NGI Data | Markets | NGI All News Access

Lean Natural Gas Storage Build Has Bulls Stirring

Natural gas futures jumped but then fell back Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was less than what traders were expecting.

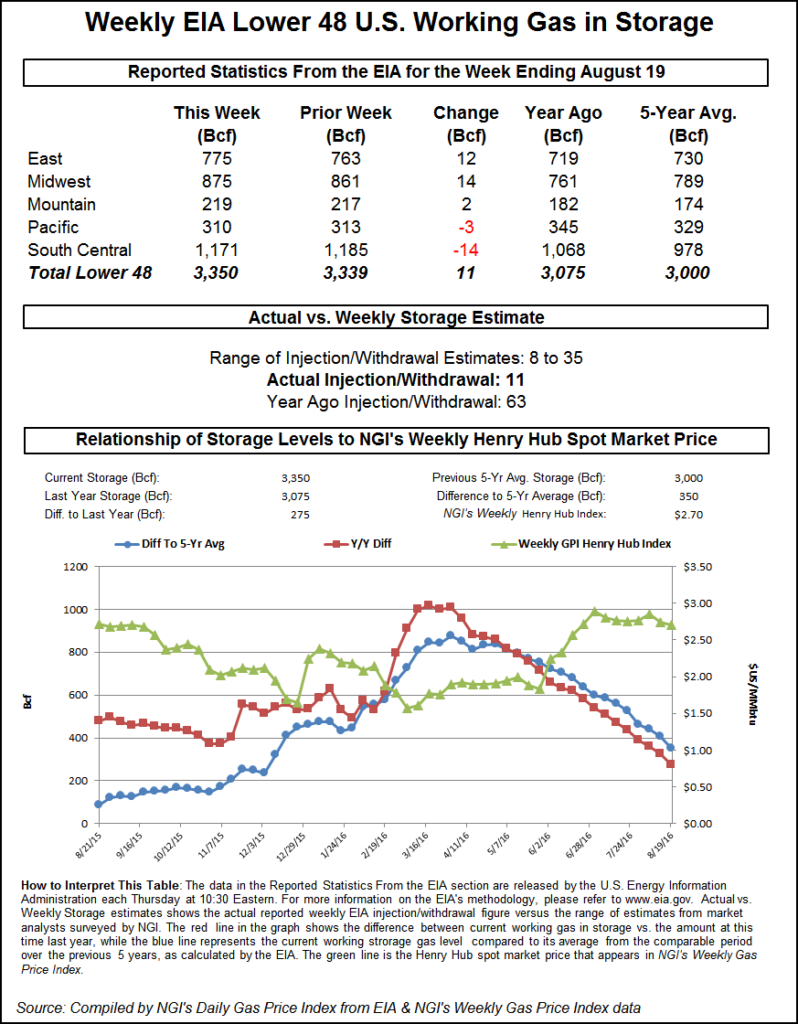

EIA reported an 11 Bcf storage injection in its 10:30 a.m. EDT release, about 7 Bcf less than what traders and analysts were expecting. September futures reached a high of $2.861 immediately after the figures were released, but by 10:45 a.m. EDT September was trading at $2.818, up 2.2 cents from Wednesday’s settlement.

“The ICE swap was 11 [Bcf] bid at 13, and I think everyone goes off that,” said a New York floor trader. “My number was 19 Bcf, and that number should have been [more] bullish based on what traders were looking for. It seems the ICE swap is always right on target.”

“The 11 bcf build for last week was the latest demonstration that with the natural gas market’s increased share of the power sector, demand is quite sensitive to any extreme in summer heat,” said Tim Evans of Citi Futures Perspective. “While supportive, we also note this will mean a more pronounced drop in demand when temperatures cool in the weeks ahead.”

Inventories now stand at 3,350 Bcf and are 275 Bcf greater than last year and 350 Bcf more than the five-year average. In the East Region 12 Bcf was injected, and the Midwest Region saw inventories increase by 14 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was lower by 3 Bcf. The South Central Region dropped 14 Bcf.

Salt cavern storage was down 13 Bcf at 292 Bcf, while the non-salt cavern figure was lower by 2 Bcf at 879 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |