Shale Daily | E&P | NGI All News Access

Oil/Gas Analysts Chart Industry’s ‘Bumpy’ Recovery

While it seems the natural gas and oil industry is convinced that the worst is over and markets are on their way to a comeback, the only certainty is that the road to recovery is going to be a long, bumpy one.

“The main reason natural gas producers, in particular, think the market has hit a bottom is that all the reduction in rig activity is finally catching up to the market,” said NGI’s Patrick Rau, director of strategy and research.

High-grading, drilling longer laterals and reducing the drilled but uncompleted (DUC) inventory will only go so far. Eventually, the impact from the severe decline in drilling will become evident, especially when so many of the rigs that have been laid down are horizontal, Rau said.

“Horizontal wells tend to have hyperbolic decline, meaning so much production occurs in the first few years of the well. If you don’t keep drilling those, the industry misses out on that initial surge of production, which is starting to be reflected in production numbers,” he said.

For example, several Appalachia operators noted on their 2Q16 conference calls that it takes 50-55 rigs to keep combined Utica and Marcellus production flat at current levels. The industry only has 35 rigs or so working in those plays today.

“We can only sustain that pace for so long without production being negatively impacted,” Rau said.

To understand where natural gas production is heading for the remainder of 2016 and into 2017, it’s important to look at where it has been.

Lower 48 natural gas production bottomed out at around 69 Bcf/d in July, when maintenance issues temporarily curtailed production in some areas.

For the entire month of July, Genscape, an energy data and intelligence provider, shows production averaging 71.7 Bcf/d.

The U.S. Energy Information Administration (EIA) shows Lower 48 production averaging 73.87 Bcf/d between April and July 2015 and 74.12 Bcf/d when August is included.

Meanwhile, production estimates by NATGAS Billboard, a report by RBN Energy and IAF Advisors, show an average of 72.0 Bcf/d from April 1, 2015, to Aug. 16, 2015, and 72.5 Bcf/d from April 1, 2016, to Aug. 16, 2016.

It’s important to note the discrepancies that often occur when estimating production as data from the EIA can change frequently throughout the year as states report their data.

“Initial data on the production side can be off by a significant amount and can be revised. Even the reports the EIA gets from the state are very preliminary,” said Genscape’s Eric Fell, a senior natural gas analyst.

If you’re surprised to hear producers discussing plans to increase production when output has largely kept pace with year-ago levels, you’re not alone.

“I think people thought production would continue to fall harder and faster than what’s actually occurred. So to hear producers talk about resuming production is pretty surprising,” said Ryan Duman, a senior research analyst at Wood Mackenzie.

But with the impact of substantial cuts to drilling becoming apparent, concerns of a storage overhang at the end of the 2016 injection season easing, Mexican and liquefied natural gas (LNG) exports growing and other demand drivers strengthening, it appears the stars are aligning for a natural gas recovery.

Demand Growth Surfacing

“Give producers half a reason, and they’ll jump on it,” Fell said. “But, there is truth to the growing demand story. Along with the production declines we’re seeing, we also have structural demand growth.”

Indeed, the EIA reported a withdrawal from storage inventories for the week ending July 29, only the third time since 1994 that a withdrawal has been reported for the June-August time period (see Daily GPI, Aug. 8). The 6 Bcf pull, driven by record power burn, trimmed the storage surplus to 13.4% above year-ago levels and 16.4% above the five-year average.

Meanwhile, Genscape, with its North American data and analytics center based in Louisville, KY, shows exports to Mexico accounted for more than 5% of total U.S. marketed gas in both June and July, a number expected to continue growing due to increasing demand from Mexico’s electric power sector and flat natural gas production in that country.

Gross pipeline exports are expected to increase by 0.7 Bcf/d this year and by 0.1 Bcf/d next year to an average of 5.7 Bcf/d, according to the EIA.

LNG exports continue to grow as well.

The EIA projects that LNG gross exports will increase to an average of 0.5 Bcf/d in 2016, with the startup of Cheniere Energy’s Sabine Pass LNG liquefaction plant in Louisiana, which sent out its first cargo in February (see Daily GPI, Feb. 24). In 2017, the export level is expected to reach 1.3 Bcf/d as Sabine Pass ramps up its capacity. This is in anticipation of Train 1 and Train 2 running near capacity, which will mean more than 1 Bcf/d in equivalent LNG produced, Genscape projects.

Genscape recently reported that three LNG ships (Sestao Knutsen (2.93 Bcf), Clean Ocean (3.35 Bcf) and Maran Gas Sparta (3.5 Bcf)) all lifted cargos from Sabine beginning Aug. 3, amounting to nearly 10 Bcf in LNG exports.

The improving fundamentals landscape has been supportive to prices. After averaging just $2.61 in 2015, the 2017 strip is averaging a hair above $3, although recent weakness in the futures curve put the brakes on the calendar year’s run at the year-to-date high of $3.22 during the first week of August.

“Prices have appreciated quite a bit this year, but they haven’t been sustained long enough and they’re not to a level where everyone is comfortable enough to jump back in,” Duman said.

Keeping a Sharp Eye on Prices

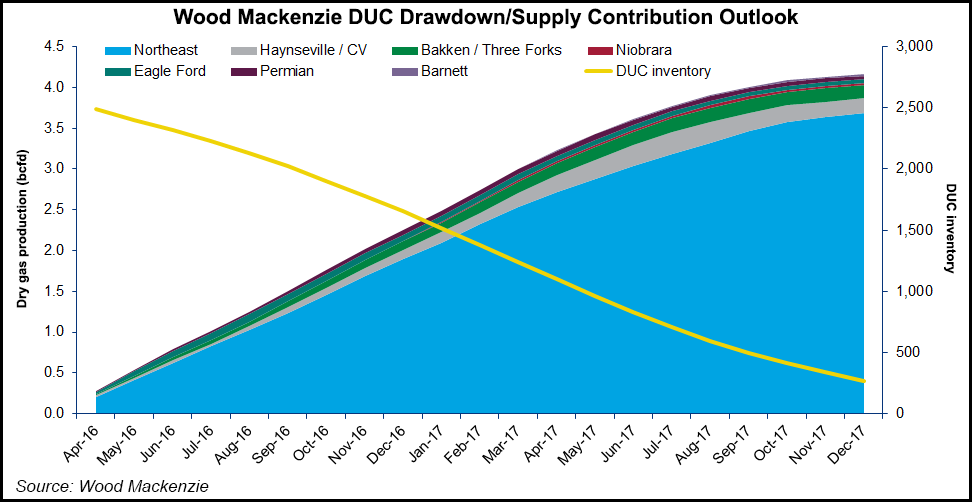

Knowing the volatility that gas markets can bring, producers are implementing a cautious approach to increasing their activity, Duman said, ramping up activity with “low-hanging fruit,” like DUCs and drilling in areas like the Northeast where breakeven costs are sub-$3 and other areas like the Haynesville where infrastructure is already in place.

To be sure, the Northeast has continued to grow production even in the face of weak gas prices and a large storage surplus heading into summer.

Reported initial production rates and other factors suggest the breakeven gas price for many dry Marcellus producers is only about $2.50. For many wet Marcellus/Utica producers, the break-even is even lower at about $2 thanks to supplemental returns on natural gas liquids (NGL) and, in some cases, condensates, according to RBN Energy.

In some cases, the effective natural gas breakeven price gets all the way to zero, with producers achieving breakeven returns from the sale of NGLs and condensates, the energy analytics/consulting company said. With such low break-even costs, it’s not surprising production in the region continues to grow.

Between Aug. 8 and Aug. 12, Appalachian gas production averaged 19.59 Bcf/d, up from the year-ago 30-day average of 17.50 Bcf/d, according to Genscape. Interestingly, the region is on pace to being the only region in the Lower 48 that is expected to post year-over-year gains.

And now producers like Cabot, Southwestern and Rice are increasing their activity by increasing rig counts and manpower, and reinvesting money saved in the region (see Shale Daily,Aug. 9;July 29;July 22). In its second-quarter earnings call, Cabot said it was adding a second completion crew in its Marcellus asset based on“continued efficiency gains, lower service costs and our improved outlook for natural gas price realizations.”

Cabot, Southwestern Look to Growth

“Cabot is the lowest cost producer in Northeast Pennsylvania and generates rates of return over 100% under current price expectations, so we plan to opportunistically increase our market share during 2017 as we await the in-service of our new infrastructure projects beginning in late-2017,” Cabot CEO Dan O. Dinges said.

Cabot owns 850,000 Dth/d on Williams’ Atlantic Sunrise natural gas pipeline project, which would expand capacity on the Transcontinental pipeline (see Daily GPI, May 6).

Meanwhile, Southwestern is in the process of re-initiating drilling and completion activity in each of its operating areas and plans to make incremental capital investments of up to $500 million from its July equity offering. Approximately $375 million of this incremental capital is expected to be invested before the end of 2016.

As part of this plan, Southwestern reinitiated drilling with its first rig in northeast Appalachia at the end of July and intends to increase its company-wide rig count to five by the end of the third quarter. These five rigs are expected to be comprised of two in northeast Appalachia, two in southwest Appalachia and one in Fayetteville. Additionally, it expects to complete approximately 90 to 100 wells in the second half of 2016, which includes new wells drilled and a portion of the DUCs inventory.

But Erika Coombs, a senior analyst at energy consultant BTU Analytics, warned production in the Northeast could be tempered by long-haul transportation options, or a lack thereof. “Infrastructure will continue to play a crucial role in the Northeast, and delays/cancellations will have far-reaching impacts in the rest of the market,” Coombs said.

Perhaps one of the more colorful examples of this is Williams’ Constitution Pipeline. The 124-mile, 30-inch diameter pipeline would transport Marcellus gas produced in northeast Pennsylvania to Schoharie County, NY, where it would connect with two existing interstate pipelines: Iroquois Gas Transmission and Tennessee Gas Pipeline. It would provide 650,000 Dth/d of takeaway capacity.

The saga of the Constitution Pipeline, dogged by environmentally-inspired state and local obstacles, has lasted more than four years. The project had an original in-service date of March 2015, but the Federal Energy Regulatory Commission has approved the company’s request for an extension, with completion now expected in the second half of 2017. This will allow the pipeline to comply with directives from the U.S. Fish and Wildlife Service to protect wildlife along the pipeline’s route (see Shale Daily, March 10).

While Northeast operators are most directly affected by uncertainty on the infrastructure front, Henry Hub pricing would also be affected if demand grows along the Gulf Coast, while supplies from the Northeast remain flat, Coombs said. “These concerns would also play into a decision to diversify away from a Northeast pure play, as we saw with Range Resources’ acquisition of Memorial Resource Development in the Cotton Valley,” she said.

Labor shortages could also throw a wrench into the natural gas recovery, as many oil and gas workers who were laid off when prices slumped have since moved on to other, more stable industries. “To attract those people back would require a good amount of incentive for them to return to rigs, which would require even higher prices,” Coombs said.

With the drilling efficiencies that have been gained, however, there is no longer a need to return to the amount of rigs the industry saw at the peak, so the need for all those workers no longer exists, she said.

“These thoughts were echoed in Halliburton’s recent earnings call when the CEO, Dave Lesar, said, ”…900 [rigs] is the new 2,000,’” Coombs advised.

For 2017, Lakewood, CO-based BTU Analytics is projecting flat year-over-year production. “In the Northeast, we expect gross gas year-over-year increases about 2.5 Bcf/d, while outside the Northeast, declines of about 2.7 Bcf/d,” Coombs said.

Meanwhile, balance sheets will be of the utmost priority for producers looking to ramp up activity next year, as this will help to dictate an operator’s willingness and ability to participate in the recovery.

“The recovery will likely be slow in developing because operators are still very much focused on shoring up their balance sheets and spending within their cash flows, and they aren’t likely to go hog wild changing their previously established and limited 2016 capex budgets,” NGI’s Rau said.

Already, service companies are talking about increasing their costs and, along with access to capital, this could make for slow progress on the production front.

“We expect service costs and prices to increase, however it will be a bumpy road, which will require producers and service companies to try to work together to maintain production,” Coombs said. On average, producers are talking about seeing service costs increase 20-30%, she said.

Expected Increase in Service Costs

Wood Mackenzie’s Duman agreed that while producers know service costs are set to rise, there appears to be consensus in the market that prices will not return to the high levels seen in 2014, before the gas market began its decline.

He warned, however, that should commodity prices sustain $3 (natural gas) and $55 (oil) come the 2017-2018 timeframe, the industry could see a more significant increase in costs as operators gain confidence to further ramp up drilling activity. Wood Mackenzie projects dry gas production to exit 2016 at about 73 Bcf/d and exit 2017 at 77.6 Bcf/d.

With labor shortages, limited capex and rising costs, there undoubtedly will be producers who opt to take a “wait and see” approach with respect to natural gas prices, Rau said.

“Look at what’s happening in the crude side of things. As soon as prices approached $50/bbl, operators began adding rigs and announced plans to add even more,” Rau said. They then watched crude prices drop again. Crude settled at around $45/b on Aug. 12.

Meanwhile, the current 2017 natural gas strip is just above $3.

“That no doubt will cause some producers to lock in some hedges, but what happens to that strip when natural gas operators come creeping out of the woodwork and start adding more gas focused rigs?” Rau said.

Since the U.S. oil rig count bottomed at 316 on May 27, it has rebounded to 381 as of Aug. 5. Yet U.S. natural gas rigs have fallen from 87 to 81 during that time, Rau noted. “The gas-focused rig count will rebound eventually, and if it happens quickly, it could create some doubt about 2017 prices,” he said.

Indeed, with a backlog of DUCs still being worked through, one has to question the impact the amped up activity will have on gas prices. But Coombs said while the backlog could indeed put a ceiling on how much prices will rise, that production is expected to be exhausted in the first half of the year, therefore providing uplift to prices.

And while the surge in the U.S. crude rig count has caused worry about a global supply glut thanks to OPEC going full throttle on production, U.S. natural gas remains isolated from similar concerns, Rau said.

“U.S. natural gas prices still aren’t as impacted by production around the world just yet,” Rau said. “U.S. production should continue to decline for the rest of 2016, and that sets the market up pretty well for 2017, assuming we don’t have an extremely mild winter.”

As always, weather is the real wild card in the natural gas recovery.

Back in April, natural gas storage inventories were starting out the injection season at a nearly 1 Tcf surplus over year-ago levels after the warmest winter on record. Fears in the industry mounted regarding the storage overhang, and whether storage facilities would be able to cope with the abundance of gas hitting the market.

But thanks to La Nina, this summer has turned out to be one of the hottest on record, driving up natural gas power burn to record levels…and keeping storage inventories in check. While most in the industry had pegged storage inventories exiting the injection season at more than 4 Tcf, many now are calling for end-of-season stocks to fall closer to 3.9 Tcf.

Looking ahead, weather could prove favorable for the natural gas market yet again if conditions turn chilly quickly.

“Temperature-adjusted demand has been very strong and if that incremental demand sustains on a per-degree basis and we get a cold winter, the storage scenario could get pretty bullish pretty quickly next year,” said RBN’s Sheetal Nasta, an energy analyst. “So it’s possible the demand side will keep a floor under prices.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |