NGI Data | Markets | NGI All News Access

NatGas Cash Softens, But Futures Swoon Following EIA Storage Stats

Traders for next-day natural gas deliveries laid low Thursday prior to the often market-moving Energy Information Administration (EIA) storage report. Benign weather conditions across the country also gave traders little incentive to purchase incremental supplies, and the NGI National Daily Spot Gas Average shed 6 cents to $2.57.

Futures bulls were tackled for a loss following the release of storage figures. EIA reported a build of 51 Bcf, and prices hit close to the low of the day immediately. At settlement, October was lower by 9.5 cents to $2.792 and November had shed 9.5 cents as well to $2.908. October crude oil couldn’t get out of its own way and fell $1.54 to $43.16/bbl.

Natural gas bulls were on the defensive Thursday morning after EIA reported a storage injection that was greater than what traders were expecting. EIA reported a 51 Bcf storage injection in its 10:30 a.m. Eastern release, about 10 Bcf greater than what traders and analysts were expecting, and even outside of the consensus injection range of 30 Bcf to 48 Bcf.

As bearish as the number was, traders were relatively unfazed. “You know $2.79 is nothing. I think the market is in good shape,” a New York floor trader told NGI. “It’s OK. It just gave people a little opportunity to add a little more on.”

Others saw it differently. “The initial reaction in price has been quite bearish, and we feel this print opens up a test of $2.76 into the weekend,” said Harrison NY-based Bespoke Weather Services following the number’s release.

“The 51 Bcf build in U.S. natural gas storage for last week was more than expected and a significant step up from the smaller than expected 11 Bcf refill in the prior week,” said Tim Evans of Citi Futures Perspective. “The gain was still less than the 68 Bcf five-year average rate and so does confirm a further tightening of the market on a seasonally adjusted basis, but the data implies a weaker overall balance in the market than had been thought.”

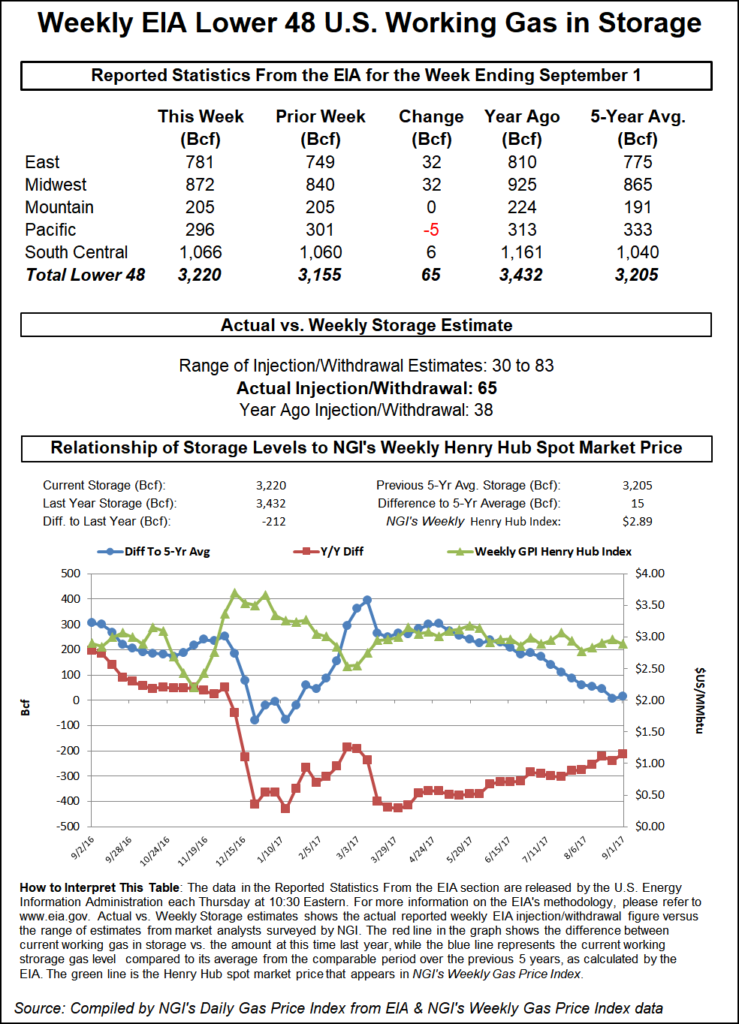

Inventories now stand at 3,401 Bcf and are 238 Bcf greater than last year and 334 Bcf more than the five-year average. In the East Region 21 Bcf was injected, and the Midwest Region saw inventories increase by 29 Bcf. Stocks in the Mountain Region rose 3 Bcf, and the Pacific Region was unchanged, The South Central Region dropped 2 Bcf.

While injections and draws completely outside the range of expectations are infrequent, they do happen, according to Nathan Harrison, NGI markets analyst. “Since NGI began tracking these data in December 2013, expectations beat/misses have occurred 23 times. The Nymex futures response is generally pretty large on the day, but has ranged from $0.005 to $0.45 on an absolute basis. On average, these events tend to generate a move of about 9.1 cents in the prompt Nymex futures price on the regular session close of the day the news is priced in. The median of these events is a 6.4 cent move.”

From coast to coast temperature forecasts called for near-normal to in some cases below normal temperatures going into the weekend. Forecaster Wunderground.com said the high Thursday in New York City of 82 would slide to 80 Friday and drop to 75 Saturday, 5 degrees below normal. Chicago’s 72 high Thursday was expected to hold Friday before rising to 76 Saturday, 4 degrees below normal. Los Angeles’ high Thursday of 81 was seen steady for Friday and easing to 77 Saturday, the seasonal norm.

Major market hubs worked lower. Gas bound for New York City on Transco Zone 6 fell 6 cents to $1.33, and gas at the Chicago Citygate also retreated 6 cents to $2.84. Henry Hub parcels fell 3 cents to $2.91 and gas at Opal changed hands down 3 cents at $2.70. Gas at the SoCal Citygate came in 9 cents lower at $2.89.

Next-day gas in the Northeast slipped a few more pennies than other market points, but losses were relatively small. Friday gas at the Algonquin Citygate fell 7 cents to $2.77 and deliveries to Iroquois, Waddington skidded 19 cents to $2.77. Gas on Tenn Zone 6 200L was quoted 7 cents lower at $2.72.

Prior to the EIA report October futures were bumping up close to $3, but will that bumping continue for much longer? “[G]iven the storage overhang and robust production figures, will prices stay bullish?” said John Sodergreen, editor of The Desk‘s weekly Tealeaves report. “We tend to think so. Despite strong production, exports are pretty firm, too. Maybe too firm. This week folks are talking again about sub-4 Tcf for an end-of-season high point.

“We think it will be higher certainly than the five-year average and last year, to be completely frank. For that matter, we figure it will breach the 4 Tcf mark, too.”

In the Gulf of Mexico (GOM) Thursday, shut-in numbers declined and workers were preparing to head back to platforms, as Hermine, upgraded to hurricane status, made its long-awaited move toward the Florida coast. (see related story)

Wunderground.com reported that a hurricane warning is in effect for parts of the northern Florida Gulf Coast as Hermine intensified in the eastern Gulf of Mexico. A tropical storm warning was in effect southward to the Tampa-St. Petersburg area, as well as the Atlantic Coast from northern Florida to southern North Carolina. Hermine was expected to move near or just inland across the Southeast on Friday, then slow down off the mid-Atlantic coast over the weekend. Very heavy rains and flooding were possible near Hermine’s path, it said.

Personnel had been evacuated from one of the 11 rigs currently operating in the GOM — unchanged from Wednesday — and three DP rigs have been moved off location out of the storm’s path, two fewer than on Wednesday, the Bureau of Safety and Environmental Enforcement (BSEE) said.

BSEE on Thursday afternoon estimated that 242,836 b/d, or 15.18% of the current oil production in the GOM was shut in, down from 19.52% on Wednesday, and 307 MMcf/d, or 9.03% of natural gas production, down from 10.59% 24 hours earlier.

At 5 p.m. EDT Thursday the National Hurricane Center (NHC) reported that Hurricane Hermine was 85 miles south of Apalachicola, Florida and was sporting winds of 75 mph. Movement was to the north-northeast at 14 mph.

NHC was also monitoring a disturbance 800 miles west of the Cabo Verde Islands but gave it a 10% chance of tropical storm formation in the succeeding 48 hours.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |