NGI Data | Markets | NGI All News Access

Lean Natural Gas Storage Build Just What Bulls Ordered

Natural gas futures scooted higher Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was less than what the market was expecting.

EIA reported a 36 Bcf storage injection in its 10:30 a.m. EDT release, about 10 Bcf less than what traders and analysts were expecting. October futures reached a high of $2.790 immediately after the figures were released, but by 10:45 a.m. EDT October was trading at $2.774, up 9.8 cents from Wednesday’s settlement.

“We were hearing 43 Bcf and are trading above $2.75, which might be an indication of a little boost,” said a New York floor trader.

Analysts were a little miffed by the miss. “It was hotter last week and you had Labor Day weekend, which everybody tends to screw up,” said John Sodergreen, editor of The Desk Tealeaves report.

“The 36 Bcf net injection into U.S. natural gas storage for the week ended Sept. 2 was less than expected,” said Tim Evans of Citi Futures Perspective. “It followed a larger than expected 51 Bcf refill in the prior week, suggesting either some shift at the margin between the two reporting periods or greater sensitivity to temperatures than anticipated. Production losses from the Gulf of Mexico may have played a small role, but we note that maximum offline was 360 MMcf/d.”

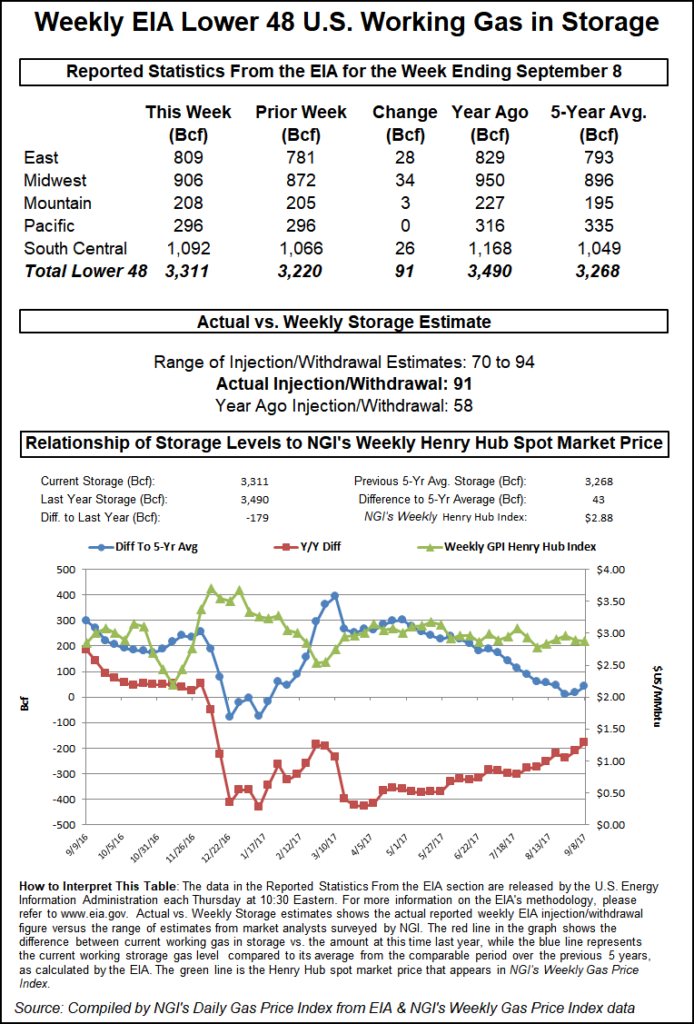

Inventories now stand at 3,437 Bcf and are 196 Bcf greater than last year and 306 Bcf more than the five-year average. In the East Region 16 Bcf was injected, and the Midwest Region saw inventories increase by 24 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was up by 3 Bcf. The South Central Region dropped 9 Bcf.

Salt cavern storage was down 7 Bcf at 280 Bcf, while the non-salt cavern figure was lower by 3 Bcf at 880 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |