NGI Data | Markets | NGI All News Access

Higher Power Demand Helps Elevate NatGas Cash; Futures Grind Higher

Natural gas for delivery Thursday worked higher in Wednesday’s trading as forecast power demand and prices turned higher in New England and the Mid-Atlantic. Gains were widespread, with most points adding over a nickel and the Northeast and Midwest showing particular strength.

The NGI National Spot Gas Average rose 9 cents to $2.56, but New England and the Midwest put up double-digit gains. Futures were unable to keep pace with the cash market and at the close September was up 3.5 cents to $2.796 and October had added 4.1 cents to $2.835. October crude oil was unable to follow through on Tuesday’s gains and fell $1.33 to $46.77/bbl.

Next-day power pricing and higher forecast peak loads added a firm undertone to the next-day market. Intercontinental Exchange reported on-peak Thursday power at the ISO New England’s Massachusetts Hub rose $3.76 to $38.08/MWh and on-peak Thursday power at the PJM West terminal advanced $5.62 to $39.56/MWh. Next-day power at the Indiana Hub gained $4.00 to $38.55/MWh.

Gas at the Algonquin Citygate tacked on 10 cents to $2.89 and packages on Iroquois, Waddington rose 12 cents to $2.87. Gas on Tennessee Zone 6 200 L added 11 cents to $2.83.

Peak power loads were also forecast to increase. ISO New England forecast that Wednesday’s peak load of 20,140 MW would rise to 20,160 MW Thursday and surge to 22,700 MW Friday. The PJM Interconnection said Wednesday’s expected peak load of 45,303 MW would rise to 47,765 MW Thursday before jumping to 52,570 MW Friday.

Next-day prices across the Midwest were also firm as on-peak power rose. Intercontinental Exchange reported that on-peak power Thursday at the Indiana Hub rose $4.00 to $38.55/MWh.

Next-day deliveries on Alliance gained 11 cents to $2.76 and gas at the Chicago Citygate rose a dime to $2.76. Deliveries to Consumers were reported 9 cents higher at $2.80 and packages on Michigan Consolidated changed hands 9 cents higher also at $2.77.

Overnight weather models turned still warmer. “The American and European ensembles gained demand again over the past 24 hours, and it seems like the eastern U.S. is the biggest recipient of the increased cooling degree days once more,” said Commodity Weather Group in its morning report.

“Our outlook makes warmer changes to the Midwest, East and South for the one-to five-day front part of the forecast, with slightly warmer changes also for the Midwest to East in the six-10 day. The West sees same to cooler adjustments in the six-15 day window, while the South is fairly flat for the six-10 day with some slight increases in warmth for the 11-15 day. The East Coast is also warmer to hotter for the 11-15 day today,” said Matt Rogers, president of the firm.

Following Tuesday’s 8-cent gain, traders noted that it had “cooled down a little bit,” said a New York floor trader. “I think traders are showing a little more of a play for the [storage] number this week. This week’s number is going to show last week’s stuff and I think it’s going to be a little bullish so they are taking the bull by the horns a little early.

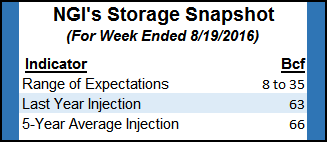

“I think traders want to get it past $2.85 to $2.86, and they are starting early.” As if the storage picture weren’t bullish enough already, The Desk‘s Early View Gas Storage Estimates in an early survey pegged the number Thursday at an average 20 Bcf, well below last year’s 63 Bcf and a 66 Bcf five-year average.

Tom Saal, vice president at FCStone Latin America LLC, says that the Cal’ 17 and Cal’ 18 annual strips are oversold. In addition in his work with Market Profile he expects the market to test Tuesday’s value area at $2.727 to $2.693 before moving on and testing a second value area at $2.682 to $2.583.

Market Profile is a breakout trading system and Saal identifies the week’s initial balance at $2.765 to $2.658. Should the market break above or below these levels buy or sell signals should be initiated. He places trading targets at $2.819 for a long trade and $2.605 for a short sale.

At 5 p.m. EDT Wednesday the National Hurricane Center (NHC) reported that Tropical Storm Gaston was holding 70 mph winds and was 1100 miles west of the Cabo Verde Islands. It was headed northwest at 16 mph. NHC projected its course to be east of Bermuda.

NHC is also following a strong tropical wave and broad area of low pressure moving across the northern Leeward Islands and Puerto Rico. It was given a 60% chance of tropical storm development in the succeeding 48 hours.

In addition to The Desk‘s initial survey estimate of a 20 Bcf build, others are expecting a still leaner injection in the Energy Information Administration’s storage report Thursday morning. Last year 63 Bcf were injected and the five-year pace is for a 66 Bcf build.

Other estimates aren’t even close. ICAP Energy predicts a 13 Bcf increase and PIRA Energy is looking for a 15 Bcf build. A Reuters poll of 19 traders and analysts revealed an average 18 Bcf with a range from 12 Bcf to 35 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |