NGI The Weekly Gas Market Report | Infrastructure | LNG | NGI All News Access

SoCal Winter Contingency Plans Include Sempra LNG From North Baja

Imported liquefied natural gas (LNG) and increased in-state production, are among the possible substitutes during the coming winter for the continued limitations at California’s largest gas storage facility.

State energy officials say up to 200 MMcf/d of supplies from LNG sources could be a “substantial mitigant” on a peak day when gas curtailments would be forecast,

In addition to the summer mitigation measures still in place (see Daily GPI, May 19), the winter plan includes 10 different contingencies (see Daily GPI, Aug. 23), one of them involves LNG. It was raised at a recent stakeholders’ meeting brainstorming mitigation measures in the wake of the continued closure of Sempra Energy’s Southern California Gas Co. (SoCalGas) Aliso Canyon storage facility in the northern fringe of suburban Los Angeles (seeDGPI, Aug. 24.

In the recent meeting, stakeholders suggested that the possibility of LNG deliveries into Sempra’s San Diego Gas and Electric Co. (SDG&E) system from its receiving LNG terminal at Energia Costa Azul in North Baja, Mexico, about 100 miles from an Otay Mesa gas receipt point near the U.S.-Mexican border. The Mexican facility is linked by transmission pipeline to an interstate pipeline interconnection at the California-Arizona border.

“Sempra has indicated interest, but expressed concern that ‘affiliate rules’ create an impediment to doing this,” the state winter plan noted, while adding that the California Energy Commission (CEC) and California Public Utilities Commission (CPUC) should investigate to see if the impediments can be mitigated.

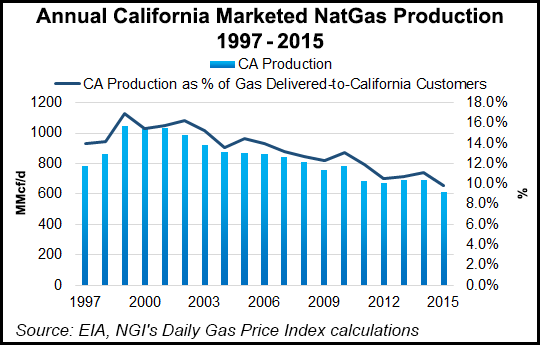

Another of the 10 contingencies looks to squeeze more supplies out of California’s in-state gas producers, of which California Resources Corp. (CRC) is the largest. For the most part there are associated gas supplies as an offshoot of oil production. “Stakeholders criticized the state’s summer action plan for assuming only 60 MMcf/d of California production was available,” the latest draft report noted.

But the state analysts said 60 MMcf/d was accurate based on recent in-state gas production operating data. Nevertheless, the latest draft plan contends that added California-based supplies could greatly reduce the need for gas from Aliso Canyon.

“The question is whether economics and operations by the producers who, in the San Joaquin Valley are producing most of their gas as ‘associated gas’, favor bringing more gas into the SoCalGas system,” the state draft winter report authors noted. CEC officials said they are taking the lead in contacting in-state producers “to ask what, if anything, producers can do to increase deliveries into the SoCalGas system.”

While struggling since being spun off from Occidental Petroleum Corp., CRC on its most recent quarterly earnings conference call reported it plans to add two more rigs this year, and that its natural gas production is doing better than oil right now, and could exceed oil at some future point (see Daily GPI, Aug. 8).

“For the second half of the year, we are also seeing significant increases in natural gas prices,” said CRC CEO Todd Stevens, noting that the closure of Southern California Gas Co.’s Aliso Canyon storage field, coupled with peak summer demand, are expected to boost proceeds from gas. CRC is California’s major gas producer.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |