NatGas Cash, Futures Add About A Nickel Each; September Now $2.85

Physical natgas traders typically try to get their deals done ahead of the Energy Information Administration’s (EIA) Thursday storage report, but given that the average physical market gain was only a penny off the rise of the September and October contracts, you would think that the two markets snuck a peak at each other from time to time.

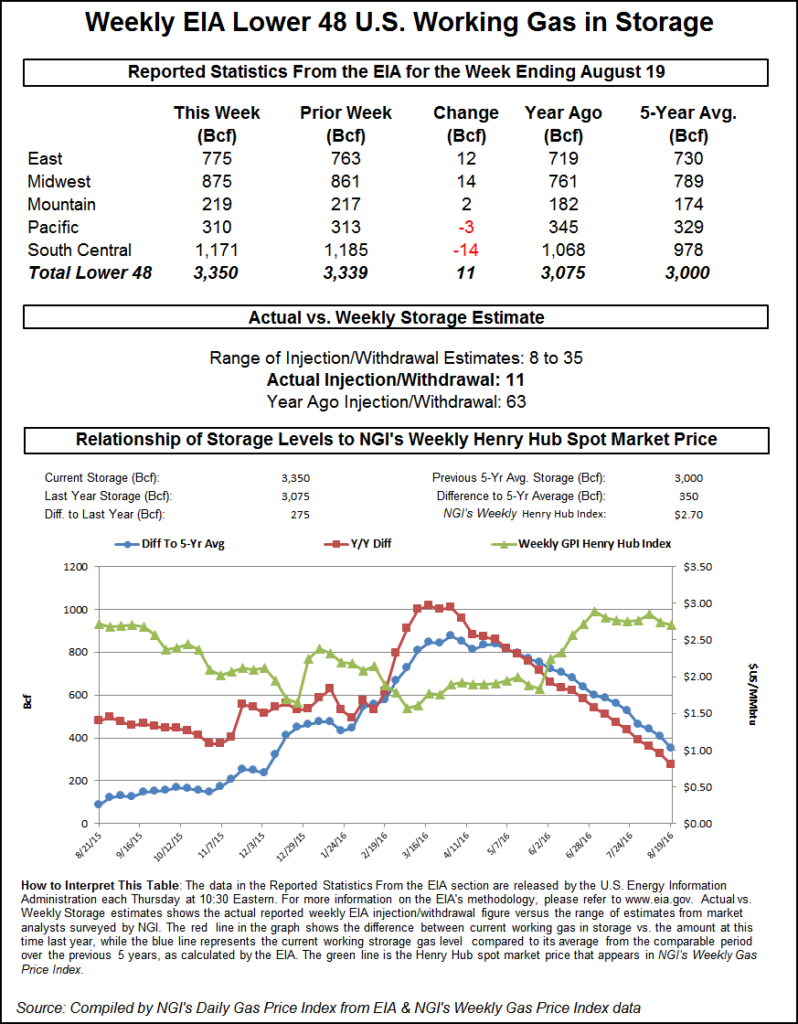

EIA reported an addition to storage of 11 Bcf, about 7 Bcf shy of expectations, and futures and prices rose. The NGI National Spot Gas average gained 8 cents to $2.64, and most points were up just by over a nickel. The Northeast, however, was up close to a half-dollar. The September contract gained 5.0 cents to $2.846, and October added 5.0 cents as well to $2.885. October crude oil rose by 56 cents to $47.33/bbl.

When the morning’s government storage report hit trader’s desks, the initial response was somewhat subdued. September futures reached a high of $2.861 immediately after the figures were released but by 10:45 a.m. EDT September was trading at $2.818 up 2.2 cents from Wednesday’s settlement.

“The ICE swap was 11 [Bcf] bid at 13, and I think everyone goes off that,” said a New York floor trader.” “My number was 19 Bcf and that number should have been [more] bullish based on what traders were looking for. It seems the ICE swap is always right on target.”

“The 11 bcf build for last week was the latest demonstration that with the natural gas market’s increased share of the power sector, demand is quite sensitive to any extreme in summer heat,” said Tim Evans of Citi Futures Perspective. “While supportive, we also note this will mean a more pronounced drop in demand when temperatures cool in the weeks ahead.”

Inventories now stand at 3,350 Bcf and are 275 Bcf greater than last year and 350 Bcf more than the five-year average. In the East Region 12 Bcf was injected and the Midwest Region saw inventories increase by 14 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was lower by 3 Bcf. The South Central Region dropped 14 Bcf.

Thin builds are likely to continue.”We’ve had such unusually hot weather in the Northeast. Last week was brutal and we are going back to brutal,” said Steve Blair, vice president at Rafferty and Co. “six- to 10-day forecasts in the East were showing much above normal, but now we are showing much above normal for much larger sections of the country all the way to the Southwest.”

Next-day gas for delivery in and around the New York-Philadelphia corridor surged as adjusted temperatures climbed back over the century mark. Accuweather.com forecast the high Thursday in New York of 86 would rise to 90 Friday with a heat index of 100. Saturday’s high in New York of 88 calculated to a heat index of 93. The seasonal high in New York is 84. Philadelphia was expected to see the same brutal temperatures. Thursday’s high of 88 was seen rising to 93 Friday with a heat index of 101. Saturday’s high of 91 registered a heat index of 95, 11 degrees above normal.

Deliveries to the Algonquin Citygate jumped 30 cents to $3.19, and gas on Iroquois, Waddington was higher by 8 cents to $2.95. Deliveries to Tenn Zone 6 200L gained a stout 25 cents to $3.08.

To the south, gas bound for New York City on Transco Zone 6 vaulted 55 cents to $2.36, but gas out of transportation-challenged Appalachia on Texas Eastern M-3, Delivery was flat at $1.45.

Major trading centers also put in a solid performance. Gas at the Chicago Citygate rose a nickel to $2.81, and gas at the Henry Hub outdid the futures and added 9 cents to $2.86. Deliveries to Opal improved by 2 cents to $2.65, and gas priced at the SoCal Border Avg. Average rose 2 cents to $2.75.

Although Thursday’s gains were storage-report driven, traders saw Tuesday’s gains as weather-driven. “The natural gas market extend[ed] the rally of the past two days as the temperature outlook has turned warmer, limiting likely storage injections over the next few weeks,” said Tim Evans of Citi Futures Perspective. “Expectations for Thursday’s DOE storage report are running near 20 Bcf in net injections, a supportive step down from the 22 Bcf refill in the prior week and well below the 66 Bcf five-year average for the week ended Aug. 19.”

Going into Thursday’s report, estimates included ICAP Energy at 13 Bcf, PIRA Energy at 15 Bcf, and IAF Advisors at a thin 11 Bcf. Last year 63 Bcf was injected.

Industry consultant Bentek Energy estimated an even thinner 9 Bcf utilizing its flow model and said, “Week-over-week, the largest change in storage activity is estimated to have occurred in the South Central region, where a withdrawal of 22 Bcf is forecast compared to the previous week’s announced 12 Bcf withdrawal. Sample withdrawal activity in the South Central salt dome facilities increased to levels surpassing the July 29 storage week, when the EIA reported a 16 Bcf withdrawal from the facilities, at -13.2 Bcf, a week over week increase in withdrawal strength of 8.7 Bcf.”

In its Thursday morning report the National Hurricane Center (NHC) was closely following an area of low pressure just southeast of the Turks and Caicos Islands. The feature lacked a well defined center and could become a tropical depression in the next couple of days, NHC said. It was given a 50% chance of tropical storm development in the succeeding 48 hours.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |