thursday. Lower production in Texas and in the Marcellus during the week also had a hand in the surge, Mobius said.

“While this is a constructive near-term development, a sustainable decline is unlikely,” Mobius said. “Production dips of more than 0.5 Bcf/d in a two-day window are often maintenance-related and should not be extrapolated through balance of the month to formulate supply and demand expectations.”

Thus, Mobius said the recent strength in October pricing may begin to subside Friday through early next week as Friday’s cooling degree day count is likely to be the pinnacle for September. “The resulting decline in natural gas demand could drive spot pricing lower, which in turn would have a negative effect on prompt-month futures,” the analyst group said.

And while prices did rally a bit into Thursday’s close, there is strong resistance ahead that should cap prices at $2.89 without any further bullish catalysts, Bespoke said. “Prices may not even reach there before reversing, as we feel $2.72 may be tested as support,” Bespoke said.

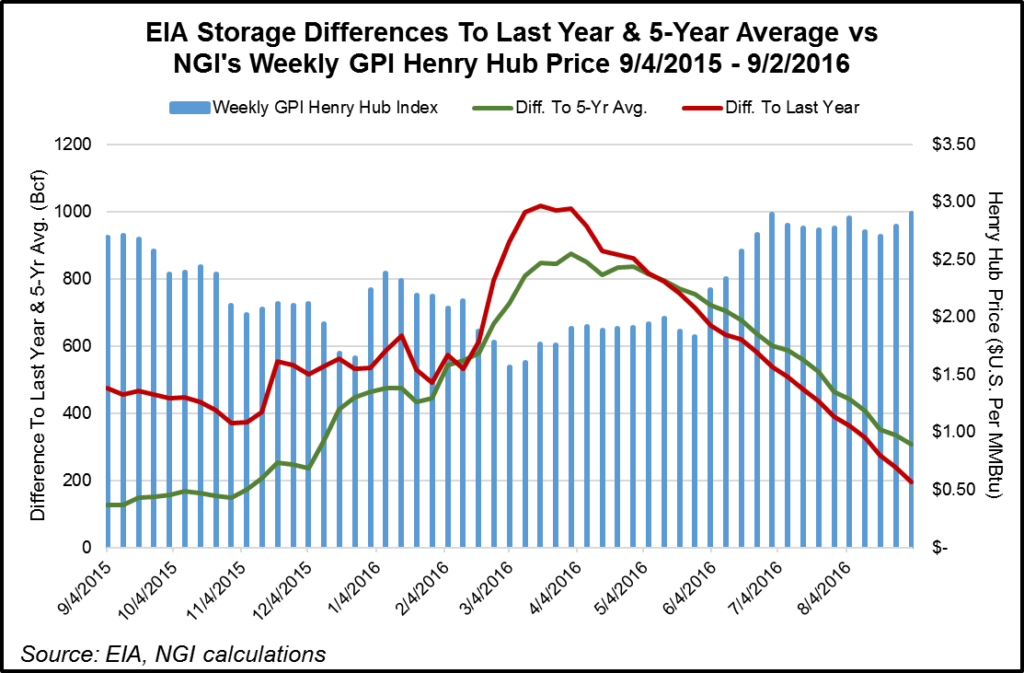

Indeed, the bearish fundamentals that sent October prices lower in the week continue. Despite the lean build, storage inventories are now 196 Bcf higher than last year at this time and 306 Bcf above the five-year average of 3,131 Bcf, according to EIA.

But as NGI’s Nate Harrison, markets analyst, pointed out, a hot summer and record power burn trimmed the surplus to the five-year average by more than half over the course of the summer.

“We also began the summer with more than a Tcf of gas above prior-year inventories, and this figure has since fallen by about 80%. Overall, maybe we’re coming down to a level of storage where other factors can have a larger influence on the expectations of traders,” he said.

Weather can always be counted on as the wild card, and while it’s a safe bet to say the hottest weather of the summer is now in the rearview mirror, brief heat waves will continue to pop up every few days or so. “Essentially, there will be modest swings in natural gas demand every few days as weather systems bring bouts of cooling between periods of moderate warming,” forecasters with NatGasWeather said.

Most importantly, the second half of September is not looking nearly hot nor cold enough to intimidate, and the forecaster believes weather sentiment is likely to be viewed as somewhat bearish. “While there’s expected to be occasional bouts of cooling over the northern and central U.S. with light early season heating demand, we expect it will be a while longer for the arrival of widespread subfreezing temperatures,” NatGasWeather said.

In the longer term, Bespoke said bearish risks into the final third of September increased overnight, and climate guidance picked up as well, showing potentially cooler weather lingering into early October.

“Though we may see some follow through buying today, this opens up more downside than upside from current price levels, as we see $2.72 as a preliminary downside target moving into early next week,” Bespoke said.

The Nymex October futures contract was trading about 1.5 cents lower at midday Friday. Taking a closer look at how futures and forwards performed this week, gains were rather small across the curve as weakness earlier in the week was essentially erased after Thursday’s swift rally.

The Nymex October contract climbed 1.4 cents between Sept. 2 and 8 to reach $2.806, while November futures were up 2 cents to $2.92. The prompt winter futures strip was up 3 cents to $3.17, and the summer 2017 futures strip was up 2 cents to $3.00.

Nationally, similar increases were seen as October forward prices rose an average 1.9 cents during that time, November forward prices picked up an average of 2 cents, the prompt winter edged up 4 cents and the summer 2017 climbed an average 2 cents, according to Forward Look.

But volatility was seen yet again in the Northeast. After plunging by double digits across the forward curve last week, prices rebounded by similar amounts for some markets. The Transco zone 6-NY October forward price was up 9.6 cents between Sept. 2 and 8 to reach $1.54, while the prompt winter jumped 9 cents to $6.05. The summer 2017 forward strip was up just 4 cents to $2.62, and the winter 2017-2018 rose 12 cents to $6.29.

At Transco zone 6-non-NY, October forward prices rose 9.2 cents from Sept. 2 to 8 to reach $1.54, but November tacked on just 1 cent to reach $2.52,Forward Look data shows. Further out the curve, the prompt winter forward strip climbed 4 cents to $4.69, while the summer 2017 forward strip rose 3 cents to $2.68.

At New England’s Algonquin Gas Transmission citygates, October forward prices were essentially flat on the week at $2.62, but November shot up 16 cents to $3.21. The prompt winter was up a stout 26 cents to $6.02, while the following winter was up 24 cents to $6.22, according to Forward Look.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |